Skilling Review

Skilling, a brokerage company founded on STP (Straight Through Processing) technology, originated from the idea of creating a user-friendly trading platform accessible to beginners and professionals alike. The brainchild of a tech-savvy Scandinavian team, Skilling first launched its operations in Malta before expanding to other locations globally.

This review aims to provide a comprehensive overview of Skilling, examining its strengths, weaknesses, and everything in between. We'll assess its features, commission structure, account types, transaction procedures, and more, using expert assessments and real trader experiences to help inform your decision-making process.

What is Skilling?

Skilling is a Scandinavian broker that launched in 2016. Initially serving the regional market with classic CFD trading services, it has grown into a sizable European broker registered in Cyprus and licensed by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. Skilling positions itself as a fintech platform, investing heavily in software and technology development for novice and seasoned traders alike.

Maintaining a balanced trading proposal, Skilling offers access to over 800 instruments and supports popular and robust trading software such as MetaTrader 4 (MT4) and cTrader. Skilling has also developed its own software, Skilling Trader, delivering high-quality, transparent technical solutions that allow traders to focus on performance.

Advantages and Disadvantages of Trading with Skilling?

Benefits of Trading with Skilling

Skilling, as a trading platform, has a multitude of advantages that add value to the trading experience of its users, whether they are beginners or seasoned traders. Let's delve into these benefits:

No Commission for Fund Transfers: One of the foremost advantages of Skilling is that there are no fees charged on either the replenishment of funds or their withdrawal. This means that traders can move their money around freely without worrying about hidden costs eroding their capital or returns.

Unlimited Requests: There are no limitations imposed on the amount or number of requests for withdrawals or deposits. This gives traders the flexibility to manage their funds as they deem fit, without any restrictions.

Insurance Fund: In the unforeseeable event of force majeure, bankruptcy, or fraud, Skilling provides an insurance fund to protect the traders' investments. This adds a layer of security and reassurance for the users, showing that the platform is prepared to take responsibility for such incidents.

Proprietary Trading Platform: Skilling has developed its proprietary professional platform for manual trading. This software provides a user-friendly interface with a robust set of features, making it easier for traders to navigate the markets.

Classic Platforms: In addition to its proprietary platform, Skilling also provides access to classic trading platforms with expert advisors such as MetaTrader 4 and cTrader. These platforms have a strong reputation in the trading community and are particularly appreciated for their extensive functionality.

High Level of Liquidity: Skilling provides access to a high level of liquidity, which ensures smooth and swift execution of trades, reducing the risk of slippage.

Wide Range of Fund Assets: Traders have access to over 750 fund assets, including indices. This gives a broad spectrum of choices for diversification and allows traders to engage in various markets.

Skilling Pros and Cons

Every trading platform has its strengths and weaknesses. Here is a summarised list of Skilling’s pros and cons:

Pros:

- Operates in various parts of the world, including Cyprus, the UK, and Seychelles.

- Offers a range of trading options, including Forex and CFDs.

- Designed to cater to both beginners and professional traders.

- Provides MetaTrader, cTrader, and its proprietary Skilling Trader platform, offering choice for traders.

- Has strong technical platform that ensures a smooth trading experience.

- Offers a variety of research tools and analysis options.

Cons:

- Does not support accounts in multiple currencies.

- Offshore operations might be seen as a risk due to typically lower regulatory standards.

- Does not offer educational materials, which could be a drawback for beginner traders.

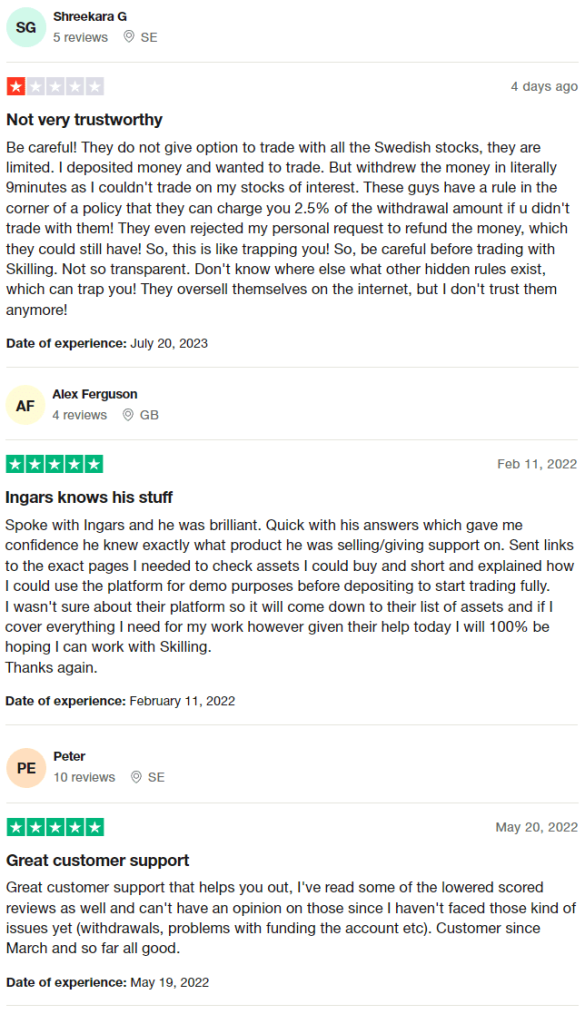

Skilling Customer Reviews

Customer reviews about Skilling vary significantly. Some customers expressed dissatisfaction due to hidden charges and restrictions on trading certain stocks. These customers felt trapped, leading them to withdraw their money soon after depositing. They also expressed concern about potentially unknown policies and a lack of transparency. However, others had positive experiences, praising the customer support staff's swift, knowledgeable assistance. Those who did not face issues with withdrawals or account funding found Skilling's services satisfactory.

Skilling Spreads, Fees, and Commissions

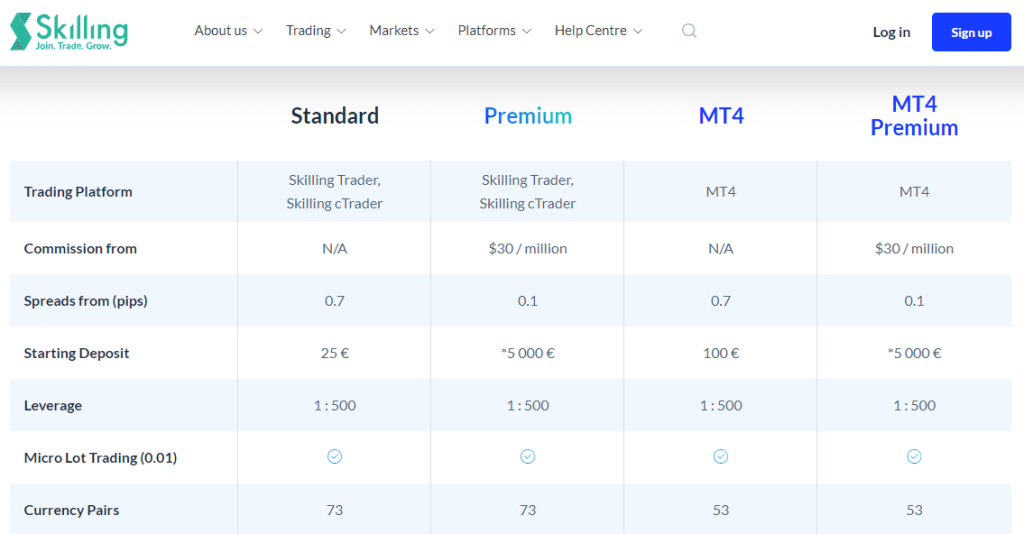

Skilling offers competitive standard account conditions, where all costs are incorporated into the spread, starting from 0.7 pips. Forex and currency pair fees are competitive compared to the industry standard, typically around 1 pip for EUR/USD. A Premium account offers interbank spreads from 0.1 pips and charges a commission of 35$ per million traded, making it quite competitive.

The broker's fees and pricing models are primarily based on spread charges. However, these fees can vary depending on the account type you choose and the trading platform you use.

While CFD fees might be slightly higher than other brokers, the spreads on some instruments can be quite competitive. Therefore, it's crucial to consider all aspects when deciding if Skilling is the right broker for you, as the quality of a broker isn't solely about trading costs.

Account Types

Skilling offers a variety of account types to cater to the different needs of traders. These include the Standard Account, Premium Account, MetaTrader 4 (MT4) Account, MT4 Premium Account, and Demo Account.

Standard Account

The Standard Account on Skilling is the most basic account and an ideal option for beginners. The account can be started with a minimum deposit of $100, and no commissions are charged on trades. Features include spreads starting at 0.7 pips, leverage up to 1:30, and the ability to trade on 73 currency pairs, 10 cryptocurrencies, 17 indices, 5 commodities, and over 700 equities. Users also have the ability to scalp and are protected by the negative balance protection feature.

Premium Account

The Premium Account on Skilling is designed for more experienced traders and has a higher minimum deposit requirement of $5,000. The key difference from the Standard Account is that this account type offers lower spreads starting at 0.1 pips and charges a commission of $30 per million when the trade volume exceeds a million. Other features are similar to the Standard Account.

MT4 Account

Skilling offers a MetaTrader 4 (MT4) Account for those who prefer to use the popular MT4 trading platform, known for its extensive usage in the forex trading community. The MT4 account requires a minimum deposit of $100, and there are no commissions on trades. Features include spreads from 0.7 pips, leverage up to 1:30, and the ability to trade on 53 currency pairs, 7 cryptocurrencies, 12 indices, 5 commodities, and over 700 equities.

MT4 Premium Account

The MT4 Premium Account mirrors the MT4 Account in most respects but requires a higher minimum deposit of $5,000. Like the MT4 Account, no commissions are charged, and users can trade on a wide range of financial instruments. The account also includes scalping and negative balance protection.

Demo Account

Skilling also offers a Demo Account that can be opened in conjunction with a live account. The Demo Account is particularly useful for novice traders looking to familiarize themselves with Skilling's platforms and tools, and for those who wish to test strategies in a risk-free environment before trading in real market conditions. The account is funded with $10,000 in virtual currency and does not have an expiry date, providing ample opportunity for practice.

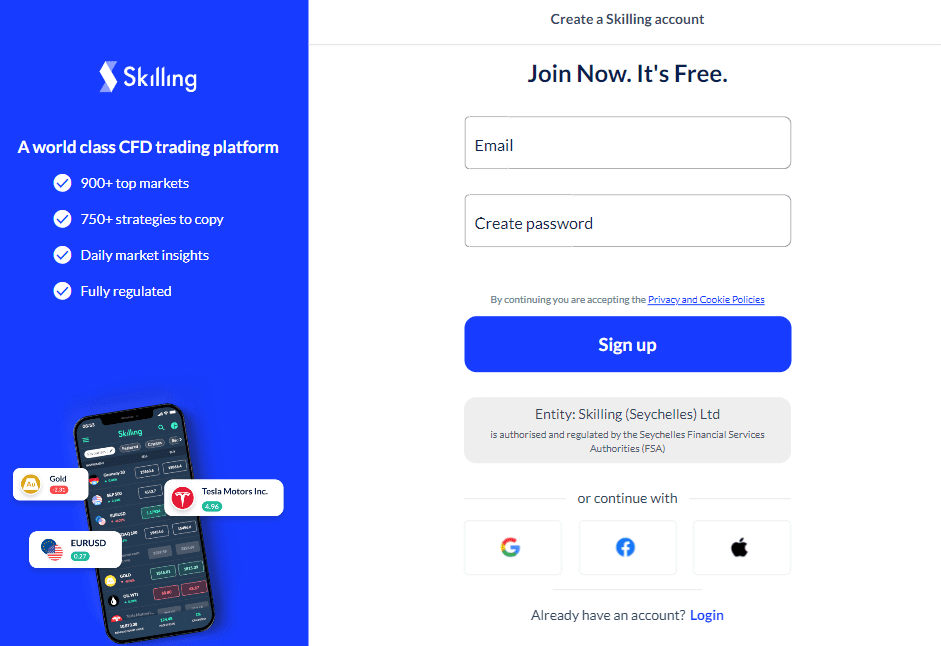

How to Open Your Account

Opening an account with Skilling is a straightforward process that can be done entirely online. Follow these steps:

- Registration: The first step is to go to the Skilling website and click on the ‘Login' button. You'll need to provide your personal details, including your name, email address, phone number, and country of residence.

- Verification: After you've completed the registration form, you'll need to verify your email address. Skilling will send a verification link to the email address you provided, and you'll need to click this link to confirm your email.

- Completing the Application: Next, you'll be asked to fill out a more detailed application form. This will include questions about your financial status, trading experience, and knowledge. This information is required to ensure Skilling complies with regulatory requirements and to tailor the platform to your needs.

- Documents Submission: To comply with Know Your Customer (KYC) regulations, Skilling will require proof of identity and proof of address. This usually involves uploading a scanned copy or photo of a valid passport or ID card and a recent utility bill or bank statement that clearly shows your residential address.

- Fund Your Account: Once your account has been approved, you can fund it using one of the payment methods available. These could include bank transfers, credit/debit card payments, or e-wallet services.

- Start Trading: After funding your account, you're ready to start trading. You can choose the financial instruments you want to trade, set your trading parameters, and place your first trade. Remember to start with small trades if you're a beginner and gradually increase your trading size as you gain more experience and confidence.

Please remember that trading in financial markets involves risk, and it's important to only trade with money you can afford to lose. It's also recommended to seek professional advice if you're unsure about any aspect of trading.

What Can You Trade on Skilling

Skilling provides a wide range of tradable markets that cater to diverse trading preferences. You can trade in major, minor, and exotic forex currency pairs, which are particularly popular among traders due to their high liquidity and tight spreads.

In addition to Forex, Skilling offers Contracts for Difference (CFDs) trading. CFDs allow traders to speculate on the rising or falling prices of fast-moving global financial markets or instruments. These include stocks from different sectors, offering you an opportunity to trade on the world's leading companies without owning the underlying assets.

Indices trading is also available on Skilling, where traders can speculate on the future price direction of some of the world's most popular indices such as the S&P 500, FTSE 100, and many more.

Commodities trading is another area where Skilling shines. This includes energies like oil and natural gas, and metals like gold, silver, and platinum. These markets are excellent for traders who wish to diversify their portfolios or hedge against specific market risks.

Finally, Skilling also offers the ability to trade on a variety of cryptocurrencies. This emerging market offers high volatility and unique opportunities for traders who understand the crypto market.

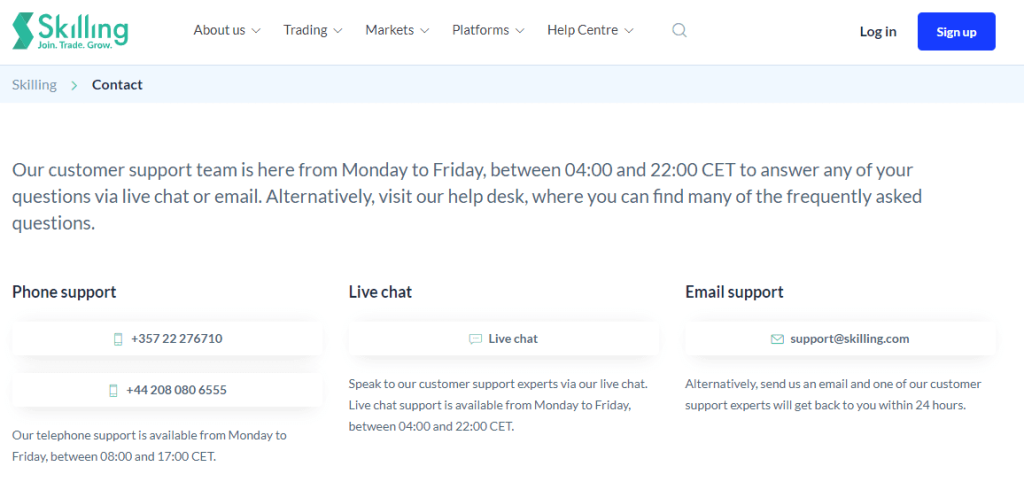

Skilling Customer Support

Providing a high level of customer support is a priority for Skilling. The platform offers multilingual customer service 24/5, meaning that you can receive support in various languages, making it accessible to a global audience.

Customer service is offered through several channels to cater to different preferences. For direct and immediate assistance, customers can use the live chat feature available on the platform. This provides real-time solutions to issues and direct communication with a support representative.

Email support is another option for customers who prefer to articulate their issues in a more detailed manner. It is also ideal for non-urgent inquiries or concerns that require comprehensive explanations or instructions.

For customers who prefer to speak directly to a representative, Skilling offers support via international phone lines. This allows users to clarify their concerns verbally and receive immediate feedback, ensuring swift problem-solving and customer satisfaction.

Through these multiple channels of communication, Skilling ensures that their clients receive the help they need promptly, efficiently, and in a manner that suits their communication style.

Advantages and Disadvantages of Skilling Customer Support

Security for Investors

Withdrawal Options and Fees

To cater to the diverse needs of its clientele, Skilling has made available numerous payment methods for deposits and withdrawals. These methods encompass a wide range of providers such as Visa/Mastercard, Neteller, Trustly, Klarna, Skrill, Swish, AstroPay, FasaPay, Directa, UnionPay, and Transact World. With a network of over 15 distinct payment mechanisms, Skilling is striving to make financial transactions as convenient as possible for its users.

One of the commendable features of Skilling is that it does not impose any fees on deposits or withdrawals. This means traders can make transactions without worrying about incurring additional costs from the broker's side. However, it's important to note that some payment systems may charge commissions for their services, and these charges will not be covered by Skilling.

In certain scenarios (not clearly indicated on their website), Skilling may apply a fee of up to 2.9% on transactions conducted through Skrill or Neteller. As a user, it's vital to be aware of these potential charges when choosing your preferred payment method.

The broker has established a minimum withdrawal limit of 50 units, where the exact amount can differ based on the payment system utilized. For a majority of systems, this limit typically stands at 50 euros.

Regarding the timeframe for processing transactions, Skilling guarantees that withdrawals to electronic systems or e-wallets will be handled within one business day. For bank payment systems, the process might take slightly longer, typically ranging between 2-7 days. This timely processing is a testament to Skilling's commitment to ensuring quick and efficient financial transactions for their clients.

Skilling Vs Other Brokers

#1. Skilling vs AvaTrade

Skilling and AvaTrade are both reputable trading platforms, each offering distinct features and services. AvaTrade has been operational since 2006, serving customers globally, and providing an extensive range of financial instruments. On the other hand, Skilling is a more recent entrant but has made its mark by offering user-friendly platforms, competitive fees, and a wide range of trading instruments.

While both brokers provide a similar variety of trading instruments, Skilling has a slightly lower minimum deposit and tighter spreads on some accounts. AvaTrade, however, has more trading platforms and an established track record of trust and reliability over the years.

Verdict: Both Skilling and AvaTrade are excellent brokers, but AvaTrade may edge out due to its longer track record, comprehensive regulatory oversight, and wider range of trading platforms. This verdict does not undermine Skilling's competitive offerings; therefore, newer traders looking for lower entry requirements may find Skilling more accessible.

#2. Skilling vs RoboForex

RoboForex stands out with its extensive trading options, offering over 12,000, compared to Skilling. The broker also boasts a broader selection of trading platforms, including MetaTrader, cTrader, and RTrader. RoboForex also offers demo contests, a feature not available with Skilling.

However, Skilling provides a more simplified and streamlined trading experience, ideal for beginners or those looking for a less complex platform. It also offers tight spreads and no commission on some account types, which could make it a more cost-effective choice for certain traders.

Verdict: For traders seeking a broad range of trading options and platforms, RoboForex may be the preferred choice. Yet, for those prioritizing a user-friendly platform with cost-effective trading conditions, Skilling could be a better fit.

#3. Skilling vs Exness

Exness is renowned for its beneficial trading conditions, including low commissions, quick order execution, and fund withdrawal. It also offers a considerable amount of leverage, allowing traders to earn on small deposits.

Skilling, in contrast, offers more limited leverage but boasts an intuitive trading platform and competitive spreads. Moreover, Skilling offers a wider range of account types and educational resources, which can be a significant advantage for beginners and intermediate traders.

Verdict: While Exness offers some attractive trading conditions, especially for high-volume traders, Skilling's diverse account types and user-friendly platform make it a superior choice for beginner and intermediate traders. The choice between the two largely depends on your trading style and volume.

Also Read: The Top 10 Brokers in 2023

Conclusion: Skilling Review

In conclusion, Skilling is a comprehensive and user-friendly trading platform ideal for both new and experienced traders. With its four diverse account types, competitive trading conditions, and extensive selection of financial instruments, Skilling offers flexibility and versatility that cater to different trading needs.

The provision of educational resources ensures that traders have the necessary knowledge to make informed trading decisions. Moreover, Skilling's solid regulatory standing in several jurisdictions offers reassurance about the platform's reliability and trustworthiness.

Although Skilling has some drawbacks, such as a limited range of research tools and withdrawal options, the platform's overall benefits significantly outweigh these limitations. Hence, Skilling presents a worthwhile option for individuals interested in exploring the world of online trading.

Skilling Review: FAQs

Is Skilling a good platform for beginners?

Yes, Skilling offers a user-friendly interface, educational resources, and a demo account, which makes it ideal for beginners. These features provide new traders with the necessary tools to learn about trading and practice their strategies in a risk-free environment before trading with real money.

Does Skilling offer good customer support?

Yes, Skilling offers multilingual customer support 24/5 via international phone lines, live chat, and email. This ensures that clients can receive assistance and answers to their queries promptly and effectively.

Are there any fees for depositing or withdrawing funds from Skilling?

Skilling does not charge any fees for deposits or withdrawals. However, it is important to note that some payment systems may charge fees, which are not reimbursed by the broker. Additionally, under certain circumstances (not specified on the website), the broker may charge a commission of up to 2.9% when depositing or withdrawing money through Skrill or Neteller.