SinoxFx Review

Choosing the right Forex broker is crucial for success in the financial markets. A reliable broker can provide a secure trading environment, competitive fees, and robust trading platforms. On the other hand, a poor choice can lead to financial loss and frustration. It's essential to evaluate brokers carefully to ensure they meet your trading needs and provide the support you require.

SinoxFx stands out in several ways despite some notable concerns. This broker allows trading in Forex, commodities, indices, cryptocurrencies, and US stocks. However, one significant drawback is the lack of regulatory oversight, which can be a red flag for potential traders. Even though SinoxFx is registered in the UK and has a presence in the UAE, the absence of stringent regulation is a critical point to consider.

In this detailed review, I aim to provide an exhaustive evaluation of SinoxFx, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering SinoxFx as your preferred brokerage service provider.

What is SinoxFx?

SinoxFx is a Forex broker that has been operating in financial markets since 2016. The company is registered in the United Kingdom and also has a presence in the United Arab Emirates. This broker provides traders access to a variety of assets, including currencies, cryptocurrencies, stocks of international companies, stock indices, and futures contracts on metals and energies.

SinoxFx claims to offer a simple yet powerful Global Online Trading Platform. They emphasize their commitment to excellent client service. This combination of a robust platform and dedicated customer support has helped them maintain their reputation as one of the world's most trusted brokers.

Benefits of Trading with SinoxFx

After trading with SinoxFx, I found several notable benefits and important drawbacks. One significant advantage is the variety of assets available for trading. SinoxFx offers access to Forex, commodities, indices, cryptocurrencies, and US stocks. This wide range allows me to diversify my investment portfolio effectively.

Another benefit is their fee structure. SinoxFx does not charge fees for deposits or withdrawals. This policy is advantageous because it helps in managing costs and maximizing trading funds. However, it's essential to be aware that external fees from banks or payment systems might still apply.

The high leverage options provided by SinoxFx are particularly appealing. With leverage up to 1:1000, I can maximize my trading potential. This feature is beneficial for experienced traders looking to increase their market exposure.

However, the lack of regulatory oversight is a significant concern. Although SinoxFx is registered in the UK and has a presence in the UAE, it does not hold a license for financial or brokerage activities. This absence of stringent regulation can affect the trust and security I expect from a broker.

SinoxFx Regulation and Safety

SinoxFx is registered in the United Kingdom, but this registration does not constitute a license for financial or brokerage activities. This distinction is important because it means that, while SinoxFx is recognized as a business entity in the UK, it is not subject to the strict regulations and oversight that licensed financial brokers must follow. This lack of regulation could affect the level of security and trust you might expect from a broker.

The company also has a presence in the United Arab Emirates, but details of its regulatory status in this region are unclear. This ambiguity adds another layer of uncertainty for potential traders. Without clear regulatory oversight, it becomes challenging to assess the broker's adherence to industry standards and protective measures.

To ensure the safety of client information, SinoxFx uses SSL encryption technology. This technology is designed to protect personal data from unauthorized access by third parties, which is a critical aspect of online trading security. Knowing that your information is secure can provide some peace of mind, but it's also essential to consider the broader regulatory context.

When clients file complaints, SinoxFx acknowledges receipt within two business days and initiates the review process. This prompt response is a positive aspect of their customer service. However, it's important to note that the broker operates without licenses from regulatory authorities, which limits the formal channels of recourse available to clients in case of disputes. This information was gathered after trading with the broker, emphasizing the importance of due diligence and understanding the regulatory framework before engaging with any financial service provider.

SinoxFx Pros and Cons

Pros

- No deposit or withdrawal fees.

- Offers affiliate programs for earning by attracting new clients.

- Variable leverage up to 1:1000.

- Five account types for both novice and experienced traders.

- Minimum deposit of $50.

Cons

- No bonuses for new or existing clients.

- Not regulated; lacks a brokerage license.

- Does not offer cent accounts for minimal risk trading.

SinoxFx Customer Reviews

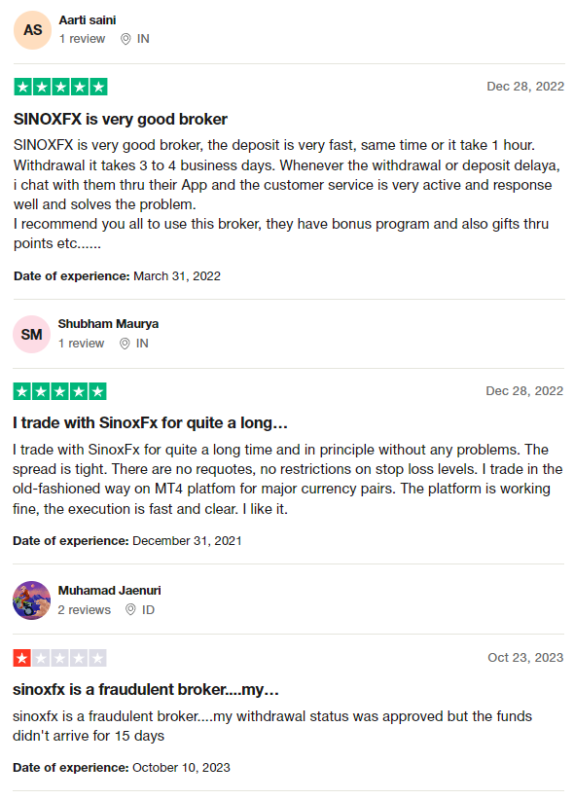

Customer reviews of Sinox Fx are mixed. Some traders praise the broker for its fast deposit process, with transactions completed within an hour, and withdrawals taking 3 to 4 business days. They highlight the active customer service, which quickly resolves issues through the app. Others appreciate the tight spreads, absence of requotes, and fast execution on the MT4 platform, making it suitable for major currency pairs. However, there are also complaints about delayed withdrawals, with some users experiencing significant delays in receiving their funds. These mixed experiences underscore the importance of carefully considering both the benefits and potential drawbacks before choosing SinoxFx as a broker.

SinoxFx Spreads, Fees, and Commissions

When it comes to spreads, fees, and commissions, SinoxFx offers a straightforward structure. SinoxFx does not charge fees for depositing or withdrawing funds, but keep in mind that banks, payment systems, or blockchains might apply their own transaction fees. This means you can move your money in and out without worrying about extra charges from the broker itself.

SinoxFx applies trading costs through spreads, which vary depending on the account type and financial instrument. For instance, the Silver account has spreads starting from 2.5 pips, the Gold account from 1.8 pips, the Platinum account from 1.2 pips, the Elite account from 0.8 pips, and the Raw account from 0 pips. This tiered approach allows you to choose an account that matches your trading style and budget.

All account types have low commissions, except the Raw+ account, which has zero commission. This can be particularly appealing if you're looking to minimize your trading costs.

Account Types

After trading with the broker, I found they offer different SinoxFx account types, which I will list down and summarize the features of each account here:

Silver

- Suitable for novice traders

- Minimum deposit: $50

- Variable leverage: up to 1:1,000

- Spreads: from 2.5 pips

Gold

- Universal account type

- Minimum deposit: $1,000

- Leverage: up to 1:1,000

- Spreads: from 1.8 pips

Platinum

- For experienced traders

- Minimum deposit: $10,000

- Leverage: up to 1:500

- Spreads: from 1.2 pips

Elite

- Professional account type

- Minimum deposit: $25,000

- Leverage: up to 1:500

- Spreads: from 0.8 pips

Raw+

- For professional traders

- Minimum deposit: $50,000

- Leverage: up to 1:500

- Spreads: from 0 pips

How to Open Your Account

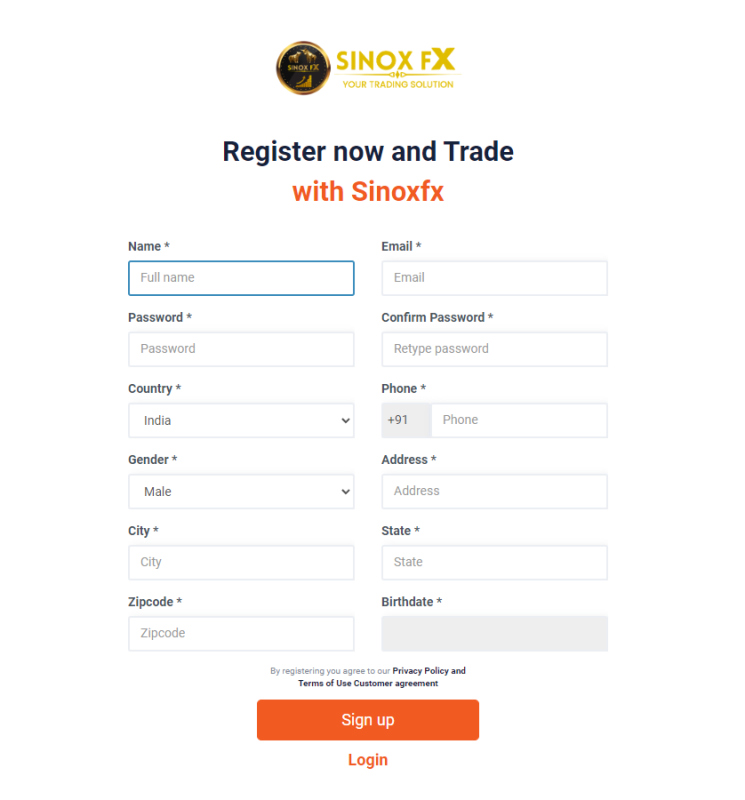

- Visit the SinoxFx website and click on the “Open Account” or “Open a Live Account” button.

- Complete the registration form with your name, email, country, phone number, gender, address, postal code, and date of birth.

- Create and confirm your password, then click the “Sign Up” button.

- Verify your email address by clicking the link sent to your inbox.

- Log in to your new SinoxFx account using your email and password.

- Upload the required documents for identity and address verification.

- Wait for the SinoxFx team to review and approve your documents.

- Once approved, deposit funds into your account and start trading.

SinoxFx Trading Platforms

SinoxFx offers the MetaTrader 5 (MT5) platform for trading. Based on my experience, MT5 is a powerful and versatile trading platform that caters to both novice and experienced traders. It provides a wide range of analytical tools, including technical indicators and charting capabilities, which help in making informed trading decisions.

One of the standout features of MetaTrader 5 is its support for automated trading. This is particularly useful for traders who prefer using expert advisors (EAs) to automate their strategies. The platform also offers a user-friendly interface, making it easy to navigate and execute trades efficiently.

Additionally, MetaTrader 5 allows access to various asset classes including currencies, cryptocurrencies, stocks, and commodities. This diversity enables traders to manage a broad portfolio from a single platform.

What Can You Trade on SinoxFx

Based on my experience, SinoxFx offers a wide range of trading instruments. You can trade various currency pairs, which provide numerous opportunities to capitalize on the forex market's fluctuations. This diversity allows you to trade major, minor, and exotic pairs, catering to different trading strategies and risk preferences.

SinoxFx also provides access to cryptocurrencies. This includes popular digital currencies like Bitcoin, Ethereum, and others, allowing you to participate in the growing crypto market. Trading cryptocurrencies can be highly volatile but offers significant potential for profit.

In addition to currencies and cryptocurrencies, SinoxFx offers CFDs on stocks, metals, energies, indices, and futures. This means you can trade shares of international companies, precious metals like gold and silver, and energy commodities such as oil and gas. The availability of indices and futures contracts further broadens your trading options, enabling you to diversify your portfolio and hedge against market risks. Overall, SinoxFx's extensive range of trading instruments provides ample opportunities to explore various markets and strategies.

SinoxFx Customer Support

Based on my experience, SinoxFx offers a variety of customer support options. They provide assistance through phone, tickets in the user account, a feedback form, and a callback request. Additionally, you can reach out to them via email.

For more convenience, their technical support is also accessible through WhatsApp, Telegram, and direct messages on Instagram and Facebook. This multi-channel approach ensures that users can get help through their preferred platform. However, there is no live chat feature, which can be a drawback for resolving urgent issues.

Advantages and Disadvantages of SinoxFx Customer Support

Withdrawal Options and Fees

Based on my experience with SinoxFx, the broker offers several withdrawal options. You can withdraw funds via bank wire, Bitcoin, Ethereum, Litecoin, other cryptocurrencies, and PayPal. Only verified traders can withdraw their funds, ensuring security and compliance.

SinoxFx does not charge withdrawal fees, which is a significant advantage. The processing time for deposits varies depending on the method used, ranging from a few minutes to up to five days. The minimum withdrawal amount depends on the method and can be either $10 or $20, while the maximum withdrawal amount ranges from $50,000 to $10 million, providing flexibility for both small and large transactions.

SinoxFx Vs Other Brokers

#1. SinoxFx vs AvaTrade

SinoxFx, operating since 2016, offers trading in Forex, commodities, indices, cryptocurrencies, and US stocks through the MetaTrader 5 platform, emphasizing high leverage up to 1:1000 and no deposit or withdrawal fees. However, its lack of regulatory oversight raises significant concerns. In contrast, AvaTrade, established in 2006 and headquartered in Dublin, Ireland, is a highly regulated broker serving over 300,000 customers worldwide. AvaTrade offers more than 1,250 financial instruments across multiple platforms, including MetaTrader 4 and 5, and is noted for its comprehensive educational resources and strong regulatory framework.

Verdict: AvaTrade is better due to its extensive regulatory oversight, broader range of financial instruments, and established reputation in the market. SinoxFx, while offering high leverage and no fees, lacks the regulatory safeguards and comprehensive support that AvaTrade provides.

#2. SinoxFx vs RoboForex

SinoxFx, founded in 2016, provides trading in various asset classes with high leverage and no fees, but suffers from limited regulatory oversight. On the other hand, RoboForex, operating since 2009 and regulated by the FSC, offers over 12,000 trading options across eight asset classes and multiple advanced platforms like MetaTrader, cTrader, and RTrader. RoboForex is known for its innovative technology, competitive trading conditions, and regular trading contests, which enhance its appeal to traders of all levels.

Verdict: RoboForex is better due to its comprehensive regulatory framework, wider range of trading options, and advanced technological offerings. SinoxFx’s lack of stringent regulation and limited platform choices make it less appealing compared to RoboForex’s robust offerings.

#3. SinoxFx vs Exness

SinoxFx, in operation since 2016, offers high leverage and a wide range of trading instruments, but lacks stringent regulatory oversight. Exness, established in 2008, operates under a stable regulatory environment with headquarters in Cyprus and additional offices in Seychelles. Exness provides access to over 120 currency pairs, including cryptocurrencies and CFDs on various assets, known for its low commissions, immediate order execution, and diverse account types.

Verdict: Exness is better due to its stable regulatory environment, broader range of trading instruments, and reputation for reliable service and low commissions. SinoxFx, while offering high leverage and no fees, falls short in regulatory assurances and overall service quality compared to Exness.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: SinoxFx Review

Based on my insights and user feedback, SinoxFx has several notable advantages and disadvantages. On the positive side, SinoxFx offers a wide range of trading instruments, including Forex, commodities, indices, cryptocurrencies, and US stocks. They provide high leverage up to 1:1000 and do not charge deposit or withdrawal fees, which can be attractive for traders looking to maximize their funds.

However, there are significant drawbacks to consider. The broker operates without stringent regulatory oversight, which raises concerns about security and trustworthiness. While they use advanced platforms like MetaTrader 5 and offer robust customer support through various channels, the lack of regulatory licenses is a major red flag. Additionally, there are mixed reviews regarding their withdrawal process, with some users experiencing delays.

Also Read: Switch Markets Review 2024 – Expert Trader Insights

SinoxFx Review: FAQs

Is SinoxFx a regulated broker?

No, SinoxFx is not regulated by any major financial authority. While it is registered in the UK and has a presence in the UAE, it does not hold licenses that ensure strict regulatory oversight.

What trading platforms does SinoxFx offer?

SinoxFx offers the MetaTrader 5 (MT5) platform, known for its advanced analytical tools and support for automated trading. This platform caters to both novice and experienced traders.

Are there any fees for deposits or withdrawals with SinoxFx?

No, SinoxFx does not charge any fees for deposits or withdrawals. However, external fees from banks, payment systems, or blockchains may still apply.

OPEN AN ACCOUNT NOW WITH SINOXFX AND GET YOUR BONUS