Financial markets are influenced by various reasons. Research has shown that however volatile these markets are, there is some sort of pattern. These patterns are somewhat influenced by the emotions of various stakeholders in financial markets.

If you invest in the stock market, forex market or any other financial market, you need to understand what market psychology is and how to use it to your advantage. Market psychology explains market conditions that cannot be explained through fundamental and technical analysis.

In this article, we have outlined market psychology with regards to the four phases of a market cycle. You will learn how to identify each phase and the emotions driving the market during each stage.

Also Read: Investor Emotions And How It Affects The Stock Market

Contents

- What is a Market Cycle?

- What is the Psychology of a Market Cycle?

- Stages of a Market Cycle

- Conclusion

- FAQs

What is a Market Cycle?

A market cycle refers to an economic trend or pattern that emerges during a financial market as it expands or contracts.

Market cycles can also be defined as the period between two highs or two lows in a market graph. Mostly they are only identified after the period is over because at this point there are clear. It is almost impossible to determine a cycle mid-way as the market is volatile and can take any direction.

However, over time, research has shown that market cycles sometimes repeat themselves. This is mostly the case, especially where economic conditions are stable for longer periods or even when these economic conditions are similar.

A cycle usually lasts depending on the type of market and economic conditions surrounding that specific market. They are witnessed over a certain set period. They can last for a few minutes or years. It all depends on the specific type of market you are analyzing as well as the reason for your analysis.

For example, a day trader would analyze the forex market for a maximum period of one day whereas a swing trader may analyze the same forex market for a longer period, say a few weeks, months, or years. Most investors/traders aim to define and identify a cycle at the onset. This helps them ride the wave and in turn make profits.

A New cycle is said to be formed when there is innovation or new regulations.

It is also important to note that each sector, industry, and/or market has its market cycle. At times they influence each other, however, mostly, each is independent of the others.

What is the Psychology of a Market Cycle?

Market psychology is the blanket term used to define the concept that financial markets are driven by investor emotions. Smart investors start trading buy first figuring out what stage of the market is in.

According to this concept, investors'/trader's emotions dictate market direction. This happens because traders/investors have an opinion on which direction the market is going to take. A single opinion might not make a difference, but when a large group of individuals has the same opinion, their opinion is completely dominant and influences market direction.

For instance, if a large number of traders believe that the price of a commodity, currency, stock, or security will increase, they will place trades based on this assumption. This causes the price of the said commodity to rise to lead to a bull market. The inverse is also true. If a large number of investors believe that the price of a commodity will dip, they will place trades based on this assumption. This in turn weakens the commodity leading to a bear market.

The above phenomenon is brought about by the rules of supply and demand. If investor sentiment is that the price of a commodity will go up, more and more people will want to trade that specific commodity. This increases the demand while at the same time regulating the supply as investors will not want to let go of the said commodity. For them to sell the commodity in a bid to satisfy the demand the commodity increases in value hence driving its prices up.

If investor sentiment is that the price of a commodity will dip, most of them will try to sell the commodity in a bid to salvage their losses. This increases the supply while lowering the demand at the same time. This in turn lowers the value of the commodity hence driving its prices down.

This is sometimes referred to as the herd mentality. Many investors do not realize just how much their sentiments drive financial markets. Therefore, market psychology is mainly driven by investor sentiment.

Stages of a Market Cycle

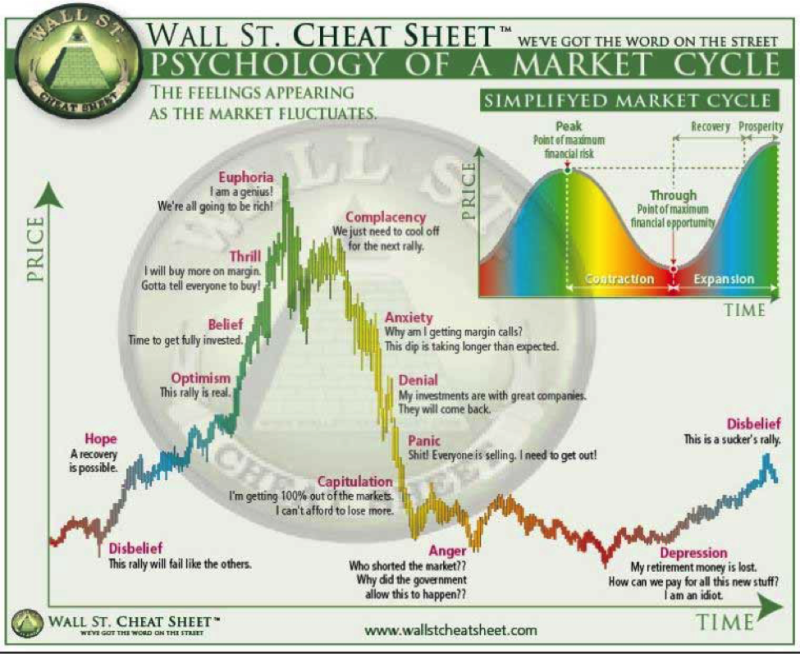

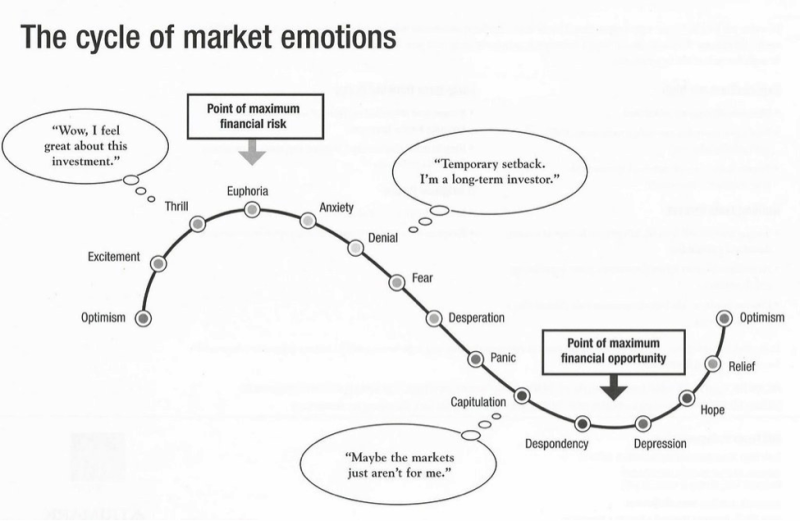

The following are some of the stages of a market cycle. Understanding them will help you understand why the market fluctuates as well as, what exactly influences investment decisions. It is also important to note that each phase of the market cycle works differently.

Accumulation phase

This phase usually comes right after the market crashes for various reasons. Investors believe that after the prices have dipped the market will correct itself and soon the prices will go up. Most investors believe that it is time to buy and accumulate a commodity with the hope of selling once its price increases.

You may have heard investors say “Buy the dip”. Essentially, during this phase, commodities sell at lower prices as most traders are still recovering from their losses. This period can also be identified as an economic recovery period. Investors most likely experienced losses when the prices of various commodities dipped.

Bear Market

At this point, the market is said to be a bearish market. Mostly only professional traders, market gurus, and a few lucky individuals interact with the market at this stage. Most traders sit this phase-out because they are either:

- Recovering from losses incurred during the previous phase.

- Waiting to see a clear market direction from price movements.

The accumulation phase is characterized by low and unstable prices. Recognizing this phase at the beginning will almost always guarantee profits. This is because you have the opportunity to accumulate assets at a discounted price. You then sell them later for a healthy profit after their price increases.

The market sentiment in the accumulation stage is usually characterized by excessive optimism and thrill. A financial advisor would describe this phase as the phase where the smart money is mostly active. The media at this point discourages traders from getting into the markets. They relate this phase to the near-collapse of a financial market stating that it has the highest financial risk.

Mark-up phase

This second phase is usually still a buying phase. Investors/traders are willing to buy commodities regardless of however much their prices have risen. It is a more stable phase as the market has fully recovered from the dip.

The prices at this phase are still gradually increasing. Investors have a clearer view of the market direction and are confident that they will make profits so long as the market direction remains the same. The market is said to be in a bull run. For this reason, traders who are generally good trade mostly during this phase.

Most buying happens towards the end of a mark-up phase. This is because most traders are looking to get into the action and make some profits as compared to their counterparts who had joined in earlier. While these traders are jumping in the ‘smart money’ and early investors – the ones who bought up the commodities during the previous phase are usually selling different asset classes.

This is because they understand market cycle dynamics. The mark-up phase is characterized by high and ever-rising prices as well as a substantial increase in market volumes.

Investor sentiment at this stage is usually characterized by greed and the fear of missing out on good trades. As most traders/investors get in without a clear plan, the market eventually begins to correct itself as demand is growing higher while the supply dwindles gradually. This drives the prices down.

In bull markets, most traders make losses mainly because they hold on to their assets and commodities with the hope that the market prices will go back up. They intend to make a profit after market growth occurs.

Laggards- traders/investors who for some reason had not gotten into the market see this as an opportunity to buy the dip as the prices are decreasing. As they jump in huge numbers, this favors traders who had gotten in at the onset of the mark-up phase. They can realize short-term substantial gains.

The investor sentiment slowly begins to change from greed and fear to anxiety as prices continue to go down. This is because the market cycle is at a near peak.

Distribution phase

This is usually the third phase of a market cycle. It is also referred to as the contraction phase. During this phase market prices are at their peak. The prices seem to remain in a constant trading range for a longer period.

From a technical analysis perspective, the market could be said to be consolidating. There is no clear market direction especially at the onset of this phase. The market experiences sideways movements Investor usually have a negative sentiment which is mostly driven by panic and anxiety during this phase. This explains why the prices remain somewhat stable as investors aren’t sure whether the market will continue in a bullish manner or will reverse into a bear market.

Most traders make small losses or small profits during this phase. It is also common to see traders selling their assets at a break-even price.

The distribution phase usually signifies a change in market direction. However, due to its almost stable nature, investors face the challenge of identifying it.

In some cases, the distribution/contraction phase does not last for long. This happens when there has been a major economic or political event that changes investor sentiment.

Mark-down phase

This is the last phase of any market cycle. It is also commonly referred to as the capitulation phase. It is characterized by a gradual and steady drop in prices. At this point, the market is said to be a bearish market. It is characterized by a reversal of the bullish market direction.

At the onset of the mark-down phase, most investors are selling to either lock in their profits or to minimize their losses before prices plunge even further. Mostly the latter. This is because investors who are selling during this phase are usually laggards. These are traders who bought late into the mark-up phase or at the onset of the distribution phase.

Investor sentiment during this phase is driven by panic and agony. We can attribute this to the fact that most investors are taking serious losses and are forced to exit the market.

The mark-down phase is a clear indication that the market cycle is over and is about to start over. This helps the smart money investors prepare for the next accumulation phase as prices will below.

Also read: What Are Cyclical Stocks?

Conclusion

Market psychology is characterized by various emotions that vary according to the current market cycle. Understanding these emotions and how to identify the various cycles will help you become a profitable trader.

As an investor your key takeaway should be to understand and take advantage of market psychology. This will enable you to think independently and avoid herd/crowd mentality.

Other key takeaways that will help you avoid falling prey to market psychology include:

- You should buy when investor sentiment is negative. This is during the accumulation phase while prices are still down. This has the biggest chance of financial reward.

- Sell when the investor sentiment is positive or at a near peak. This is mostly towards the end of the mark-up phase. Again, this helps you maximize your profits.

- Understand your emotions and try as much as not to fall prey to them. If you can successfully manage to do this, you will be taking trades based on logic rather than getting into trades based on your emotions.

- Have a trading plan. This will include a few confluences/conditions that need to be met before you enter any trade. This will prevent you from emotion-based trading. A trading plan is also useful in analyzing your past mistakes.

FAQs

How Do Investors Take Advantage Of Market Psychology?

Investors mostly go all-in when the overall market sentiment is negative (panic and agony). This enables them to buy when an asset's price is low and there is low demand. They then sell when the market sentiment is positive (greed) and there is an increased demand for the asset. This allows them to avoid losing positions and instead make solid and profitable investments.

Does The Period Of A Market Cycle Affect Market Psychology?

No. The time taken for a specific phase of a market cycle does not influence marketing psychology in any way. The market sentiment is still the same regardless of the period a cycle takes. However, it makes it much more difficult to identify a cycle. If you misidentify a trading cycle you could get into a trade at the wrong time will leave you vulnerable to significant losses.

Does Market Psychology Affect All Financial Markets?

Yes, it influences all sorts of financial markets and instruments. It affects; stock prices, currencies, interest rates, options, indices, commodities, real estate etc. It is present in any market that involves humans as market participants. Humans tend to make decisions based on fear, greed, or need.