IGM FX Review

IGM FX, a notable broker in the Forex and CFD trading arena, was established in 2016 in the Mediterranean hub of financial trading, Cyprus. With an impressive portfolio of over 160 Contracts for Difference (CFDs) across a variety of assets, such as Forex, Stocks, Indices, Commodities, Metals, and Cryptocurrencies, this brokerage firm has much to offer its clientele.

This detailed review delves into the various facets of IGM FX, examining the highs and lows of this broker, including its offerings, commission framework, different account types, and transaction processes. Our intention is to bring you a balanced and comprehensive view of the brokerage, amalgamating expert opinions and firsthand trader feedback, which will help you make an informed decision about this broker.

What is IGM FX?

IGM FX is a financial trading platform offering a broad spectrum of opportunities in the global trading market. Regulated by the Cyprus Securities and Exchange Commission (CySEC), a regulatory authority recognized for its stringent standards, IGM FX has secured a reputation for trust and reliability in the trading community. The broker provides an environment conducive to trading for both the beginner and the seasoned veteran. Through its proprietary WebTrader and Desktop platforms, the broker ensures a seamless, user-friendly experience that caters to the needs and preferences of various types of traders.

The trading platforms of IGM FX are lauded for their intuitive design and advanced trading features. Traders can access a multitude of financial instruments, real-time market data, and advanced analytical tools to execute trades efficiently and manage their portfolios effectively. In a nutshell, IGM FX is a dynamic trading hub that serves as a bridge connecting its clients to the exciting and diverse world of financial trading.

Advantages and Disadvantages of Trading with IGM FX?

Benefits of Trading with IGM FX

IGM FX provides its clients with numerous benefits. A standout advantage is the wide array of trading accounts it offers, enabling traders to choose one that best suits their financial goals and risk tolerance. This diversity of accounts offers access to a broad selection of CFDs on major, minor, and exotic currency pairs, catering to different trading strategies and preferences.

Another key advantage of IGM FX is its competitive pricing structure. Traders can benefit from low spreads, which can significantly reduce their trading costs and potentially increase their profit margins. IGM FX's provision for high leverage, up to 1:400 for professional trading, is also a remarkable benefit. This high degree of leverage can empower traders to control large positions with a relatively small amount of capital, amplifying their potential for profits while also increasing the risk of losses.

Finally, the broker provides a wealth of educational resources and supports to help traders develop their skills and knowledge. From market analysis and news updates to educational webinars and detailed guides, IGM FX equips its clients with the tools necessary for informed trading.

IGM FX Pros and Cons

Pros:

- Regulatory Compliance: IGM FX is regulated by CySEC, providing traders with a secure and regulated environment for their trading activities.

- Accessibility: The broker is available to traders across Europe, opening the door to a broad range of markets and financial instruments.

- Affordability: With a low minimum deposit requirement, IGM FX makes trading accessible to individuals with varying budgetary constraints.

- Cost-effective trading: The broker offers commission-free trading and low spreads, which can significantly reduce trading costs.

- Investor Compensation Fund: As a member of the Investor Compensation Fund, IGM FX offers an extra layer of financial protection to its clients.

- Diversity of Clients: IGM FX's services are tailored to meet the needs of both retail and professional traders.

Cons:

- Limited Regulatory Oversight: While IGM FX is regulated by CySEC, it is not overseen by any other regulatory authority. This single-layer regulation might concern some traders seeking multiple regulatory safeguards.

- Lack of Educational and Research Materials: The broker does not offer educational and research materials, which could disadvantage novice traders who rely on these resources to learn and stay informed.

- Limited Customer Support: Without 24/7 customer support, traders may encounter delays in resolving queries or issues that occur outside of support hours.

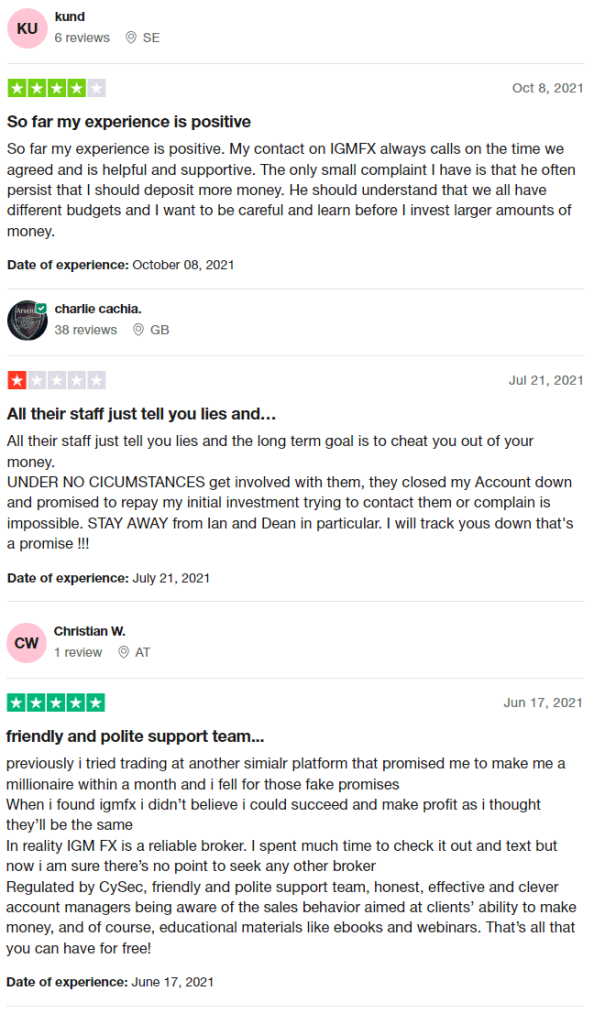

IGM FX Customer Reviews

User feedback about IGM FX is diverse. Some clients laud the platform for its punctual support staff, although they also indicate room for improvement regarding deposit suggestions. Some have had negative experiences, accusing the platform of dishonest practices. On a positive note, others praise the platform for its reliability and its abundance of educational materials.

IGM FX Spreads, Fees, and Commissions

IGM FX stands out in the trading community for its competitive spreads and fees. Offering an average spread of 0.7 pips on the widely traded EUR/USD currency pair, IGM FX gives traders an edge by offering rates significantly lower than the industry average of 1.2 pips. This tighter spread is not only restricted to Forex trading but extends to other popular trading instruments, making the platform cost-effective across diverse trading options.

While the broker does offer commission-free trading, it's crucial for traders to be aware of other potential charges. For instance, depending on the funding method, traders may incur additional fees for deposits and withdrawals. Similarly, during overnight trading, traders might face swap or rollover fees. It's important for traders to familiarize themselves with these potential costs to have a complete understanding of the overall trading expenses.

Account Types

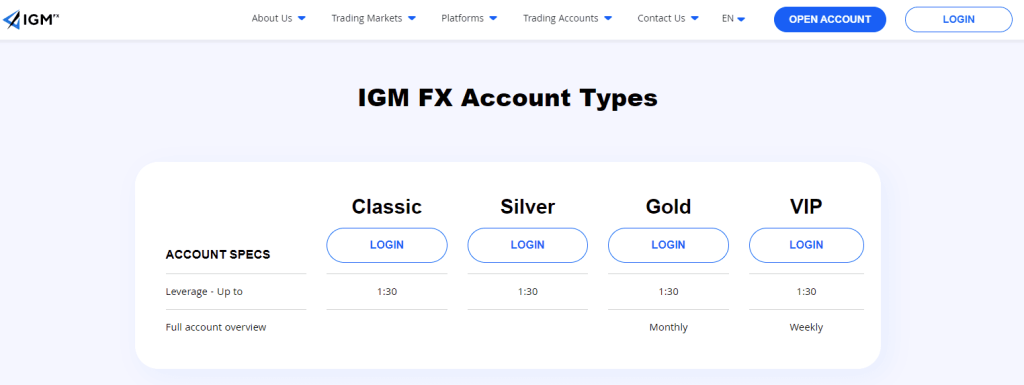

At IGM FX, traders have a multitude of account types to choose from, each catering to different trading styles and preferences. The two main types are Professional and Trading accounts.

Professional accounts are designed for experienced traders, with eligibility determined by several criteria. To qualify for a Professional account, a trader should engage in trades equivalent to €25,000 per transaction without leverage. Alternatively, transactions should have a nominal value of €100,000 in the Forex market, bonds, or commodities; €50,000 for indices; and €10,000 for CFDs. Additionally, traders must possess a trading portfolio of at least €500,000 in cash deposits or financial instruments. Lastly, they should demonstrate more than one year of experience in the financial segment or CFDs.

Trading accounts, on the other hand, are subdivided into Classic, Silver, Gold, and VIP. These differ from Professional accounts in stop-outs, which are 20% for Professional accounts and 50% for Trading accounts. Spreads are flexible, starting from 0.9 pips. For the EUR/USD pair, the spread is 2.5 pips. Trading CFDs on stocks carries a spread of 0.21 pips.

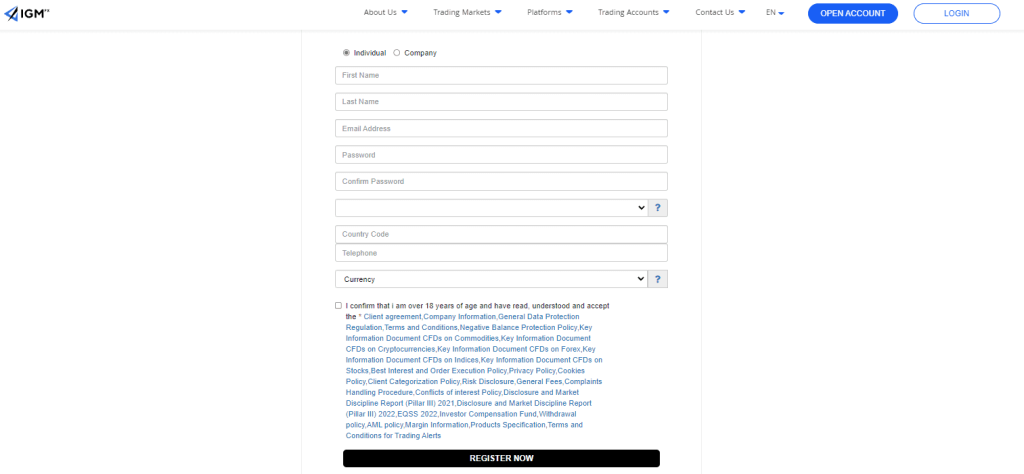

How to Open Your Account

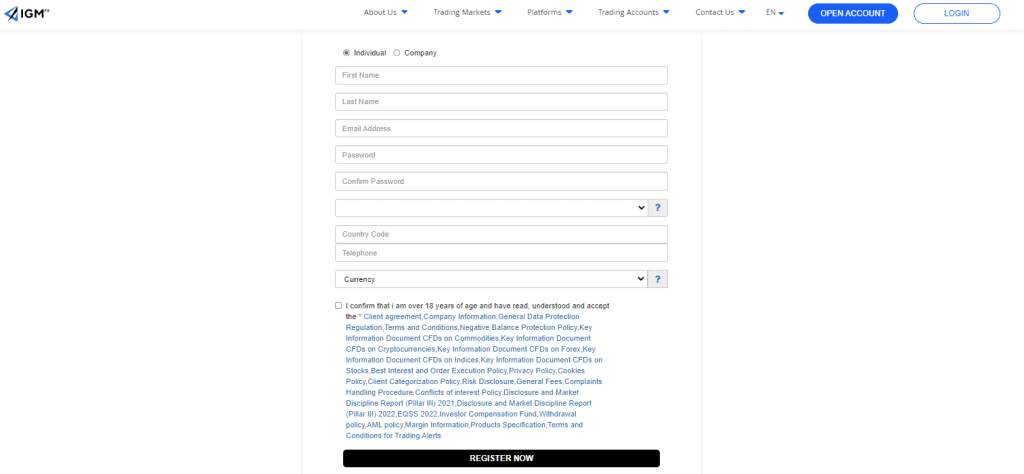

The account-opening process at IGM FX is straightforward and can be completed within minutes. Follow these steps to get started:

- Choose to Open a Professional or Trading Account: Visit the IGM FX website and click on the “Open Account” button.

- Enter Personal Information: You'll be prompted to provide personal details, such as your name, email address, phone number, etc.

- Verify Your Identity: As a regulated broker, IGM FX adheres to Know Your Customer (KYC) protocols. Thus, you'll need to upload documents confirming your identity and residential address. Typically, a government-issued ID and a recent utility bill or bank statement serve as adequate proof.

- Confirm Your Trading Experience: You will need to complete an electronic questionnaire that assesses your trading experience and knowledge. This is an essential step to ensure that the products and services provided by the broker are suitable for you.

- Deposit Funds: Once your account is activated and verified, you can proceed to deposit funds and begin trading.

What Can You Trade on IGM FX

IGM FX is known for its extensive variety of trading opportunities, making it a versatile platform suitable for a broad spectrum of traders. The brokerage firm provides access to over 160 Contract for Differences (CFDs) across a wide range of asset classes.

If you're interested in currency trading, IGM FX offers more than 40 Forex pairs, encompassing major, minor, and exotic currencies. Forex trading is popular among traders due to the high liquidity of these markets and the competitive spreads offered by IGM FX.

For those looking to diversify their portfolios, IGM FX also offers CFDs on indices, commodities, metals, and even popular cryptocurrencies. Thus, whether you're a cryptocurrency enthusiast, an index trader, or a commodities speculator, IGM FX has a multitude of options to cater to your trading style.

IGM FX Customer Support

When it comes to customer support, IGM FX understands the importance of being readily available to its clients. They offer a comprehensive customer support system operational from Monday to Friday, 24 hours a day. The support staff can be contacted through both email and phone.

IGM FX's support team comprises experienced trading specialists who are equipped to handle a broad range of issues. Whether you encounter a technical glitch, have a question about the platform's features, or need assistance with operational concerns, the support team is dedicated to providing timely and efficient resolutions.

Advantages and Disadvantages of IGM FX Customer Support

Security for Investors

Withdrawal Options and Fees

IGM FX offers a hassle-free withdrawal process designed to provide traders with easy access to their funds. Once a withdrawal application is submitted, the broker takes up to 5 business days to approve it. The duration of processing largely depends on the withdrawal method selected.

IGM FX provides a variety of withdrawal options, including bank transfers, bank cards, and e-wallet services like Skrill and Neteller. Bank transfers typically take 3-5 days to process.

Before initiating a withdrawal, traders must verify their user account, a standard practice designed to prevent financial fraud. This process involves providing necessary documentation that verifies the trader's identity and residence.

To initiate a withdrawal, clients are required to complete a withdrawal request form, which is then sent to IGM FX's financial department. After confirming the account balance and conducting a routine check for any suspicious activity, the financial department approves the withdrawal request. This comprehensive yet streamlined procedure helps ensure the security and integrity of your trading capital.

IGM FX Vs Other Brokers

#1. IGM FX vs AvaTrade

IGM FX is known for its competitive spreads, particularly on the EUR/USD currency pair, where the spread can go as low as 0.7 pips. It offers a vast array of CFDs across various asset classes including Forex, indices, commodities, and cryptocurrencies, providing its clients with plenty of opportunities for portfolio diversification. However, IGM FX has only one regulatory body, CySEC, overseeing its operations.

AvaTrade, on the other hand, offers a slightly higher spread on the EUR/USD pair, but it provides more comprehensive educational and research support compared to IGM FX. AvaTrade is also regulated by multiple international bodies, including the Australian Securities and Investments Commission (ASIC), the Japanese Financial Services Authority (FSA), and the South African Financial Sector Conduct Authority (FSCA), in addition to CySEC.

Verdict: While both brokers have their strengths, AvaTrade edges out due to its superior educational resources and wider regulatory oversight. This makes AvaTrade a more robust and supportive platform for both novice and experienced traders.

#2. IGM FX vs RoboForex

While IGM FX offers competitive spreads and a wide selection of CFDs, it primarily caters to professional traders. It's designed for those with a substantial trading portfolio and who have significant trading experience, which might deter novice traders.

On the other hand, RoboForex caters to a broader spectrum of traders. It offers a wider range of account types to suit different trading styles and experience levels. Moreover, RoboForex also provides access to a broader range of trading instruments, including over 12,000 assets across stocks, ETFs, indices, commodities, and cryptocurrencies.

Verdict: Given the wider range of account types, more extensive trading instruments, and more inclusive target audience, RoboForex has the upper hand. Therefore, it is better suited to meet the varied requirements of both novice and professional traders.

#3. IGM FX vs Exness

IGM FX provides low spreads and commission-free trading, which can be attractive for traders focusing on cost-effectiveness. It also offers a straightforward platform for trading, ideal for those who prefer simplicity and user-friendliness.

Exness, however, outperforms IGM FX in terms of platform diversity. It offers multiple trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary Exness Trader. These platforms are recognized for their advanced charting tools and automated trading capabilities. Exness also has a wealth of educational resources and analytical tools, which can significantly help traders in making informed decisions.

Verdict: Despite IGM FX's competitive fee structure, Exness surpasses it due to its versatile platform offerings and extensive educational resources. These attributes make Exness more appealing, particularly for traders seeking a comprehensive trading experience with advanced tools and resources at their disposal.

Conclusion: IGM FX Review

In conclusion, IGM FX has carved out a niche for itself as a reputable, CySEC-regulated brokerage firm. Its commitment to providing a secure and competitive trading environment is reflected in its low spreads, varied trading instruments, and efficient customer support. For professional traders who prioritize low-cost trading, IGM FX could be an ideal choice. However, the absence of a 24/7 customer support system could also be a drawback for traders who require round-the-clock assistance.

Overall, IGM FX stands out for its competitive pricing, security, and its comprehensive range of trading instruments. It is an appealing platform for traders looking for a cost-effective trading environment, backed by regulatory security.

IGM FX Review: FAQs

Does IGM FX offer any educational resources for new traders?

As of our current review, IGM FX does not offer substantial educational resources on its platform. This may make the platform less appealing for beginner traders or those looking to deepen their trading knowledge.

What kind of customer support does IGM FX offer?

IGM FX offers customer support from Monday to Friday, 24 hours a day. The support staff can be contacted through email and phone to assist with technical issues, general inquiries, and operational concerns.

What is the minimum deposit required to open an account with IGM FX?

One of the advantages of trading with IGM FX is its low minimum deposit requirement. However, the exact amount may vary based on the type of account you choose to open, so it's best to check their official website or contact their customer support for the most accurate information.