The vast world of commodity trading has often been equated to a volatile ocean where only the bravest and most strategic navigators thrive. Amidst the complexities of the trading market, commodity brokers function as the captains, guiding the course of the transactions. In the digital age, commodity brokers have evolved from traditional brokerage firms to include online Forex trading platforms.

These platforms not only offer the convenience of trading from anywhere, but also allow traders to participate in various markets, including commodities. In this detailed guide, we aim to simplify the understanding of commodity brokers, delve into the specifics of trading commodities on Forex, and provide an in-depth analysis of top-tier commodity brokers: AvaTrade, RoboForex, Alpari, InstaForex, and XM.

How to Trade Commodity on Forex?

Forex trading of commodities involves trading contracts of commodities rather than owning the physical goods. The commodities, categorized broadly into hard and soft commodities, are bought or sold based on their price movements. Hard commodities include natural resources such as oil, gold, and gas, whereas soft commodities include agricultural goods or livestock.

To start trading commodities on Forex, follow these steps:

#1. Research and Choose a Forex Broker:

Select a trustworthy and reputable Forex broker that offers commodity trading. Research extensively, consider factors like their reputation, regulatory compliance, customer service, and the platform's ease of use.

#2. Open a Trading Account:

Once you've chosen a broker, you'll need to open a trading account. This often involves providing personal identification documents and completing an application form.

#3. Deposit Funds:

Fund your trading account using one of the broker's accepted payment methods.

#4. Select a Commodity:

Choose the commodity you wish to trade based on your market analysis and trading strategy.

#5. Place a Trade:

Decide whether you want to go long (buy, expecting prices to rise) or short (sell, expecting prices to fall) on the commodity.

#6. Manage Risk:

Use risk management tools like stop losses and take profit levels to limit potential losses and secure profits when the price reaches your target level.

#7. Monitor and Close Your Position:

Regularly monitor the market and your open trades. When you're ready or your pre-set stop loss or take profit levels are hit, close your trade.

Best Commodity Brokers

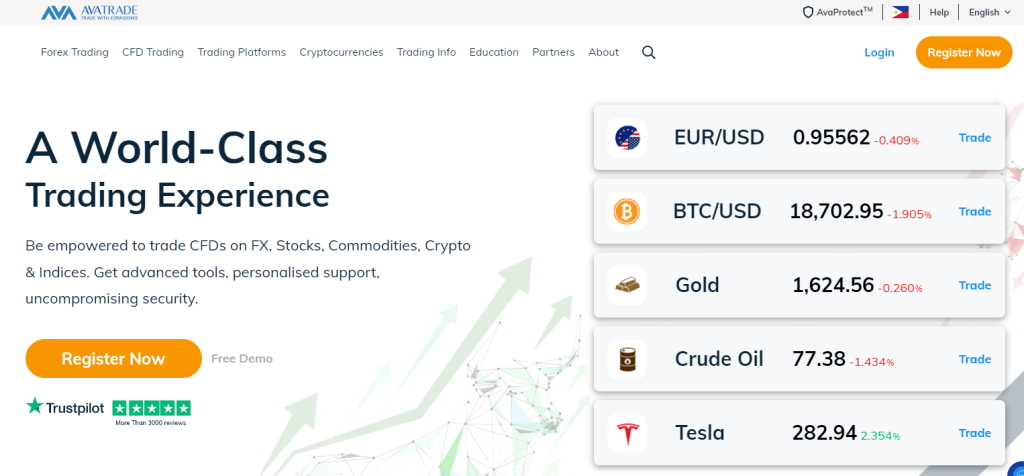

#1. Avatrade

What is Avatrade?

AvaTrade is an internationally recognized online broker that provides a comprehensive platform for trading in diverse financial markets. Established in 2006, AvaTrade offers its clients access to Forex, commodities, indices, stocks, bonds, ETFs, and cryptocurrencies.

The company is known for its dedication to providing a client-oriented focus, offering support in 14 languages, and regulatory oversight from several top-tier financial authorities globally.

Advantages and Disadvantages of Trading with Avatrade

Commissions and Fees

AvaTrade operates primarily on a spread-only basis, meaning it doesn't charge additional commissions for trades. Instead, the cost of trading is integrated into the spread – the difference between the buying and selling price of an asset. It's worth noting that AvaTrade's spreads may be slightly higher than some of its competitors. The broker also charges an inactivity fee of $50 per quarter after three consecutive months of non-use, and an administration fee if the account remains inactive for 12 months.

#2. Plus500

What is Plus500?

Plus500 is a leading provider of Contracts for Difference (CFDs), offering trading facilities on a wide range of financial instruments, including commodities, shares, forex, indices, and more. The platform is known for its user-friendly interface, advanced charting tools, and real-time alerts, enabling traders to make informed decisions efficiently. Plus500 operates under strict regulatory frameworks, being authorized and regulated by several financial authorities worldwide, such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities & Investments Commission (ASIC) in Australia. This extensive regulatory oversight ensures a secure and transparent trading environment, making Plus500 a preferred choice for commodity traders seeking reliability and comprehensive features.

Advantages and Disadvantages of Plus500

Commissions and Fees

Plus500 primarily earns revenue through the market spread, which is the difference between the buy and sell prices of an instrument, and does not charge dealing commissions on trades. However, traders should be aware of additional fees that may apply, such as overnight funding, which is added or subtracted when holding a position after a specified time, and a currency conversion fee of up to 0.7% for trades on instruments denominated in a currency different from the account's base currency. Additionally, an inactivity fee of up to $10 per month may be charged if there is no account activity for at least three months. Despite these fees, Plus500's transparent pricing structure and absence of commission charges make it a competitive option for commodity traders.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

OPEN A DEMO ACCOUNT ON PLUS500

#3. Alpari

What is Alpari?

Alpari has been in the market since 1998, providing Forex and CFD trading services that include commodities, cryptocurrencies, and indices. Alpari is well-known for its variety of account types that cater to different trading styles and levels of experience.

Advantages and Disadvantages of Trading with Alpari

Commissions and Fees

Alpari’s commission and fee structure is dependent on the type of account you choose. Some account types incorporate trading costs into the spread, while others charge a commission per trade. It's crucial to understand the specifics of each account type before choosing one.

#4. InstaForex

What is InstaForex?

Established in 2007, InstaForex is an online broker that provides trading services in multiple financial markets, including commodities, Forex, and indices. InstaForex is recognized for its extensive educational resources and comprehensive customer support.

Advantages and Disadvantages of Trading with InstaForex

Commissions and Fees

InstaForex uses a blend of spread and commission charges. Depending on the type of account, you may encounter either fixed or floating spreads, and some accounts also involve a commission per trade. Details of these costs are clearly outlined on the InstaForex website.

#5. XM

What is XM?

XM is a multi-regulated Forex and CFD broker that offers trading in a variety of financial instruments, including commodities. Established in 2009, XM has earned a solid reputation in the trading community for its transparency, excellent educational resources, and diverse trading platforms.

Advantages and Disadvantages of Trading with XM

Commissions and Fees

Similar to other brokers, XM charges a mix of spreads and commissions, with some accounts being spread-only. XM's zero account, for instance, charges a commission but offers very tight spreads. However, the broker does apply an inactivity fee to dormant accounts and high withdrawal fees for certain withdrawal methods.

The Intricacies of Commodity Futures in Modern Trading

In the intricate labyrinth of the financial markets, commodity futures hold a significant position. They serve as a key instrument in commodities trading, offering a pathway for traders to hedge against potential price changes or speculate on the price movements of various commodities.

Commodity futures represent a contractual agreement to buy or sell a predetermined amount of a commodity at a specific price on a particular date in the future. Trading futures can involve commodities like gold, oil, or agricultural products. These contracts standardize the quality and quantity of the commodity to eliminate the challenges of handling physical goods.

Active traders find futures trading to be an exciting and potentially lucrative sphere due to the considerable leverage it offers. This leverage can magnify profits, but it's important to remember it can also magnify losses, making risk management crucial in futures trading.

The global commodity markets are vast and dynamic. Numerous factors can influence the prices of commodities, including geopolitical events, changes in supply and demand, economic indicators, and even weather patterns. Traders must stay informed about these factors to make informed decisions about their commodity trades.

Choosing a reliable commodities broker is an essential part of the trading experience. The right broker can provide valuable market insights, offer advanced trading platforms, and deliver efficient customer service to support your trading journey. The choice of a commodities broker can often make the difference between a profitable trade and a missed opportunity.

As an active trader, your trading experience is defined not just by the trades you make, but also by the strategies you employ, the market analysis you undertake, and the knowledge you acquire over time. From understanding the nuances of the commodity markets to mastering the art of risk management in futures trading, every aspect contributes to your trading experience.

Trading commodities requires careful planning and preparation. It's not just about investing your money, but also investing your time in understanding market trends, mastering trading strategies, and constantly learning from your experiences.

The world of commodity brokers and futures trading offers endless possibilities for those willing to navigate its complexities. With the right broker, effective trading strategies, and a commitment to continual learning, trading commodities can be an exciting and rewarding journey.

Conclusion

As we delve into the complex world of commodity trading, it becomes apparent that choosing the right commodity broker is as vital as strategizing your trades. Numerous factors should be weighed, including regulations, trading fees, customer service, trading platforms, and educational resources, to name a few. AvaTrade, RoboForex, Alpari, InstaForex, and XM stand out as reputable commodity brokers, each presenting unique strengths and weaknesses. As a trader, it’s crucial to research extensively and select a broker that aligns with your trading needs and objectives.

FAQs

Is trading commodities risky?

Yes, commodity trading can be risky due to the volatility of commodity prices, influenced by various factors like supply, demand, geopolitical issues, and economic indicators. Therefore, traders should have a solid risk management strategy.

Can I start trading commodities with a small investment?

Yes, many brokers offer micro or mini contracts, allowing traders to start with a small investment. However, the potential for profit or loss is correspondingly small.

What is the best time to trade commodities?

The best time to trade commodities depends on the commodity and its market hours. For instance, oil is best traded when the New York Mercantile Exchange (NYMEX) is open.

Can I trade commodities on all Forex platforms?

Not all Forex brokers offer commodity trading. Therefore, ensure your chosen broker supports commodity trading before opening an account.

Are commodity brokers regulated?

Reputable commodity brokers are usually regulated by top-tier financial authorities like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).