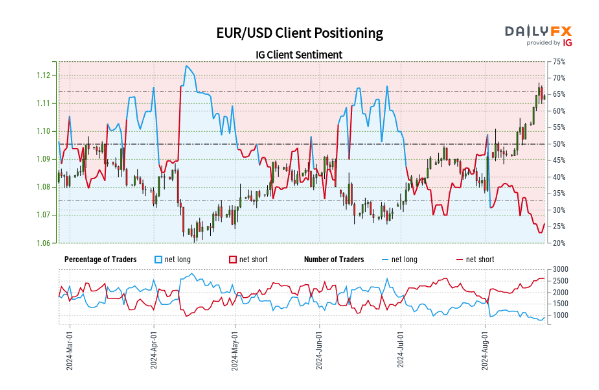

EUR/USD Sentiment

Retail trader data indicates that 25.76% of EUR/USD traders are net-long, with a ratio of traders short to long at 2.88 to 1. The number of traders net-long has increased by 12.88% from yesterday but decreased by 17.56% from last week. Conversely, the number of traders net-short has risen by 0.68% from yesterday and 19.41% from last week.

Typically, a contrarian approach to crowd sentiment is adopted. The current net-short positioning suggests that EUR/USD prices may continue to rise. Although there is less net-short positioning compared to yesterday, it remains more significant than last week. This mixed sentiment offers a neutral trading bias for EUR/USD.

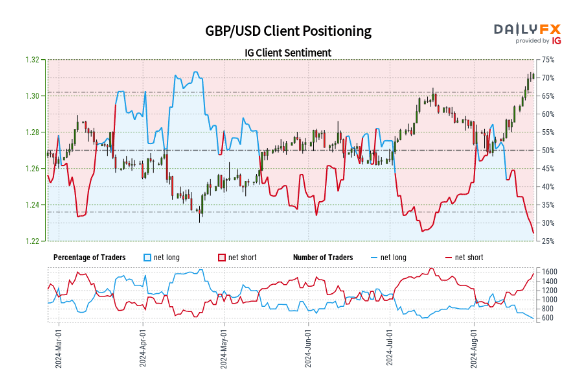

GBP/USD Sentiment

Retail trader data reveals that 28.27% of GBP/USD traders are net-long, with a ratio of traders short to long at 2.54 to 1. The number of traders net-long is down by 0.48% from yesterday and 32.83% from last week. In contrast, the number of traders net-short has increased by 6.55% from yesterday and 41.14% from last week.

A contrarian view of the crowd sentiment suggests that GBP/USD prices may continue to rise. The increased net-short positioning compared to both yesterday and last week supports a stronger GBP/USD-bullish contrarian bias.

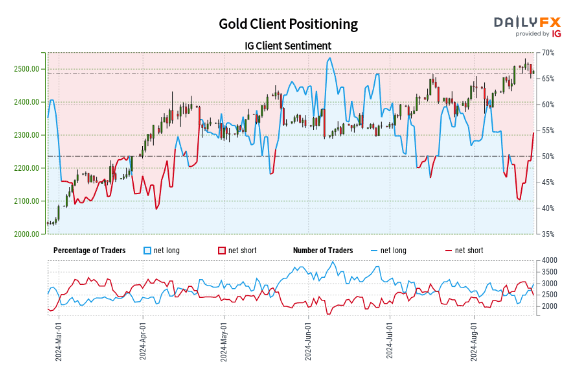

Gold Sentiment

Retail trader data shows 54.85% of Gold traders are net-long, with a ratio of traders long to short at 1.21 to 1. The number of traders net-long has risen by 8.56% from yesterday and 18.90% from last week. Conversely, the number of traders net-short has decreased by 9.27% from yesterday and 5.95% from last week.

Using a contrarian perspective, the high net-long positioning implies that Gold prices may continue to fall. The increase in net-long positioning compared to both yesterday and last week supports a strong Gold-bearish contrarian bias.