YEN Deprecation Viewed as Unjustified by Japan's Finance Ministry

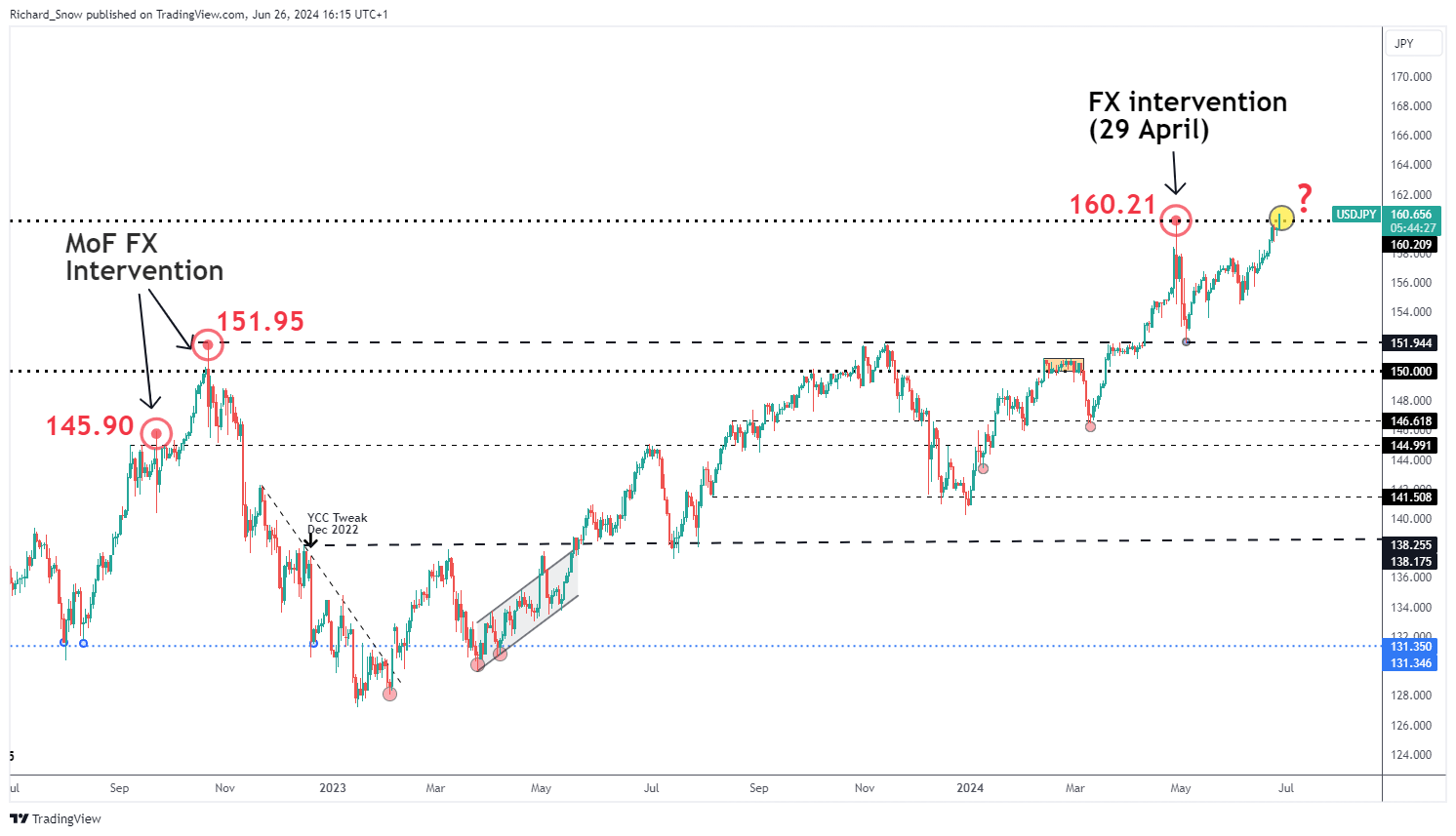

Masato Kanda, Japan's primary currency authority at the Ministry of Finance (MoF), has voiced strong objections to the yen's rapid decline, which he deems speculative and unwarranted. Despite his warnings, the USD/JPY pair has surged past levels that previously triggered official interventions.

Kanda highlighted his deep concerns as the yen approaches a 4% drop in two weeks, a threshold that historically signals excessive volatility. This comes after the yen weakened by approximately 3.15% in just two weeks, nearing this critical point.

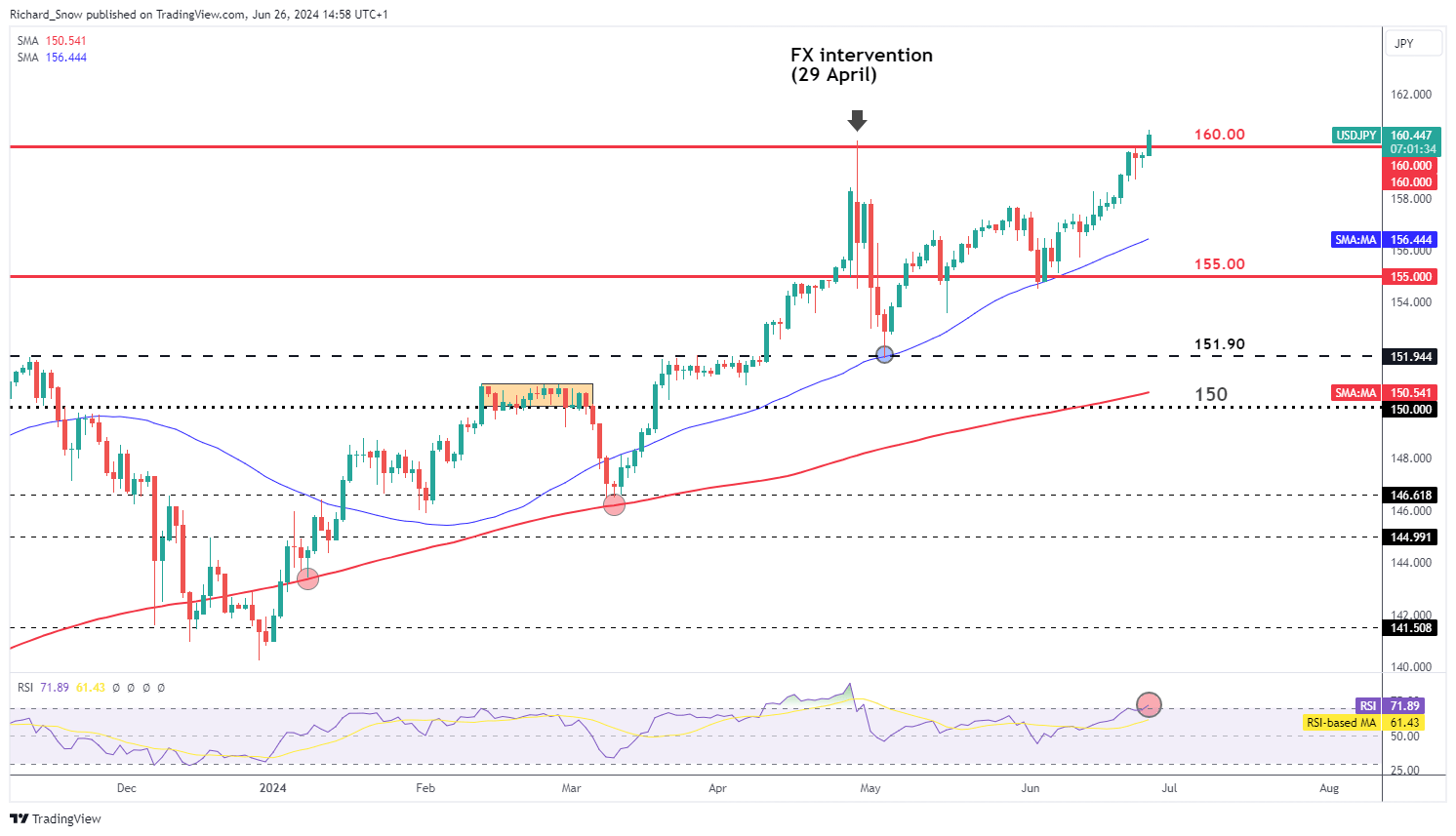

As of the latest update, USD/JPY reached an intra-day peak during the London session at around 160.81, entering oversold territory as indicated by the RSI.

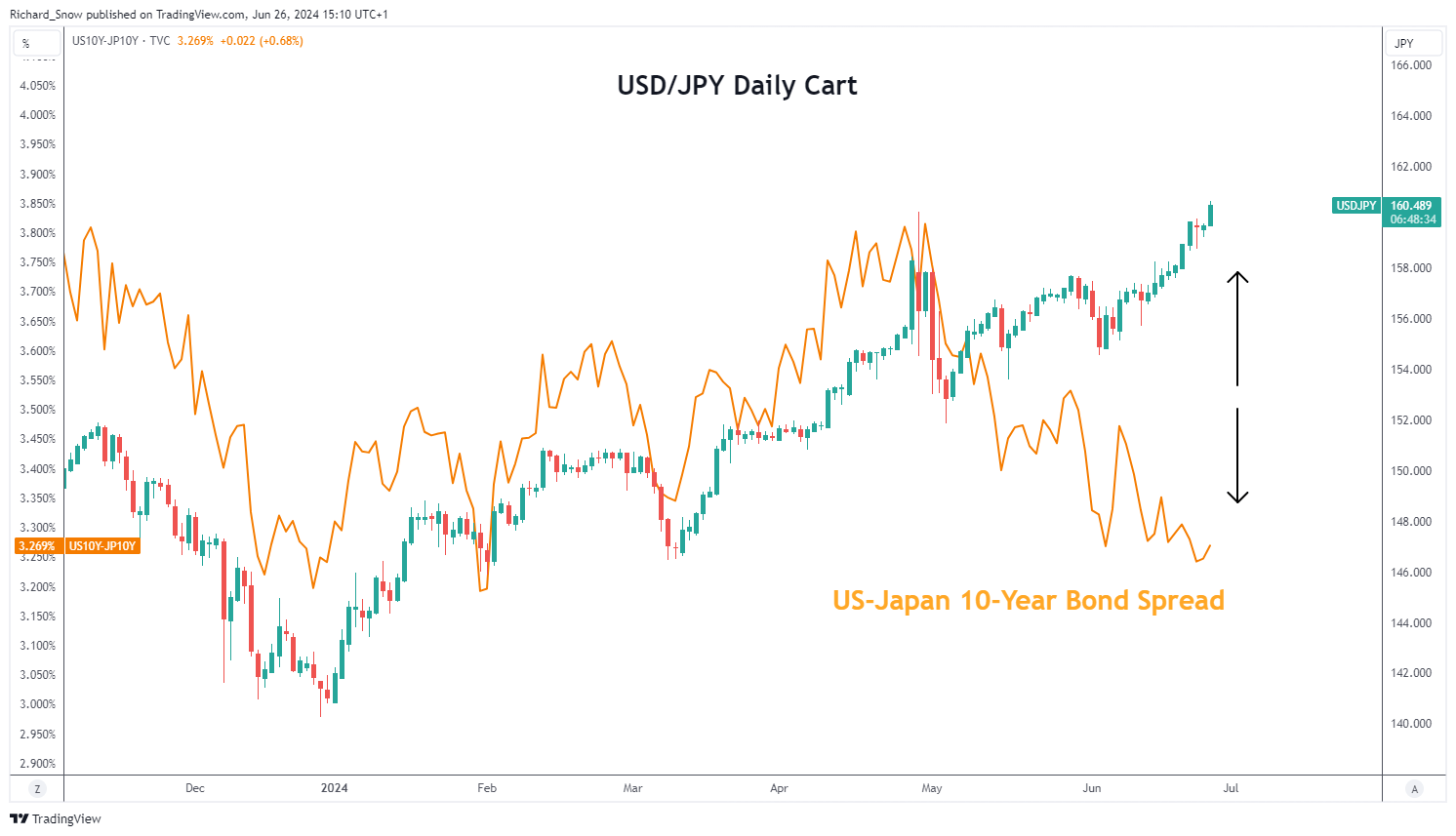

USD/JPY Dismisses Shifting US-Japan Bond Yields

Despite a rise in Japanese Government bond yields above 1%, USD/JPY continues to trade high, showing resilience at levels around 160.00. Typically, movements in the US-Japan bond yields influence the currency pair, yet recent trends suggest a disconnection.

The Bank of Japan (BoJ) has not provided specifics on anticipated adjustments to its bond buying, delaying details until a meeting scheduled for next month. The upcoming bond purchase schedule, due to be released this Friday, could offer a temporary slowdown in the yen's depreciation if the US PCE data also comes in lower than expected. However, the ongoing momentum suggests this may be insufficient to curb the pair's rise.

Recent Disconnect Between USD/JPY and US-Japan 10Y Bond Spreads (orange)

A Risky Standoff: Market Confidence vs. Ministry of Finance

The market continues to challenge the Ministry of Finance's stance, keeping the USD/JPY comfortably above 160.00. This defiance occurs despite substantial intervention from Japanese officials, involving massive yen purchases to counter the currency's fall. With potential for sudden, high volatility, this scenario underscores the need for careful risk management, especially given previous shifts of about 500 pips following interventions.

Prior, Surpassed Instances of FX Intervention