Trading can often feel like piecing together a puzzle where each move the market makes adds another piece to the picture. Over the years, I've learned that some of the best tools for figuring out where the market is headed are the chart patterns it leaves behind. One pattern that has consistently helped me identify potential market reversals is the W pattern, also known as the double bottom pattern. This pattern is straightforward yet powerful, signaling when the market might be gearing up for a change in direction.

Through countless trades, I’ve seen this pattern play out, leading to profitable opportunities. I want to share how you can spot this pattern, trade it effectively, and use some of the strategies that have worked well for me. Whether you're a seasoned trader or just starting, understanding the W pattern can give you an edge.

Let’s break it down and see how you can use the W pattern to your advantage.

What is W Pattern Trading?

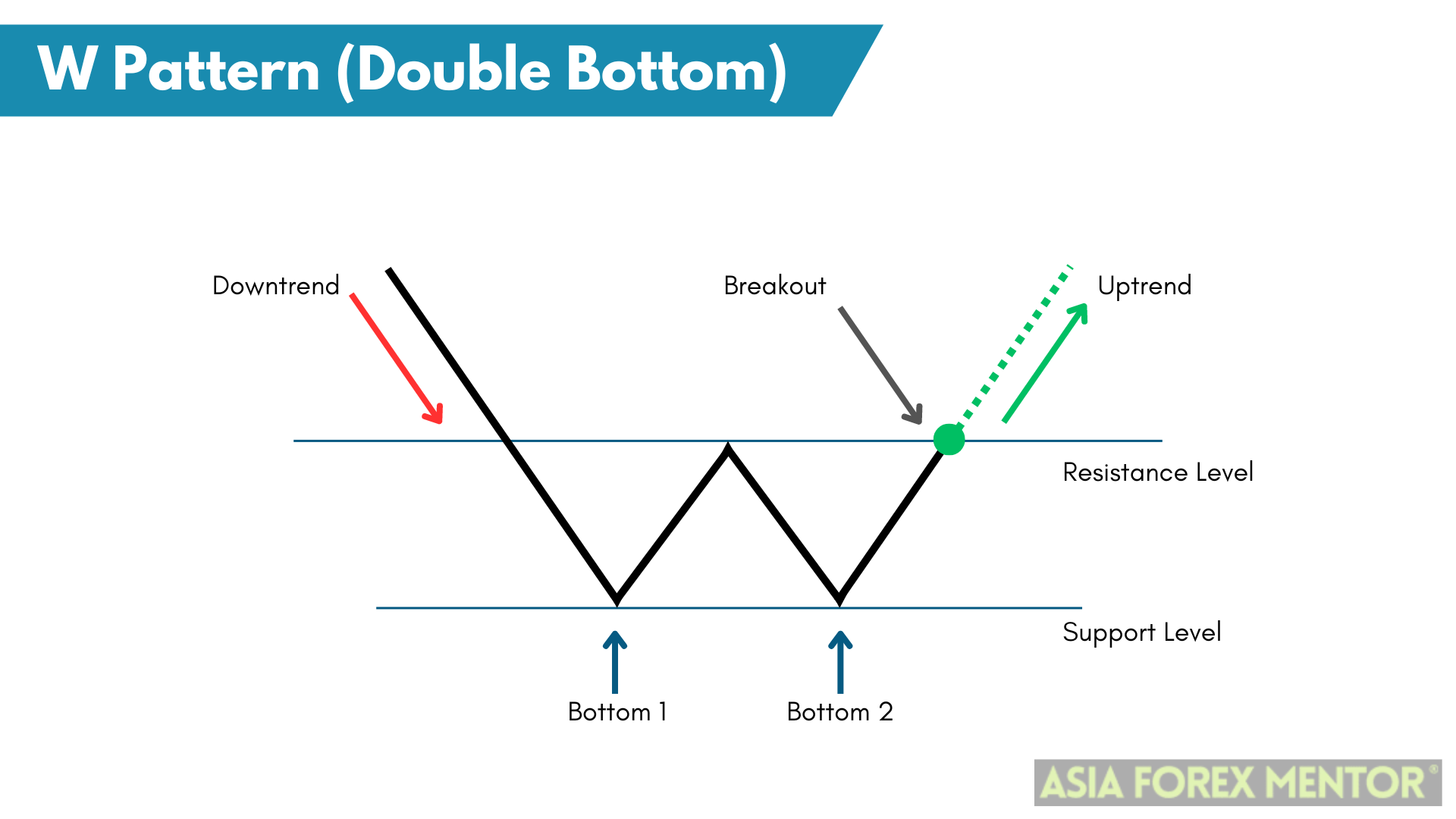

W pattern trading is a technique I've leaned on to catch those moments when the market is showing signs of switching from bearish to bullish. The pattern is named after its shape on the chart, which resembles a “W.” This pattern typically appears after the market has experienced a downward trend and indicates that the selling pressure is easing, with buyers beginning to step in.

Also called the double bottom pattern, this setup involves two distinct lows at about the same level, with a peak sitting between them. When this pattern forms, it often suggests that the market might be ready to reverse its direction. Spotting this pattern early has allowed me to enter trades confidently, knowing that I’m catching the market just as it’s starting to turn.

Also Read: How to Trade the Bearish Quasimodo Pattern

What is the W Bottom Pattern?

The W bottom pattern, often referred to as the double bottom pattern, is one of those chart setups that can be incredibly useful when trading. It occurs when an asset’s price forms two distinct lows at nearly the same level, with a peak between them. This formation suggests that the asset has found strong support at this price level, hinting that a reversal to an upward trend could be on the horizon.

In my experience, this pattern has shown up time and again across various forex pairs, and when it does, it often signals that the market is about to shift. Spotting this pattern early and confirming it with other indicators can lead to successful trades.

How to Spot the W Bottom Pattern

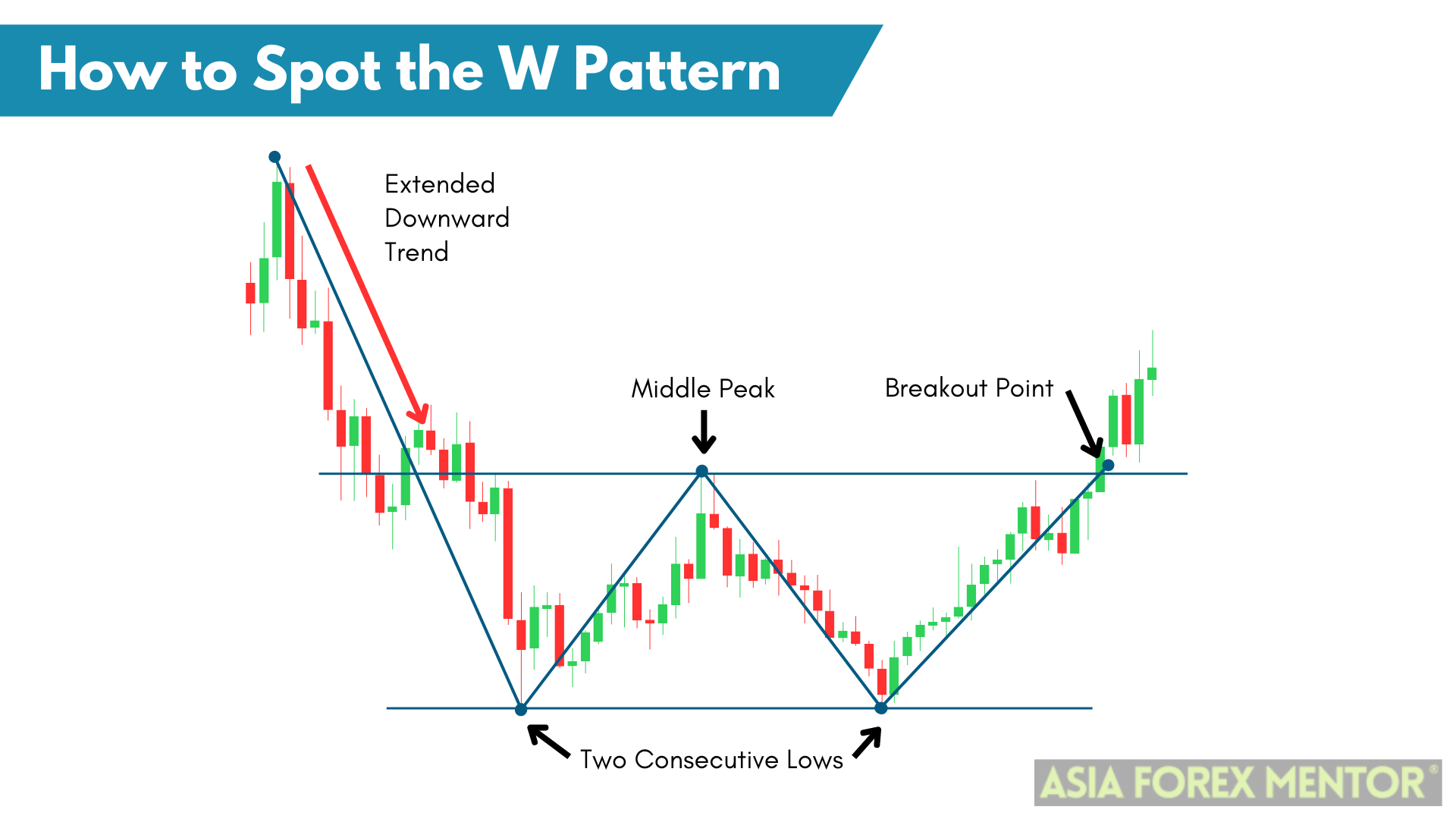

Recognizing the W bottom pattern involves a bit of chart-watching and an understanding of what the market is telling you. Here’s what I usually look for:

- Extended Downward Trend: This pattern typically shows up after a significant drop in price. The market has been moving down, creating the first low.

- Two Consecutive Lows: You’ll notice that the price hits a low, rises to a peak, and then drops again to a second low. Both lows are at about the same level, which shows that the market is testing a support zone.

- Middle Peak: Between these two lows, there’s a peak where the price temporarily rallies before dropping again. This peak is crucial because it shows that buyers are beginning to test the market.

- Breakout Point: The pattern is confirmed when the price breaks above the middle peak after forming the second low. This breakout is often a signal that a new upward trend is starting.

How to Trade the W Bottom Pattern

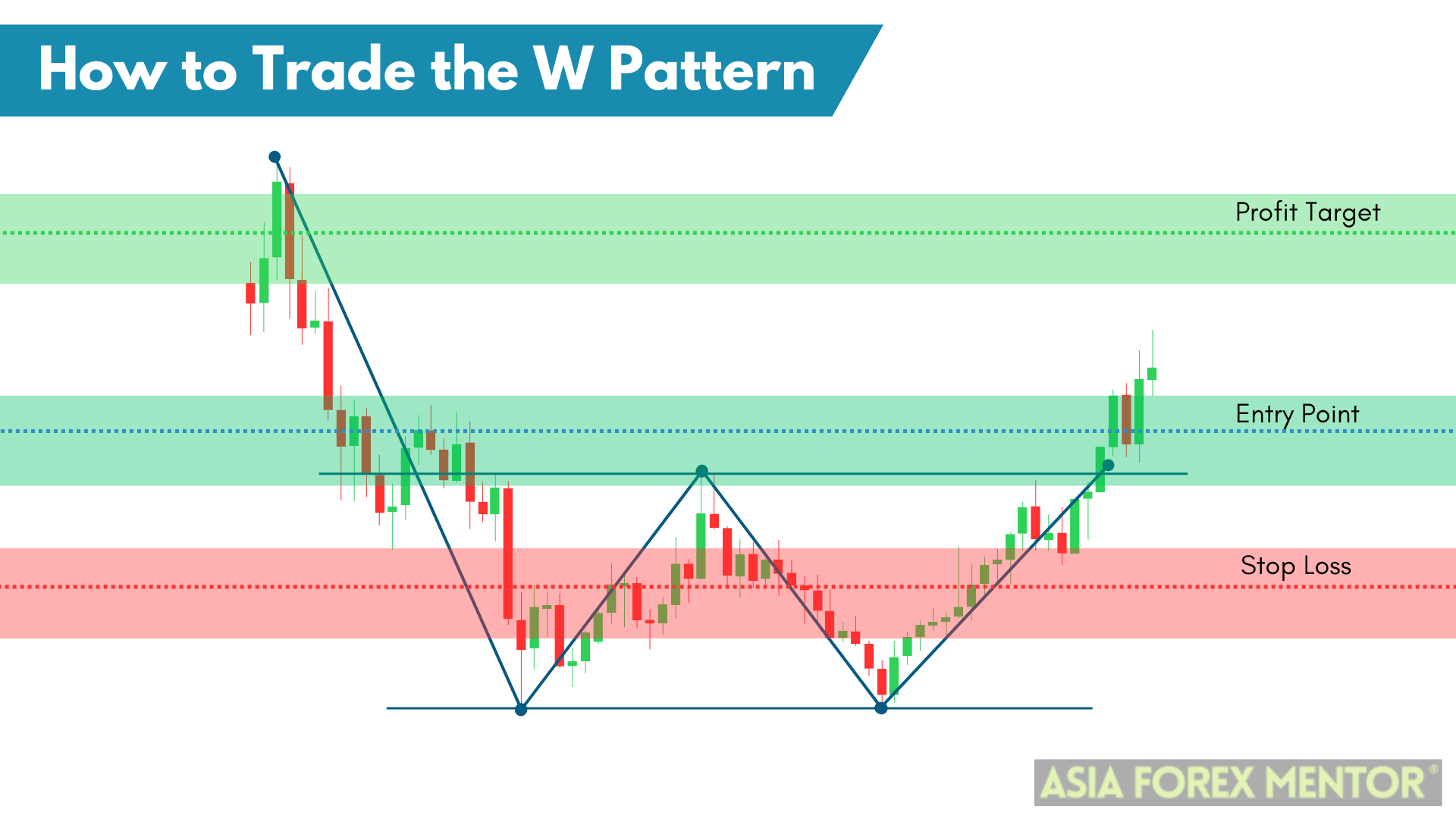

Trading the W bottom pattern has become a key part of my strategy. Here’s how I go about it:

Entry Point: I look to enter a long position when the price breaks above the middle peak of the W pattern. This breakout indicates that the market is shifting from a downward trend to an upward one, making it an ideal point to enter a trade.

Stop Loss: To manage risk, I place a stop loss just below the second low of the pattern. This helps protect against potential losses if the pattern fails and the price continues to decline.

Profit Target: I set my profit target by measuring the distance from the lowest point of the pattern to the middle peak, then projecting that distance upward from the breakout point. This gives me a reasonable target for how far the price might rise.

Pros and Cons of W Pattern Trading

Pros

- W patterns offer reliable signals for trend reversals, which can lead to high-probability trades.

- These patterns provide straightforward guidelines on when to enter and exit a trade, which simplifies decision-making.

- Whether you’re trading forex, stocks, or commodities, W patterns can be applied to identify potential market shifts.

Cons

- Sometimes, the market can reverse after a breakout, leading to potential losses.

- Waiting for the W pattern to fully develop can require patience, especially in fast-moving markets.

Difference Between the Double Bottom and Double Top Pattern

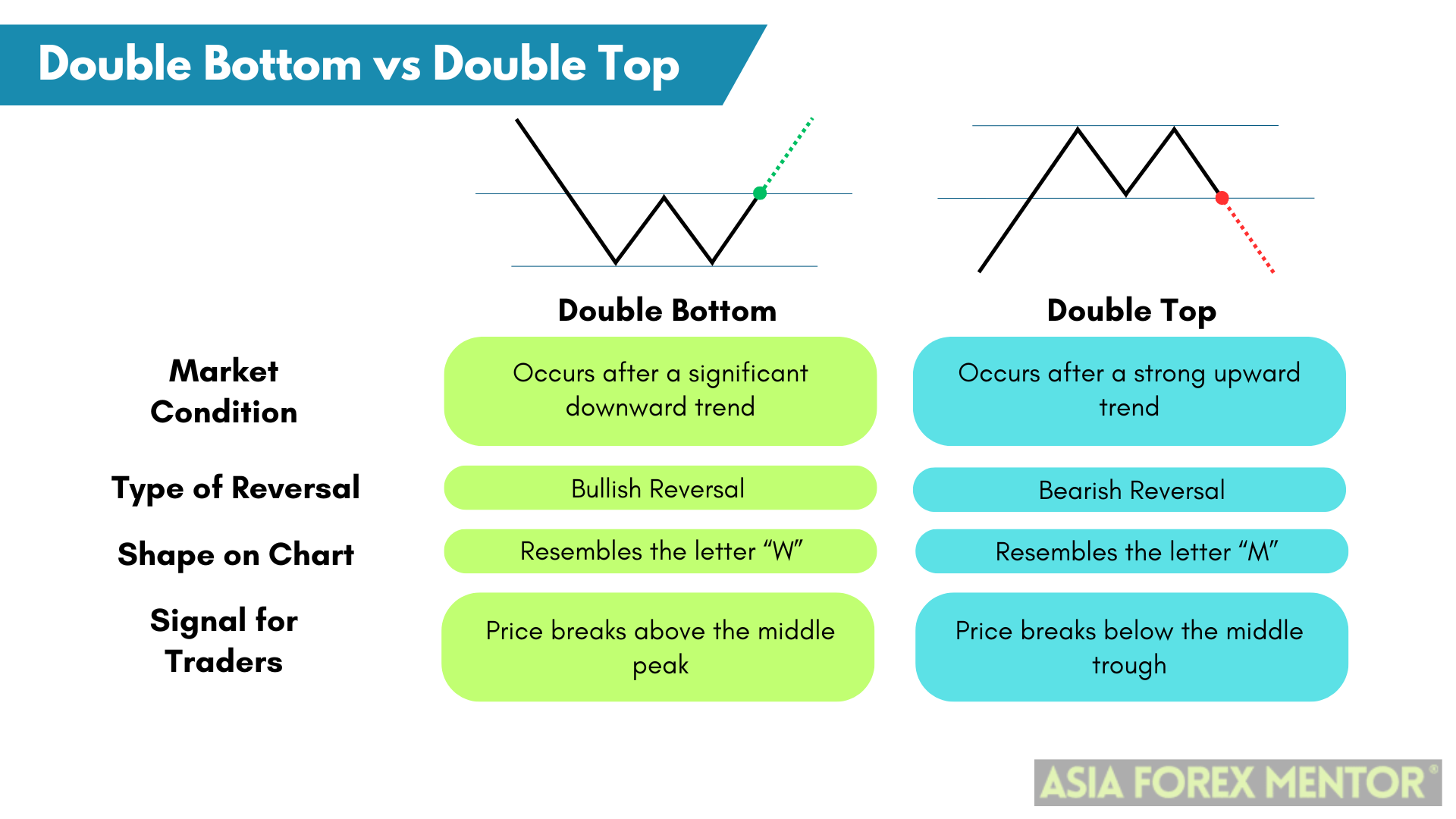

Double Bottom Pattern (W Pattern)

- Market Condition: The double bottom pattern occurs after a significant downward trend. It is a bullish reversal pattern that indicates the potential end of a downtrend and the beginning of an uptrend.

- Shape: This pattern resembles the letter “W,” with two distinct lows at approximately the same level and a peak between them.

- Signal: When the price breaks above the middle peak after forming the second low, it suggests that the market is shifting from bearish to bullish. Traders often see this as an opportunity to enter a long position, anticipating upward movement.

Double Top Pattern (M Pattern)

- Market Condition: The double top pattern appears after a strong upward trend. It is a bearish reversal pattern that signals the potential end of an uptrend and the start of a downtrend.

- Shape: This pattern looks like an inverted “W” or the letter “M,” with two distinct peaks at roughly the same level and a trough between them.

- Signal: When the price breaks below the middle trough after forming the second peak, it indicates that the market is likely to reverse downward. Traders typically use this signal to enter a short position, expecting the price to decline.

Key Differences

- Direction of Reversal: The double bottom pattern is a bullish reversal, while the double top pattern is a bearish reversal.

- Market Trend: The double bottom occurs after a downtrend, suggesting a potential upward reversal. In contrast, the double top happens after an uptrend, indicating a potential downward reversal.

- Trading Strategy: Traders use the double bottom pattern to identify buying opportunities (going long), whereas the double top pattern is used to spot selling opportunities (going short).

Indicators to Use to Confirm the Pattern

To increase the chances of a successful trade, I often use additional technical indicators to confirm the W patterns:

- Moving Averages: These can help determine the overall trend direction and confirm whether a breakout is likely to hold.

- Relative Strength Index (RSI): RSI is helpful for identifying overbought or oversold conditions, providing additional insight into whether a reversal is likely.

- Volume: A surge in volume during a breakout strengthens the case that the pattern is valid.

- MACD: The Moving Average Convergence Divergence (MACD) indicator is useful for confirming momentum shifts, especially during a breakout.

Tips for Trading W Patterns

1. Be Patient: W patterns can take time to fully develop, so patience is key. Don’t rush into a trade before the pattern is complete and confirmed.

2. Use Other Indicators: While W patterns can be powerful on their own, confirming them with additional indicators like RSI, volume, or MACD can increase your chances of success.

3. Set Clear Targets: Determine your entry, stop loss, and profit target levels before entering the trade. This helps remove emotion from your decision-making and ensures you’re trading with a plan.

4. Practice on Demo Accounts: If you’re new to trading W patterns, consider practicing on a demo account first. This allows you to get comfortable with the pattern without risking real money.

5. Stay Disciplined: Stick to your trading plan and don’t let emotions drive your decisions. It’s easy to get caught up in the moment, but discipline is what separates successful traders from the rest.

Common Mistakes to Avoid

1. Entering Too Early: One of the most common mistakes is jumping into a trade before the pattern is fully formed and confirmed. This can lead to losses if the market doesn’t follow through as expected.

2. Ignoring Stop Losses: Always use a stop loss to protect your capital. Ignoring this critical step can lead to significant losses if the market moves against you.

3. Overtrading: Just because you spot a W pattern doesn’t mean you should trade every single one. Quality over quantity is key. Look for patterns that meet all your criteria and have strong confirmation signals.

4. Neglecting Market Conditions: W patterns are powerful, but they aren’t foolproof. Always consider the broader market conditions before making a trade. A strong trend or significant news event can override a pattern, leading to unexpected results.

Conclusion

W pattern trading has been a reliable method in my trading toolkit, helping me consistently identify potential trend reversals. Whether you’re trading the W bottom or W top pattern, this approach can give you a clearer picture of where the market might be headed. By learning how to spot these patterns and using the strategies outlined here, you can increase your chances of making successful trades.

Remember to be patient, use other indicators to confirm the pattern, and always have a clear plan before entering a trade. With practice and discipline, W pattern trading can become a valuable part of your trading strategy.

Also Read: How to Trade the Bullish Tri-Star Pattern

FAQs

What is the W Pattern in Trading?

The W pattern in trading, also known as the double bottom pattern, is a bullish reversal chart pattern that typically appears after a prolonged downtrend. It resembles the letter “W” on a price chart and indicates that the market may be preparing to reverse direction from bearish to bullish. This pattern consists of two distinct lows at about the same level, with a peak in between. Traders often use this pattern to identify potential entry points for buying into a rising market.

How Reliable is the W Pattern for Predicting Market Reversals?

The W pattern is considered a reliable indicator for predicting market reversals, especially when confirmed with other technical indicators like RSI, MACD, or moving averages. However, like any trading strategy, it is not foolproof. False breakouts can occur, and market conditions can change unexpectedly. It’s important to use risk management tools like stop losses to protect your trades and ensure that the W pattern aligns with the broader market context before making any trading decisions.

Can the W Pattern be Used in All Financial Markets?

Yes, the W pattern can be used across various financial markets, including forex, stocks, commodities, and cryptocurrencies. The principles of the pattern remain consistent across these markets, making it a versatile tool for traders. Whether you’re trading in short-term or long-term markets, the W pattern can help identify potential trend reversals and profitable entry points.