So, you’re thinking about forex trading in Singapore, or maybe you’re already in the game and looking for the best forex broker to step up your trading. Either way, picking the right forex broker can feel like a big deal, right? With so many options out there, it’s easy to feel a little lost. But don’t stress—we’ve got you covered!

In this guide, we’re going to run through the best forex brokers in Singapore for 2025. Yup, the top 5 that’ll have you trading with confidence. Whether you're after low fees, user-friendly trading platforms, or just solid customer service, you’ll find it here.

And hey, Singapore’s a financial hub, so you’re in good hands with the Monetary Authority of Singapore (MAS) keeping things in check. They make sure the forex brokers you’re trading with are legit and playing by the rules. So you can focus on what really matters—finding the best trading platform and making smart moves in the forex market.

What to Consider When Choosing a Forex Broker in Singapore

So, you’re ready to get serious about forex trading in Singapore. That’s awesome! But before you jump in, choosing the right forex broker is key. There are a few things you’ll want to keep in mind to make sure you’re getting the best bang for your buck—and that your money is safe.

1. Importance of MAS (Monetary Authority of Singapore) Regulation

First things first, you want a broker that’s regulated by the Monetary Authority of Singapore (MAS). Why? Because MAS makes sure that brokers are legit and follow strict rules to keep your funds secure. This is super important because you don’t want to risk your money with a shady broker. Look for that MAS stamp of approval before you sign up with any broker.

2. Overview of Trading Fees

Next up, let’s talk about trading fees. These are the costs you’ll face when you place trades, and they can vary from broker to broker. You’ll want to check out commissions, which are fees the broker charges per trade. Then, there’s the spread—that’s the difference between the buy and sell price of a currency pair. Some brokers offer low spreads but might charge higher commissions, so watch out for those sneaky hidden costs. Be sure to compare fees to avoid paying more than you should.

3. Types of Trading Platforms

When it comes to trading platforms, you’ll want something that’s easy to use and packed with the features you need. The most popular ones are MetaTrader 4 and MetaTrader 5, which offer great tools for analyzing the market and managing trades. Some brokers also have their own proprietary platforms, which can be pretty good, too. Just make sure the platform you choose fits your style, whether you’re a beginner or an experienced trader.

4. Leverage and Margin Requirements for Singapore-based Traders

Leverage can be a double-edged sword. It allows you to control a larger position with a smaller amount of money, but it can also lead to bigger losses if things don’t go your way. In Singapore, there are specific margin requirements set by brokers based on MAS regulations. Make sure you understand how much you can borrow and what the risks are before you start trading with leverage.

5. Customer Support Quality and Availability

Nothing’s worse than running into a problem with your trading platform and not being able to get help. That’s why good customer support is a must! Look for brokers that offer 24/7 support and have a reputation for being responsive. Whether you need help with a trade, a deposit, or just figuring out how the platform works, you want a broker that’s got your back.

Ease of Withdrawals and Deposits for Singaporean Traders

Finally, let’s talk money—specifically how easy it is to get your money in and out of your trading account. A good forex broker should offer multiple options for deposits and withdrawals, like bank transfers, credit cards, and even PayNow in Singapore. Plus, you don’t want to deal with long wait times or high fees just to get access to your funds. Make sure your broker makes this process smooth and hassle-free.

The 25 Best Forex Brokers in Singapore

#1. AvaTrade: Best Overall for Singaporean Traders

What is AvaTrade?

AvaTrade is a popular and well-established forex broker that has been providing trading services since 2006. It’s considered one of the best brokers in Singapore due to its strong regulation, including oversight from the Monetary Authority of Singapore (MAS). AvaTrade offers a wide range of trading platforms, including MetaTrader 4 and 5, as well as its own AvaTradeGO and WebTrader platforms, catering to different levels of traders. The broker’s commitment to education, with numerous resources for beginners and experienced traders alike, also sets it apart, making it a top choice for those looking to enter or expand in the forex market in Singapore.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

When trading with AvaTrade in Singapore, you can expect zero commissions on most accounts, meaning you’ll only need to consider the spreads when calculating your trading costs. The typical spread for major currency pairs starts at around 0.9 pips. AvaTrade also charges a $50 inactivity fee after three months of no activity and an additional $100 administration fee after 12 months of inactivity. There are no withdrawal fees, and you can deposit or withdraw funds via multiple methods, including credit cards, bank transfers, and e-wallets.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Plus500

What is Plus500?

Plus500 is a leading provider of Contracts for Difference (CFDs), offering a user-friendly platform for trading a wide range of financial instruments, including forex, commodities, equities, indices, and options. In Singapore, Plus500SG Pte Ltd holds a capital markets services license from the Monetary Authority of Singapore (MAS) for dealing in capital markets products. The platform provides over 2,000 CFD financial instruments across seven categories, free real-time price quotes, and web and mobile platforms for added flexibility. These features, combined with its regulatory compliance, make Plus500 a preferred choice for traders in Singapore.

Advantages and Disadvantages of Plus500

Plus500 Commissions and Fees

Plus500 operates on a zero-commission model, primarily earning revenue through the bid-ask spread. There are no fees for deposits or withdrawals, but traders should be aware of certain charges: an inactivity fee of up to USD 10 per month applies if the account is inactive for at least three months; overnight funding fees are added or subtracted when holding positions after a specified time; and a currency conversion fee of up to 0.7% is charged for trades on instruments denominated in a currency different from the account's currency. Additionally, utilizing a Guaranteed Stop Order to manage risks is subject to a wider spread.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

OPEN A DEMO ACCOUNT ON PLUS500

#3. Pepperstone

What is Pepperstone?

Pepperstone is a globally recognized forex broker that has gained a strong reputation in Singapore due to its competitive pricing and fast execution speeds. Established in 2010, Pepperstone provides access to a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. The broker is well-regulated by top-tier authorities, such as the Monetary Authority of Singapore (MAS), ensuring a secure and reliable trading environment. Its low spreads and advanced trading technology make it ideal for traders looking for a seamless experience, whether they are beginners or experienced professionals.

Advantages and Disadvantages of Pepperstone

Pepperstone Fees and Commissions

The broker offers two main account types: the Standard Account, which is commission-free with spreads starting from 1.0 pips, and the Razor Account, which has spreads as low as 0.0 pips but charges a $7 commission per round-turn per standard lot. There are no deposit or withdrawal fees, making it cost-effective for regular traders. Additionally, Pepperstone's fast execution and tight spreads make it a great choice for strategies like scalping and day trading.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

#4. FP Markets

What is FP Markets?

The FP Markets brokerage is a well-established provider of Forex and CFD trading services and is recognized as one of the best forex brokers in Singapore. It offers tight spreads, fast execution speeds, and multiple trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. The broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with international financial standards. FP Markets provides traders with access to a wide range of financial instruments, including forex, indices, commodities, stocks, and cryptocurrencies, making it a preferred choice for traders in Singapore looking for low-cost trading and advanced trading tools.

Advantages and Disadvantages of FP Markets

FP Markets Fees and Commissions

In Singapore, FP Markets offers competitive spreads and commission structures, depending on the type of account chosen. The Standard Account is commission-free, with spreads starting from 1.2 pips, while the Raw Account features spreads from 0.0 pips and charges a commission of $3 per lot per side. Equity CFD trading incurs a commission starting at 0.05% per trade, with a minimum charge. There are no inactivity fees or hidden charges, although certain platforms, such as IRESS Trader, may have monthly fees that can be waived upon meeting trading volume requirements.

OPEN AN ACCOUNT NOW WITH FP MARKETS AND GET YOUR WELCOME BONUS

#5. Interactive Brokers

What is Interactive Brokers?

Interactive Brokers is a leading global broker known for its wide range of investment products and advanced trading tools, making it one of the best brokers in Singapore. Established in 1978, it offers access to over 150 global markets and provides robust platforms like Trader Workstation (TWS), which caters to both professional and retail traders. Interactive Brokers is heavily regulated, including by the Monetary Authority of Singapore (MAS), ensuring a secure and transparent trading environment. Its competitive pricing, extensive market access, and reputation for innovation make it a top choice for serious investors in Singapore.

Advantages and Disadvantages of Interactive Brokers

Interactive Brokers Fees and Commissions

When trading with Interactive Brokers in Singapore, traders benefit from low commissions and tight spreads. For forex trading, commissions range from $16 to $40 per million round turn, depending on the trading volume, while spreads on major currency pairs like EUR/USD start at 0.63 pips. The broker offers various account types with no minimum deposit, and active traders can enjoy discounted rates as trading volume increases. Additionally, there are no deposit fees and the first withdrawal each month is free, with subsequent withdrawals incurring a small fee. Interactive Brokers is ideal for traders seeking advanced tools, deep liquidity, and transparent pricing.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR BONUS

#6. IG Group

What is IG Group?

IG Group is a well-known global broker with a long history (over 50 years) and a good reputation in Singapore. As a MAS-regulated platform, it brings a sense of security that many traders appreciate. You’ll find it’s not just about forex, IG offers access to over 13,000 markets, including CFDs on forex, indices, shares, commodities, ETFs, and even options and futures in some regions . It also has a lot of tools for trading, like MetaTrader 4, ProRealTime, mobile apps, risk-management features like guaranteed stops, advanced charting, and even APIs for traders who know how to use them.

Advantages and Disadvantages of IG Group

IG Group Fees and Commissions

IG mostly uses a spread-only strategy for forex CFDs, so you won't have to pay extra fee on regular trades. Spreads on big pairings like EUR/USD normally start around 0.6 pips, which is competitive but not the narrowest in the market. IG has spreads as low as 0.1 pips for Direct Market Access (DMA) pricing, but it charges a commission of roughly US$60 for every million dollars traded. Most of the time, deposits and withdrawals are free, however some card transactions may have modest processing costs. If you trade or fund in a different currency, there is also a currency translation fee of about 0.8%. Extras like ProRealTime charting cost roughly £30 a month, but IG will give you your money back if you make at least four trades in a month. This makes it free for people who trade a lot.

OPEN AN ACCOUNT NOW WITH IG GROUP AND GET YOUR BONUS

#7. Saxo Markets

What is Saxo Markets?

Saxo Markets, which is also called Saxo Bank, is a well-known multi-asset broker that traders in Singapore prefer since it has a lot of markets to choose from and a tiered pricing system. It is still a MAS-regulated platform in 2025, and it offers over 71,000 assets, including forex, CFDs, equities, ETFs, commodities, bonds, futures, and even crypto. Saxo's tiered account system—Classic, Platinum, and VIP—is what sets it apart. Clients in higher tiers have tighter spreads and benefits like cash interest and priority service. Traders can also pick between platforms, such as SaxoInvestor for beginners and SaxoTraderPRO for more advanced users.

Advantages and Disadvantages of Saxo Markets

Saxo Markets Fees and Commissions

The fees of Saxo depend on the kind of account. For example, Classic accounts have average EUR/USD spreads of about 1.1 pips (with a minimum of 0.9), whereas VIP clients can have spreads as low as 0.4 pips if they have bigger balances or volumes. In Singapore, there is no inactivity fee, and trading stocks is competitive. US trades start at US$1, while SG stocks at 0.03% with a S$3 minimum. Currency conversions cost an extra 0.25% on top of the spot rate. Digital withdrawals are free, but physical ones can cost up to SGD 50 to complete.

OPEN AN ACCOUNT NOW WITH SAXO MARKETS AND GET YOUR BONUS

#8. CMC Markets

What is CMC Markets?

One of the earliest FX and CFD trading companies, CMC Markets was founded in 1989 and is MAS-regulated in Singapore. CMC stands out with its award-winning proprietary platform, Next Generation, which offers advanced charting, price forecasting, and several order kinds. Singapore traders can trade over 12,000 assets, including forex, indices, commodities, shares, ETFs, and treasuries, making it one of the most varied markets. CMC Markets is a popular choice for active traders who seek sophisticated tools and beginners who like its clean, modern mobile app because of its decades of experience and significant presence in Asia.

Advantages and Disadvantages of CMC Markets

CMC Markets Fees and Commissions

The spreads on EUR/USD on ordinary accounts at CMC Markets start at about 0.7 pips, but the average is just over 1 pip. This means that their forex prices are very competitive. In Singapore, there is a minimum charge for share CFDs, which is 0.1% of the deal value. If you don't trade for 12 months, you'll additionally have to pay a $10 inactivity fee every month. Deposits and digital withdrawals are free on CMC's end, however your bank may still charge you for transfers.

OPEN AN ACCOUNT NOW WITH CMC MARKETS AND GET YOUR BONUS

#9. OANDA

What is OANDA?

OANDA is a well-known and trusted broker in Singapore. It has been around since 1996 and is licensed by the MAS. It is noted for being open, having low prices, and giving users a variety of platforms, including MetaTrader 4, MetaTrader 5, and TradingView. OANDA has a lot of currency pairs and CFDs that traders can choose from. It also has research tools and account options that are good for both new and experienced traders. It has always been one of the most reliable brokers in Singapore since it focuses on trust, rules, and technology that is easy to use.

Advantages and Disadvantages of OANDA

OANDA Fees and Commissions

OANDA has two ways to pay: a spread-only model with EUR/USD spreads of roughly 0.8 to 1.0 pips, and a commission-based Core account with spreads of 0.0 pips and a cost of about US$50 for every million exchanged. You don't have to make a minimum deposit, so it's easy for beginners to use. However, if you don't trade for 12 months, you'll have to pay a $10 inactivity fee. OANDA doesn't charge anything for deposits and withdrawals, but banks or card issuers may charge their own fees for processing.

OPEN AN ACCOUNT NOW WITH OANDA AND GET YOUR BONUS

#10. Swissquote

What is Swissquote?

Swissquote is a one-of-a-kind broker in Singapore because it is both a trading platform and a fully licensed bank. It was founded in Switzerland in 1996 and is well-regulated by MAS. It has a lot of different assets, including forex, indices, equities, ETFs, commodities, and even cryptocurrencies. Singapore traders like it because it has bank-level security and professional-grade trading tools. This makes it especially appealing to serious investors who want both safety and variety in one place.

Advantages and Disadvantages of Swissquote

Swissquote Fees and Commissions

The minimum deposit for a Swissquote Standard account is $1,000, which is more than what many other low-cost brokers ask. For Standard accounts, Forex spreads start at roughly 1.7 pips on EUR/USD and can get as low as 1.4 pips for Premium tiers. There are commissions on stocks, such USD 0.03 per share for US stocks. Most of the time, deposits and digital withdrawals are free, although international bank transfers may cost more. The cost is clear, but the tiered structure can be hard for newcomers to understand.

OPEN AN ACCOUNT NOW WITH SWISSQUOTE AND GET YOUR BONUS

#11. Tickmill

What is Tickmill?

Tickmill is well valued by traders who seek dependable execution and cheap trading expenses. Established in 2014, the company is governed by a number of prestigious regulators, including the UK's FCA and CySEC. With Raw account spreads that start close to zero and a variety of platforms, such as MT4, MT5, TradingView, and its own Tickmill Trader, the broker is well-liked. Both novice and seasoned traders seeking value continue to be drawn to Tickmill because of its reputation for openness and affordability.

Advantages and Disadvantages of Tickmill

Tickmill Fees and Commissions

There are two primary account kinds offered by Tickmill. While the Raw account has spreads starting at 0.0 pips plus a $3 commission per side every lot, the Classic account has no charge and spreads starting at about 1.6 pips. Because the minimum deposit is only $100, it is accessible to beginners. Although banks may impose their own fees, Tickmill normally offers free deposits and withdrawals. There is a $10 quarterly inactivity fee after a year of no trading. All things considered, Tickmill is a reasonably priced broker with a variety of platform choices.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR BONUS

#12. Fusion Markets

What is Fusion Markets?

Fusion Markets has quickly become known among traders for having some of the lowest trading costs in the business. Fusion was started in 2017 and is regulated by ASIC in Australia. It is not regulated by MAS, but many Singapore traders use it because it is cheap. Its major selling point is its very narrow spreads and minimal commissions, which make it a great choice for scalpers and high-frequency traders. Fusion also has both MT4 and MT5 platforms, which give traders access to reputable and well-known tools without any extra bells and whistles.

Advantages and Disadvantages of Fusion Markets

Fusion Markets Fees and Commissions

The key to Fusion is affordability. While the Classic Account offers spreads of about 0.9 pips with no visible cost, the Zero Account can provide you raw 0.0 pip spreads with a commission of USD 2.25 per side (USD 4.50 round-trip). Fusion offers free deposits and withdrawals, and there is no minimum deposit required. Crucially, they don't impose inactivity fees, which makes it a good choice even if you don't trade frequently.

OPEN AN ACCOUNT NOW WITH FUSION MARKETS AND GET YOUR BONUS

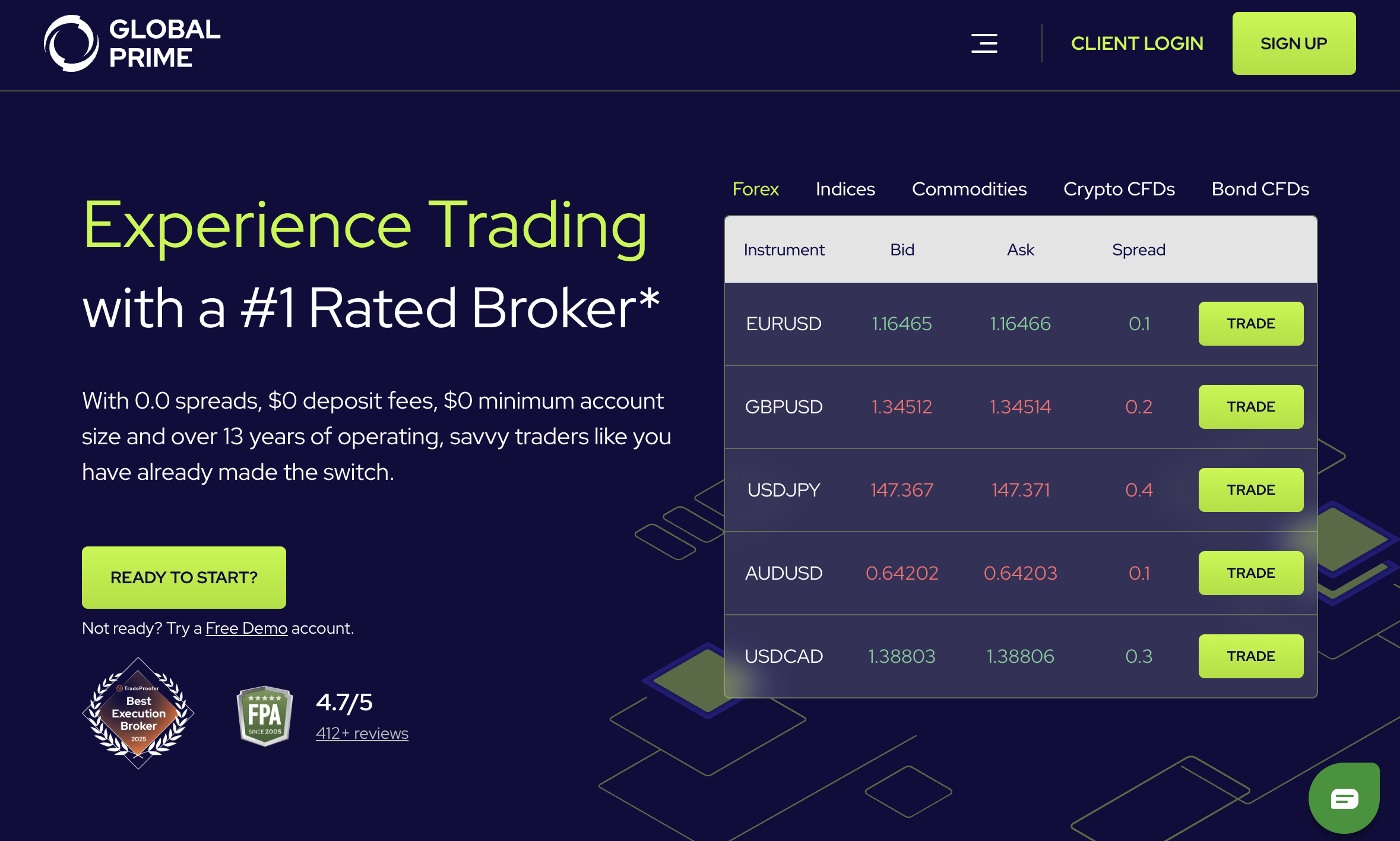

#13. Global Prime

What is Global Prime?

Global Prime is an Australian broker that has gained a dedicated following of traders by putting honesty first. It was set up in 2010 and is regulated by ASIC. It is quite popular in Singapore since it has minimal trading costs and policies that are good for customers. One of Global Prime's best advantages is that it gives clients transaction receipts, which show them exactly how and where their trades were made. This level of openness is unique in the industry. The broker supports MT4 and MT5, which are both solid and well-known trading platforms.

Advantages and Disadvantages of Global Prime

Global Prime Fees and Commissions

Global Prime runs on an ECN-style model that appeals to cost-focused traders. The Raw Account has spreads that can be as low as 0.0 pips, and each side of each lot pays a USD 3.50 fee (USD 7 round trip). There is no commission on the Standard Account. The broker doesn't impose an inactivity fee, and deposits and withdrawals are free on their end. However, banks may levy their own fees for transfers. Global Prime is still popular with active traders since they are open about their prices and keep them competitive.

OPEN AN ACCOUNT NOW WITH GLOBAL PRIME AND GET YOUR BONUS

#14. IC Markets

What is IC Markets?

IC Markets is one of the most well-known forex brokers in the world. It started in Australia in 2007. It isn't controlled by MAS, although it is extensively regulated in other important places and is very popular with traders in Singapore. IC Markets is well known for its low-cost ECN trading environment, which has fast execution and deep liquidity that scalpers, day traders, and algorithmic traders like. The broker works with MT4, MT5, and cTrader, which are three of the most trusted platforms in the business. This gives traders a lot of options.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets doesn't have its own platform; instead, it offers its ECN-style environment through popular platforms including MT4, MT5, cTrader, and TradingView. Traders really like that the Raw account has a lot of liquidity and tight raw spreads from 0.0 pips, and that it charges USD 3.50 in commission per side every lot (USD 7 round trip). The Standard account comes with built-in spread-only pricing, starting at about 1.0 pip, and no commissions if you want things simple. There are no costs for deposits or withdrawals on the broker's side, and there are no inactivity penalties, so it's quite easy to use, even if you don't use it for a while.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR BONUS

#15. GO Markets

What is GO Markets?

GO Markets is an Australian broker that has been active since 2006 and is well-known among retail traders. You can use MT4 and MT5 to trade currencies, indices, commodities, and stocks. It is not regulated by the Monetary Authority of Singapore (MAS), but it is quite popular in Singapore since it is cheap and easy to open up an account, which makes it a good choice for new and budget-conscious traders.

Advantages and Disadvantages of GO Markets

GO Markets Fees and Commissions

There are two main accounts at GO Markets. With the GO Plus+ account, spreads start at 0.0 pips and there is a US$2.50 commission per side each lot (US$5 round trip). There are no commissions on the Standard account, and spreads are usually between 0.8 and 1.0 pips. There are no costs for deposits or withdrawals, and most importantly, there are no inactivity penalties. This makes GO Markets affordable even for traders who take a break.

OPEN AN ACCOUNT NOW WITH GO MARKETS AND GET YOUR BONUS

#16. Axi

What is Axi?

Axi, which used to be called AxiTrader, is an Australian broker that started in 2007 and has since become a global brand that both retail and professional traders trust. It has a good reputation for having low trading costs, good platform compatibility (MT4/MT5), and easy account setup. Axi is also known for its copy trading options and complex trading tools like PsyQuation, which helps traders improve their methods by analyzing them.

Advantages and Disadvantages of Axi

Axi Fees and Commissions

Axi provides two simple account options: the Standard account, which has spreads of roughly 0.8–1.1 pips and doesn't charge a commission, and the Pro account, which has tight 0.0-pip spreads and a USD 7 round-trip commission each lot (USD 3.50 each way). There is no minimum deposit, thus most traders can use it. Axi doesn't impose fees for deposits or withdrawals, but your bank might. Just remember that there is a price for not doing anything. After 12 months of no trading, you will have to pay USD 10 per month.

OPEN AN ACCOUNT NOW WITH AXI AND GET YOUR BONUS

#17. Hantec Markets

What is Hantec Markets?

Hantec Markets is a well-known broker that has been around since 1990 and has acquired a good reputation in forex and CFD trading. It works all over the world, but Singapore traders still like it since it offers low spreads, no fees for deposits or withdrawals, and a safe trading environment. The broker gives you access to MT4 and MT5, which are simple trading platforms that don't have any further features.

Advantages and Disadvantages of Hantec Markets

Hantec Markets Fees and Commissions

There are two primary types of accounts at Hantec Markets. The Pro account has spreads as low as 0.1 pips on EUR/USD and charges USD 2 per lot each side (USD 4 round trip). There are no commissions on the Standard account, and spreads are usually between 0.3 and 0.5 pips. Hantec doesn't charge anything for deposits or withdrawals, although banks may charge their own fees. If your account is inactive for longer than six months, you will be charged a cost of $5 each month.

OPEN AN ACCOUNT NOW WITH HANTEC MARKETS AND GET YOUR BONUS

#18. City Index

What is City Index?

City Index is a well-known broker that has been around for a long time. It is now part of StoneX Group, which is also the parent company of Forex.com. City Index has been in business for more than 40 years and has a good name for being trustworthy and dependable. It is MAS-licensed in Singapore, which makes it a safe alternative for traders there. The broker lets you trade forex, indices, commodities, shares, and crypto CFDs on MT4 and its own AT Pro and Web Trader platforms.

Advantages and Disadvantages of City Index

City Index Fees and Commissions

City Index has a great selection of products, such as forex, indices, commodities, shares, and crypto CFDs, all of which may be traded on their own platforms such AT Pro and Web Trader. Forex spreads start at 0.5 pips on the EUR/USD pair, and share CFDs have commissions starting at 0.08% (minimum S$10). The broker doesn't charge anything for deposits or withdrawals, but your bank might. Watch out for overnight lending fees, which are usually rather hefty. Also, keep in mind that there is an inactivity tax, which is usually around S$15 per month after a long period of inactivity.

OPEN AN ACCOUNT NOW WITH CITY INDEX AND GET YOUR BONUS

#19. Moomoo SG

What is Moomoo SG?

Moomoo SG is the Singapore branch of Futu Holdings, a fintech company that is listed on the NASDAQ. Younger, tech-savvy investors like it because it has a mobile-first trading app, commission-free stock promotions, and is regulated by the MAS. The software has trading, market data, and social elements all in one place, making it easy for both new and seasoned investors to keep an eye on and trade in worldwide markets.

Advantages and Disadvantages of Moomoo SG

Moomoo SG Fees and Commissions

Moomoo SG is known for its stock trading promotions with no commissions, especially for stocks in the U.S. and Hong Kong. In the U.S., stocks usually cost about US$0.0049 per share, with a minimum platform fee of US$0.99. In Singapore, stocks are charged 0.03% of the trade value, with a minimum of S$0.99. Moomoo doesn't charge anything for deposits made using FAST transfer or digital withdrawals, however banks may charge their own costs. You can trade forex and CFDs, but the selection is smaller than what you can find at a specialist FX broker. One important thing to keep an eye on is the cost of converting currencies. Spreads are said to be around 0.3%–0.33%, which can add up when dealing in more than one currency. Moomoo SG doesn't charge inactivity fees, which is a big plus for casual investors.

OPEN AN ACCOUNT NOW WITH MOOMOO SG AND GET YOUR BONUS

#20. PhillipCapital

What is PhillipCapital?

PhillipCapital is one of the oldest brokerage firms in Singapore, having been around since 1975. The company's main trading system, POEMS (Phillip's Online Electronic Mart System), was the first online trading platform in the country and is still widely used today. PhillipCapital is authorized by the Monetary Authority of Singapore (MAS) and has a strong presence in the local market. It offers a wide range of products, including SGX and global equities, ETFs, currencies, CFDs, bonds, futures, and unit trusts. This makes it a reliable all-in-one solution for both traditional and modern traders.

Advantages and Disadvantages of PhillipCapital

PhillipCapital Fees and Commissions

PhillipCapital has a lot of market access, but its costs are greater than those of app-based competitors. Commissions for Singapore stocks and ETFs start at 0.08% with no minimum under the Cash Plus account. For greater asset values, they can go down to 0.06%. U.S. equities cost a constant US$3.88 each trade, but that price goes down to US$1.88 depending on how many stocks you own. If you own SGX shares but don't trade them at least once a quarter, you'll have to pay a S$15 quarterly maintenance fee. Deposits through FAST are free, and most withdrawals are also. However, withdrawals that aren't for trading can cost 0.2% of the amount withdrawn, up to S$100. PhillipCapital doesn't impose fees for not using the service, but their overall pricing is more complicated and expensive than those of newer, cheaper brokers.

OPEN AN ACCOUNT NOW WITH PHILLIPCAPITAL AND GET YOUR BONUS

#21. UOB Kay Hian

What is UOB Kay Hian?

UOB Kay Hian is one of Singapore's biggest domestic brokerage firms. It has been around since 1876. It is part of the UOB Group and offers a comprehensive range of investment services, including stocks and ETFs, futures, bonds, currencies, unit trusts, and wealth management. UOB Kay Hian is fully regulated by MAS and has earned its reputation on doing thorough research, executing trades like an institutional investor, and knowing the local market inside and out. This makes it a reliable choice for serious investors.

Advantages and Disadvantages of UOB Kay Hian

UOB Kay Hian Fees and Commissions

UOB Kay Hian gives you good access to the market, but it costs a lot. For SGX stocks, brokerage fees start at 0.275% of the trade value, with a minimum fee of S$25. Most of the time, charges for U.S. stocks are a flat US$20 per deal, although busy traders can get lower rates. Investors need also think about clearing fees, custody fees, and administrative fees, which make the total structure more complicated than most app-based brokers. FAST doesn't charge anything for deposits, and most withdrawals are free as well. However, foreign transactions may cost more at the bank. UOB Kay Hian is a good choice for investors who care about reputation, thorough research, and full-service investment support, even though their costs are higher.

OPEN AN ACCOUNT NOW WITH UOB KAY HIAN AND GET YOUR BONUS

#22. XM

What is XM?

XM Group is a global broker that serves millions of traders in more than 190 countries. It has been around since 2009. It doesn't have a MAS license, however it is regulated by ASIC, CySEC, and IFSC, so Singapore traders can use its overseas entities. XM has a good name because it boasts fast execution speeds, versatile account options, and access to more than 1,000 financial products, including forex, CFDs, indices, stocks, commodities, and crypto. It is a popular choice for traders of all levels because it supports many languages and is easy to use for beginners.

Advantages and Disadvantages of XM

XM Fees and Commissions

XM has four primary sorts of accounts: Micro, Standard, Ultra Low, and Zero. The Standard account has no commissions and spreads that start at 1.0–1.6 pips. The Ultra Low and Zero accounts have tighter spreads, starting at 0.6 pips or even 0.0 pips, with commissions that average US$7 each round trip. Deposits and withdrawals are free, but there may be a minor internal fee for bank transfers under $200. XM levies a one-time maintenance fee of $15 after 12 months of inactivity, then $5 every month until the account is revived. XM is a great choice for traders throughout the world who want both flexibility and reliability. It has fast execution, a wide range of account kinds, and clear financing policies.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR BONUS

#23. RoboForex

What is RoboForex?

RoboForex is a global forex and CFD broker that was started in 2009 and is regulated by the IFSC in Belize. Even though it doesn't have a MAS license, traders in Singapore can nevertheless use it through its overseas entities. RoboForex is noted for having a low entry barrier (you only need to deposit US$10 to start) and for offering services like CopyFX, which lets you duplicate other traders' trades. This is great for novices. It works with more than 12,000 trading tools, such as forex, stocks, indices, ETFs, commodities, and cryptocurrencies, on a number of platforms, including MT4, MT5, cTrader, and R Trader

Advantages and Disadvantages of RoboForex

RoboForex Fees and Commissions

RoboForex makes it easy for both new and experienced traders to get started. There are no commissions on the Pro account, and the spreads are roughly 1.3 pips. The ECN and Prime accounts have raw spreads that are as low as 0.0–0.2 pips, and they charge $2 to $4 per side per lot (around $4 to $8 round trip). They pay for all deposits and most withdrawals, and some days they are even free. However, your bank may still charge you. The best part? RoboForex doesn't charge you for not using your account, even if it stays silent for a long time.

OPEN AN ACCOUNT NOW WITH ROBOFOREX AND GET YOUR BONUS

#24. Eightcap

What is Eightcap?

Eightcap is a global FX and CFD broker that started in 2009 and is regulated by top-tier organizations including ASIC and FCA. It doesn't have a local MAS license, although it does serve traders in Singapore through its worldwide branches. Eightcap is most well-known for its connection to TradingView, which lets traders use powerful charting, scripting, and social trading tools right in their broker account. This, together with MT4 and MT5, makes Eightcap very appealing to traders who depend on powerful technical analysis workflows.

Advantages and Disadvantages of Eightcap

Eightcap Fees and Commissions

Eightcap has two sorts of accounts: Standard and Raw. There are no commissions on the Standard account, and spreads start at about 1.0 pip. The Raw account has tighter spreads (0.0–0.1 pip) and a commission of USD 3.50 per side per lot (USD 7 round trip). Eightcap doesn't charge you for deposits or withdrawals, but your bank or payment provider might. Most of Eightcap's businesses, including those in Singapore, don't levy inactivity fees. But be warned that the EU/CySEC entity does charge a €10/month inactivity fee after three months of inactivity. Overall, Eightcap is a good choice for technical traders because it has narrow spreads and low setup costs.

OPEN AN ACCOUNT NOW WITH EIGHTCAP AND GET YOUR BONUS

#25. FxPro

What is FxPro?

FxPro is a well-known global FX and CFD broker that has been around since 2006. It is regulated by top-tier organizations including the FCA (UK) and CySEC (Cyprus). It lets traders trade a lot of different things, like more than 70 currency pairs, stock CFDs, indices, commodities, futures, and cryptocurrencies. The broker has a lot of different platforms to choose from, including as MT4, MT5, cTrader, and its own FxPro Edge. This makes it easy to use for different types of trading. FxPro is still a trusted choice for both professional and retail traders because it has a good reputation and millions of clients throughout the world.

Advantages and Disadvantages of FxPro

FxPro Fees and Commissions

The fees for FxPro vary depending on the platform and account type. On Standard MT4/MT5 accounts, the only thing that affects the price is the spread. The average spread for EUR/USD is between 1.2 and 1.5 pips. The Raw+ and cTrader accounts have tighter spreads that start at 0.0 pips, but they also charge a commission of roughly US$3.50 per side every lot (US$7 round trip). Deposits are free, and most withdrawals don't have a broker cost. However, some payment methods may have fees from third parties, and if you trade in a currency other than your base currency, you will have to pay currency conversion fees. One thing to keep in mind is that FxPro imposes penalties for inactivity. After six months of no trading, there is a one-time price of $5, and after twelve months of inactivity, there is a monthly fee of $15.

OPEN AN ACCOUNT NOW WITH FXPRO AND GET YOUR BONUS

How to Open a Forex Trading Account in Singapore

Step 1: Choose the Best Forex Broker

The first step is choosing one of the best forex brokers in Singapore. You’ll want to look for brokers that are regulated by the Monetary Authority of Singapore (MAS), as this ensures your funds are secure and the forex trading legal framework is solid. Look for brokers with low trading costs, good trading platforms, and features like a mobile trading app or advanced charting tools. Popular forex brokers in Singapore often include features such as demo accounts and negative balance protection to help safeguard retail traders.

Step 2: Open a Trading Account

Once you’ve chosen a singapore forex broker, it’s time to open a trading account. This usually involves filling out an online form with some basic details about yourself, including your name, address, and email. You’ll also need to choose between different types of accounts, such as a demo or live account, based on your needs. A demo account is a great way to practice before putting any real money on the line, while a live account lets you get into the actual foreign exchange market.

Step 3: Verification Documents

To complete the process, you’ll need to submit verification documents. This typically includes ID proof (like a passport or national ID) and address verification (such as a utility bill or bank statement). These documents are required to comply with regulations set by the Monetary Authority of Singapore and ensure that your trading activities are secure and legitimate.

Step 4: Set Up Your Trading Platform

Next, you’ll want to set up your trading platform. Whether you’re using MetaTrader 4, MetaTrader 5, or a proprietary platform, getting familiar with the tools available is key. The best forex trading platforms allow you to trade on desktop or via a mobile trading app, giving you flexibility no matter where you are. You can access real-time charts, place orders, and even analyze currency pairs on the go.

Step 5: Fund Your Account

Finally, you’ll need to fund your trading account. This can usually be done through bank transfers, credit cards, or e-wallets, depending on the broker. Keep in mind that different brokers have different minimum deposit requirements, so always check this beforehand. Once your account is funded, you can start trading forex and experimenting with trading ideas on live markets.

Demo vs. Live Accounts

If you’re new to trading, it’s a good idea to start with a demo account. This allows you to practice without risking real money, get a feel for the platform, and test out trading strategies. Once you feel confident, you can switch to a live account where you’ll be trading with real funds in the actual forex market.

Conclusion

Finding the best forex broker in Singapore for 2025 really comes down to what suits your trading style and needs. Whether you’re new to trading or have some experience, it’s important to look for brokers that are regulated by the Monetary Authority of Singapore (MAS), have low trading costs, and offer great trading platforms. We’ve covered some of the top brokers that stand out for their security, flexibility, and user-friendly features. From advanced tools to competitive spreads, these brokers can help you trade currency pairs with confidence.

Also Read: The 25 Best Forex Brokers in Taiwan in 2025

FAQs

What makes MAS regulation important when choosing a forex broker in Singapore?

MAS regulation ensures that forex brokers operate under strict financial rules, keeping traders’ funds safe and protecting them from fraud. Trading with a MAS-regulated broker adds a layer of security and trust.

What fees should I watch out for when trading forex in Singapore?

The main fees are spreads, commissions, overnight financing charges, and sometimes inactivity fees. Some brokers also charge currency conversion fees if you trade in different base currencies. Comparing these costs helps avoid paying more than necessary.

What’s the difference between a demo and a live forex trading account?

A demo account lets you practice with virtual money in real market conditions—perfect for beginners. A live account, on the other hand, involves real money and actual market exposure, which carries both risks and rewards.