Squared Financial Review

First known as ProbusFX, later rebranded to SquaredDirect, and now popular as Squared Financial, this broker specializes in trading foreign exchange (FX) and Contracts for Difference (CFDs). With its main operational base in Cyprus, Squared Financial offers comprehensive trading solutions, supporting clients with dedicated educational resources and professional guidance. Besides forex, the platform also grants access to precious metals trading, and CFDs on Energies and Indices.

This review provides a thorough analysis of Squared Financial, shedding light on its strengths, weaknesses, and everything in between. As we evaluate its features, commission structure, account types, transaction procedures, and more, we hope to present a well-rounded perspective, synthesizing expert evaluations and real trader experiences to aid you in your decision-making process.

What is Squared Financial?

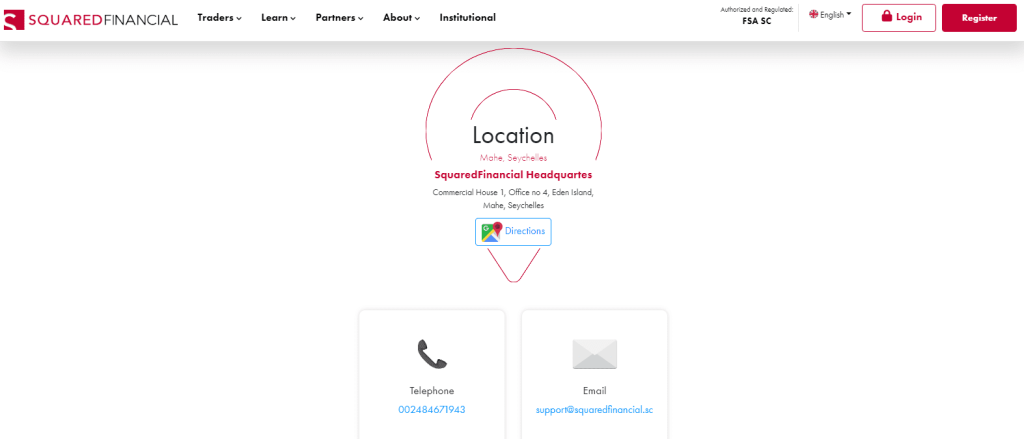

Squared Financial is a celebrated fintech establishment that offers investment and wealth management services. Its journey began in 2005, and since then, it has evolved into a dependable brokerage service with offices in Cyprus and the Republic of Seychelles. The broker is a subsidiary of Squared Financial (CY) Limited, regulated by reputable organizations like the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA SC).

In 2020, the Global Awards recognized Squared Financial for its transparency, boosting its credibility among traders. From beginners to professionals, the broker offers adaptable, tech-driven solutions that cater to diverse investment needs. Its robust product and service range make it an excellent platform for trading selected products or nurturing long-term investments.

Advantages and Disadvantages of Trading with Squared Financial

Benefits of Trading with Squared Financial

Trading with Squared Financial presents several unique advantages that cater to a diverse range of traders, regardless of their experience level or investment size.

One of the critical benefits of Squared Financial is its competitively tight spreads, which begin from as low as 0.0 pips for Elite accounts. This offering allows traders to maximize their potential returns by minimizing their cost of trading.

Another prominent benefit is the broker's extensive selection of payment systems. Squared Financial provides various methods for deposits and withdrawals, including major credit cards, bank wires, and several electronic payment systems. Many of these options enable instant payments, providing you with quick and efficient access to your trading capital.

Squared Financial also provides access to MetaTrader 4 and MetaTrader 5, two of the most popular trading platforms in the forex market. These platforms are known for their reliability, user-friendly interfaces, and advanced charting tools, which are key for effective trading.

Finally, Squared Financial offers a wide variety of trading tools, with seven asset classes encompassing various levels of volatility. This expansive selection gives you the flexibility to diversify your portfolio and tailor your trading strategies to suit your risk tolerance and investment objectives.

Squared Financial Pros and Cons

Like any brokerage, Squared Financial has its own set of strengths and weaknesses that traders should consider.

Pros

- Variety of Tradable Instruments: Squared Financial offers an extensive range of tradable assets, providing traders the opportunity to diversify their investment portfolios.

- Islamic Account: The broker offers an Islamic account option, which complies with Sharia law by not charging any interest or swap fees.

- Well-regulated: Squared Financial is licensed by reputable regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC), ensuring a secure and transparent trading environment.

- Low Minimum Deposit: The entry-level account requires a relatively low minimum deposit, making it accessible to novice traders and those with smaller investment budgets.

- Multiple Payment Methods: The broker provides a wide range of payment options, giving traders flexibility in how they deposit and withdraw funds.

Cons

- No Referral Bonus: Squared Financial does not currently offer a bonus for referring new clients.

- Demo Account Validity: There is no clear indication of how long the demo account remains active.

- No US Clients: Traders from the United States are not accepted, limiting the broker's market reach.

- High Minimum Deposit for Advanced Accounts: The advanced account options require a significantly higher minimum deposit, which may be prohibitive for some traders.

- E-payment Limitations: Electronic payment methods can only be used for deposits, not for withdrawals, which may inconvenience some traders.

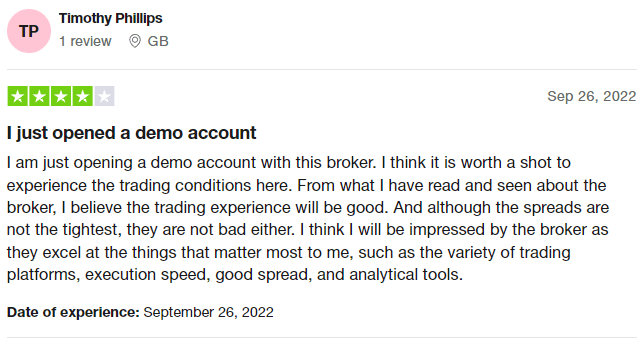

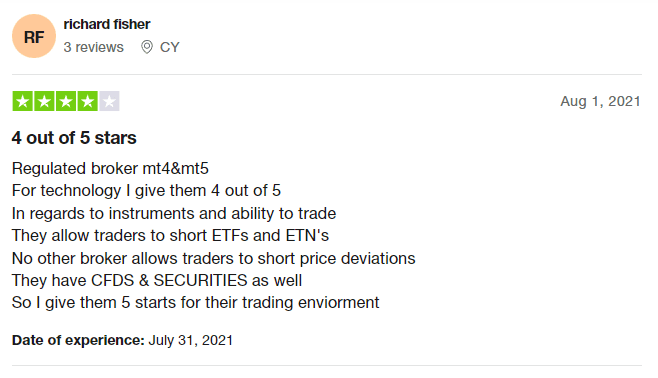

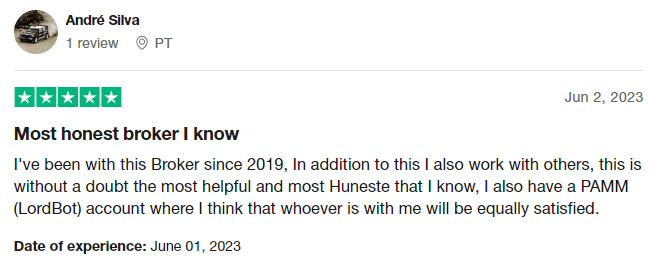

Squared Financial Customer Reviews

Customers have expressed positive feedback about Squared Financial. One customer mentioned opening a demo account to experience the trading conditions, expecting a good overall trading experience. They acknowledged that while the spreads may not be the tightest, they are still reasonable. The variety of trading platforms, execution speed, good spread, and analytical tools were mentioned as standout features. Another customer praised the broker's regulated status, giving a high rating for their trading environment, including the ability to short ETFs and ETNs. Lastly, a customer found Squared Financial to be the perfect solution to their trading problems, specifically mentioning the broker's superb education resources.

Squared Financial Spreads, Fees, and Commissions

Squared Financial's fee structure is both competitive and transparent, providing traders with a clear understanding of their trading costs.

Depending on the account type selected, the broker's fees are either spread or commission-based. The SquaredPro account offers no commission trading with standard spreads for forex pairs, while the SquaredElite account boasts spreads starting from 0 pip but charges a $5 commission per trade.

Moreover, Squared Financial does not charge deposit or withdrawal fees, allowing you to manage your funds more efficiently. However, it is essential to keep in mind potential rollover fees for positions held overnight and inactivity fees for dormant accounts.

One important fee to consider is the overnight funding or swap fee, which is applicable to long positions. As an example, a long position on the EUR/USD pair would cost -12.5 for buying or 5.5 for selling.

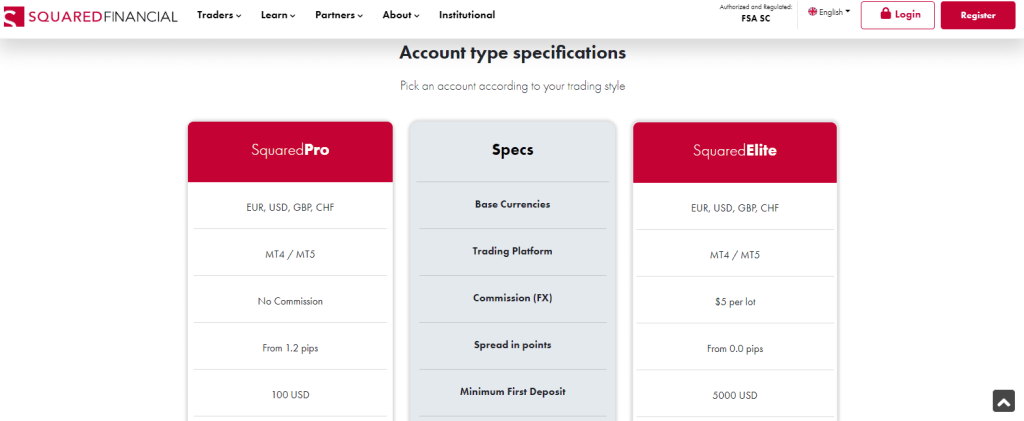

Account Types

Squared Financial offers two distinct account types – SquaredPro and SquaredElite. These account types cater to a variety of trading needs, offering varying features based on your trading experience, style, and investment capacity.

The SquaredPro account is a spread-based account where the broker charges the spread and swap or rollover fees. The unique advantage of the SquaredPro account is its relatively low minimum deposit requirement, which stands at 100 USD. This accessibility makes it an attractive choice for beginner traders or those with a modest investment budget.

On the other hand, the SquaredElite account operates on a commission basis. While the spreads on this account type are tighter, starting from 0 pips, the broker does charge a commission. Additionally, the SquaredElite account has a higher minimum deposit requirement of 5000 USD, making it more suitable for experienced or professional traders.

For traders adhering to the Islamic faith, Squared Financial also offers two types of Islamic, swap-free accounts – Standard Swap-free and Extended Swap-free. Squared Financial grants Extended Swap-free status by default to all applicable trading accounts created by clients in non-Islamic countries.

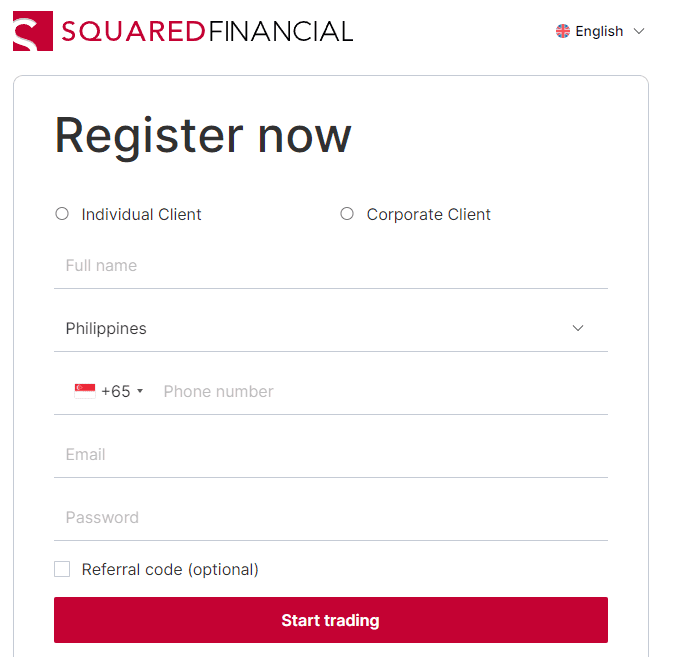

How to Open Your Account

Opening an account with Squared Financial is a straightforward process that can be done in a few simple steps:

- Initiate the Process – Visit the Squared Financial website and select the option to open an account.

- Complete Registration – Fill out the registration form with all the requested personal information. This typically includes your full name, contact information, and financial details.

- Account Verification – After registering, you will receive a verification email at the provided email address. Verify your account by clicking on the link in the email, and you're all set to log in and start trading.

What Can You Trade on Squared Financial

Squared Financial offers a robust selection of tradable assets to its clients, allowing for broad diversification opportunities and a flexible trading experience. Here's what you can trade:

- Cryptocurrencies: Squared Financial allows trading of popular digital currencies, a market known for its volatility and potential for high returns.

- Forex: The platform offers a wide range of currency pairs, including major, minor, and exotic pairs, catering to all types of forex traders.

- Metals: Investors can trade precious metals like gold and silver, known for their safe-haven status during market volatility.

- Energies: The broker provides access to energy commodities such as crude oil and natural gas, a key sector for commodity trading.

- Indices: Traders have the opportunity to invest in major global indices, allowing exposure to broader market trends.

The full list of tradable instruments, complete with their contract specifications, is available on Squared Financial's website.

Squared Financial Customer Support

SquaredFinancial guarantees robust customer care, promising client satisfaction with 24/5 live chat services in multiple languages, some of which are less commonly found. Their Secure Client Area provides complete account management solutions, a real-time news feed, numerous educational resources, and market commentary for traders' convenience.

Advantages and Disadvantages of Squared Financial Customer Support

Security for Investors

Withdrawal Options and Fees

Squared Financial clients can perform secure and straightforward withdrawals through the client area. The platform accepts a range of depositing options, including credit cards, bank wire, and e-payments. Another advantage is that the broker doesn't charge any commissions or fees on withdrawals.

Squared Financial Vs Other Brokers

#1. Squared Financial vs AvaTrade

Squared Financial and AvaTrade are both reputable brokers in the online trading space, each with its own unique strengths.

Squared Financial stands out for its multiple regulations, including CySEC and FSA, and its expansive product offering that caters to a wide variety of traders. Furthermore, it provides clients with competitive spreads, a selection of powerful trading platforms (including MetaTrader 4 and MetaTrader 5), and a dedicated customer support team.

On the other hand, AvaTrade, regulated by several entities such as ASIC, FSA, and the Central Bank of Ireland, is known for its user-friendly platforms that are ideal for beginner traders. They offer a robust suite of educational resources, including webinars, eBooks, and courses, which can be a significant advantage for novice traders.

Verdict: While both brokers are well-regulated and offer a comprehensive trading experience, your choice depends on your specific needs. If a broad product range and multiple platform options are your priority, Squared Financial may be the right choice. However, if you are a beginner trader and appreciate a more educational-focused approach, AvaTrade could be a better fit.

#2. Squared Financial vs RoboForex

Squared Financial and RoboForex are both recognized for their commitment to providing traders with a flexible and secure trading environment.

RoboForex offers a wider range of trading assets than Squared Financial, including stocks and ETFs. It also provides a unique CopyFX platform for copy trading, which can be attractive to beginner traders. Additionally, RoboForex is known for its attractive bonus programs and loyalty system.

However, Squared Financial shines with its tight spreads, comprehensive educational resources, and robust regulation under CySEC and FSA. It also offers a choice between MetaTrader 4 and MetaTrader 5, two of the industry's most powerful platforms.

Verdict: If you are an investor looking for a wide range of trading assets and the opportunity to engage in copy trading, RoboForex might be the better choice. However, if you prioritize tight spreads, extensive educational resources, and strong regulation, Squared Financial would be a better fit.

#3. Squared Financial vs Exness

Exness is known for its instant order execution, wide variety of account types, and unlimited leverage for some of its accounts. It also offers MetaTrader 4 and 5 platforms, similar to Squared Financial.

However, Squared Financial stands out with its comprehensive educational resources, customer support, and a simplified account structure that makes it easier for traders to choose the right account for their needs. Additionally, its strong regulation under CySEC and FSA instills confidence in its commitment to trader security.

Verdict: Both brokers offer solid trading platforms and a secure trading environment. However, if you value a simplified account structure, superior customer support, and a strong focus on trader education, Squared Financial could be a better choice. Meanwhile, if unlimited leverage and a broader variety of account types appeal to you, Exness might be more suitable.

Conclusion: Squared Financial Review

Our review concludes that Squared Financial is a Forex broker worth considering. It stands out for its transparency, stringent regulation, diverse trading platform selection, and provision of a variety of tradable assets. The platform, however, does have some areas for improvement, such as expanding its payment options to include e-payments for withdrawals and increasing the clarity around its demo account. Despite these minor setbacks, Squared Financial appears to be a reliable broker that caters well to both beginners and seasoned traders.

Squared Financial Review FAQs

What types of trading accounts does Squared Financial offer?

Squared Financial offers two types of trading accounts: SquaredPro and SquaredElite. The SquaredPro account is a spread-based account with a minimum deposit requirement of 100 USD, making it a suitable choice for beginners or those with a smaller investment budget. The SquaredElite account operates on a commission basis and offers tighter spreads but requires a higher minimum deposit of 5000 USD. It's more appropriate for experienced or professional traders. For traders adhering to the Islamic faith, Squared Financial also offers Islamic, swap-free accounts.

What trading platforms does Squared Financial support?

Squared Financial supports both MetaTrader 4 and MetaTrader 5 trading platforms. These platforms are popular for their user-friendly interfaces, advanced charting capabilities, automated trading options, and wide array of technical indicators, making them suitable for both novice and experienced traders.

What assets can I trade with Squared Financial?

Squared Financial provides a broad selection of tradable assets. Traders have the opportunity to trade in various markets, including cryptocurrencies, forex, metals, energies, and indices. This diversity allows traders to diversify their investment portfolio and reduce risk by not being limited to a single asset class. The full list of tradable assets can be found directly on the broker's website.