Bitcoin Fear and Greed Index

One of the best terms that can describe the crypto market comprehensively is “bipolar.” From a perspective of short-term and long-term timeframes, Bitcoin and other cryptocurrencies are rocked with mammoth elements that lead to phenomenal swings. Partly attributed to the fear and greed amongst traders, the volatility tends to propagate fear and investor sentiment.

According to Warren Buffet, success means that you should be greedy when others are fearful and fearful when others are greedy. Given that the Bitcoin fear and greed index is a metric for evaluating emotions and general sentiments by combining data from different sources then compiling the same into a single figure, gauging this sentiment is helpful when assessing the market.

Content

- What is The Bitcoin Fear and Greed Index?

- Data Sources of The Bitcoin Fear and Greed Index

- Bitcoin Fear and Greed Index Today

- Benefits of The Fear and Greed Index

- Fear and Greed Index – Downsides

- Is There a Way to Overcome Fear and Greed?

- Final Thoughts

What is The Bitcoin Fear and Greed Index?

So, why is this metric important after all?

Since the 2017 crash, there has never been crypto plummet witnessed and happened with such enormity as the May 19 plunge. Several factors led to this dive, but the most prominent factors were the tweet from Elon Musk and China’s crackdown on mining in different parts of the country. All of these occurrences left the market in an incredibly vulnerable state.

As of the end of that fateful Wednesday, many people had sold off their investments for fear of losing money. At a glance, this reaction is gauged by the Bitcoin fear and greed index. Technically, it is a software developed by CNN that tracks the emotional reaction of the Bitcoin market. According to their official website, the Bitcoin fear and greed index’s main aim is to help people make informed decisions when Bitcoin and the general market behave irrationally. Typically, investors tend to get greedy when the market adopts a bullish tone for Fear of Missing Out (FOMO), often regarded as the “Greed” part of the index.

Conversely, when investors note that the prices begin to plunge, the “fear” bit manifests, coupled with investor pullback and a cautious tone adopted by traders. The fear and greed index chart is bound between 0 and 100, where a value of 0 represents extreme fear, while a value of 100 represents excessive greed in the market.

Extreme fear on greed index CNN chart can mean a fair risk/reward ratio at meager prices and can be a buy signal. On the other hand, an extreme greed chart can show little reward and the compounding risk of holding an investment at overpriced levels, which can also signal to sell the assets to lock in profits while they are still viable.

Also read: How to read Crypto charts

Data Sources of The Bitcoin Fear and Greed Index

The greed index works by weighing an apt comparison between different factors that carry different weights to the Bitcoin asset. At a glance, the data segments outlined below visualize a quantitative impact in the Bitcoin sentiment:

- Volatility – 25%

- Market momentum/volume – 25%

- Social media – 15%

- Surveys – 15%

- Dominance – 10%

- Trends – 10%

Volatility

This metric represents the current volatility and maximum drawdowns of the Bitcoin and takes the comparison between average values of the last 30 to 90 days. A rise in volatility often signifies fear.

Social media

Analysis from Twitter gathers and counts posts on different Bitcoin hashtags to gauge the level of sentiment. The most recent occurrence that led to a significant plummet of the Bitcoin market was Elon Musk’s tweet that his car manufacturing company, Tesla, would no longer accept payments made in Bitcoin due to “environmental concerns” emanating from banks of energy used by powerful computers for mining. Although he asked people not to take his tweets seriously in February this year, his tweet fueled a phenomenal investor pullback following the plunge in Bitcoin.

Market momentum

Similar to how volatility works, this metric measures the current volume and market momentum and compares it against 30 and 90-day averages to add the obtained values together. High buying volumes in a chart that adopt a bullish tone signifies that the “greed” is high.

Dominance

Although Bitcoin’s market share has declined, as more coins continue being incepted and gain value, the price of Bitcoin continues to hold more value on the crypto market. This currency makes up about 60% of the Bitcoin market and is projected to hit an astronomical 70% by the end of 2021.

While this dominance is partly fueled by the perception that Bitcoin is a haven for crypto investment, its effect is, as expected, not insignificant. When Bitcoin dominance shrinks, the crypto traders and investors get greedy to buying risky altcoins. At the same time, analyzing the dominance of a cryptocurrency other than Bitcoin portrays a converse behavior that signifies the greedy behavior of the whole crypto market.

Surveys

Strawpoll, a colossal public polling platform, conducts weekly surveys by asking people what they generally deduce from their subjective judgment of the crypto market. Usually, a collation of 2,000-3,000 votes paints a clear picture of a group of investors’ perception of the market. Although results from this poll are often not taken seriously, they are pretty helpful in preliminary trend prediction.

Trends

Google Trends Data from various Bitcoin-related search terms yield numbers that analysts crunch to gain a comprehensive understanding of the bullish market. If, for instance, you search for Google Trends for “Bitcoin News,” you won’t get a comprehensive picture of how the market looks like. However, searching “Bitcoin Price Manipulation” will show over a 1500% rise of the search query. In other words, this clear indication of fear in the market means the score is significantly low.

Bitcoin Fear and Greed Index Today

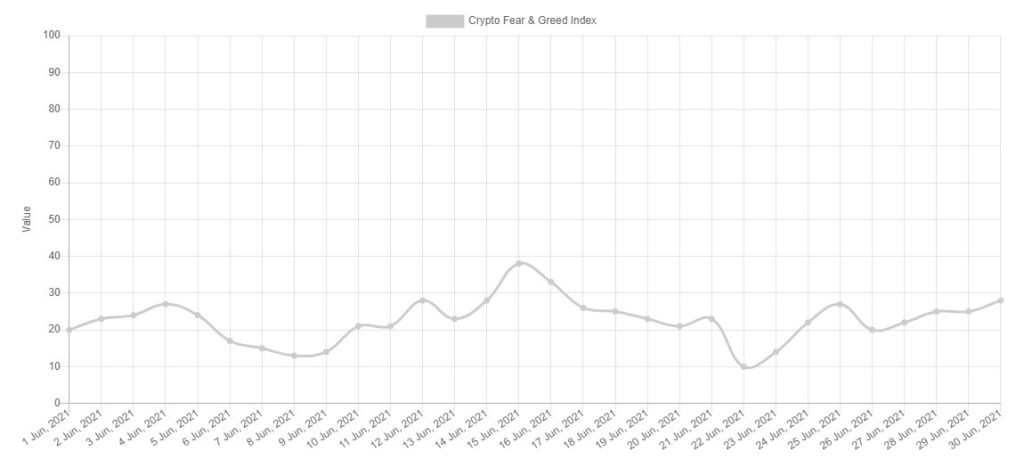

As of 2nd July 2021, the index is at 21, which means that fear dominates trader decisions as they take a somewhat cautious tone. A close analysis of the bitcoin fear and greed index tradingview chart shows potential for an exponential rise in the chart over the next couple of days.

Benefits of The Fear and Greed Index

According to psychologists, greed inherently affects brains’ performance in a way that coaxes people to set aside abstract thinking and provoke sentimental decision-making. This resonates with findings from Forexlive that show that 76.1% of traders lose money because of fear.

While there is generally no scientific evidence linking human greed to money, fear and greed can be colossal motivators. By contrast, the fear and greed index has been a trustworthy indicator of the fluctuations in equity markets.

Given that many investors are emotional and their cognitive reactions are based on the sentimental response, behaviorists have successfully shown the fear and greed on investor decisions – which presents a strong reason for monitoring this index. According to Attic Capital, the index plummeted to a low of 12 on September 17 2008 when S&P 500 plunged to a low following the bankruptcy of The Aftermath Brothers and the anticipated collapse of the insurance company AIG. Conversely, the Federal reserve’s decision to undertake quantitative easing led to a Bitcoin and fear index of 90.

Several dexterous traders agree that the fear and greed index is a crucial indicator, although it’s not the exclusive tool used to make investment decisions. According to reviews from crypto fear and greed index Reddit, investors should keep tabs with other indicators when evaluating potential indicators.

Also read: Is Cryptocurrency a good investment

Back to top

Fear and Greed Index – Downsides

While this is often arguable among traders, most experts agree that a buy-and-hold strategy is ideal for witnessing investment returns in the long term. Skeptics often see the index as a genuine “barometer” for market timing and not a viable tool to make trading decisions. Past trends, they claim, show that such a strategy generates less favorable returns.

Is There a Way to Overcome Fear and Greed?

Traders react differently. This, however, doesn’t mean that fear and greed are not pertinent to the decisions made by a trader. In other words, the best way to overcome fear and greed is to develop a trading plan and stick with it to avoid unforeseeable impulses.

Actions that might deviate from the plan include eliminating stops on losing positions, overleveraging or doubling down on losing positions. At the same time, another way to reduce the emotional impulse is lowering the trade size. You can also use a trade journal to help you stay accountable to your trades.

Also read: How to day trade crypto

Final Thoughts

While this metric is not an exact science, we can confidently assert that it paints an overall picture of the overall sentiment of the crypto market. A period dominated by fear may trigger colossal sell-offs and a consequent plunge in crypto prices. This often creates a lucrative opportunity for investors to buy, who often view the current state as a temporary dip before the market rebounds.

While it is often used in conjunction with other tools, the Bitcoin fear and greed index is often helpful in understanding the state of the crypto market. It reveals when the market is overbought or oversold, but it is crucial to dive deeper to have a comprehensive understanding. Aside from online resources, you can have tailored sessions with Asia Forex Mentor to understand the intricacies of the cryptocurrency market at your pace.