Risk reward practices in Trading

It's an undeniable truth that money management and account management is the key to successful trading. Successful traders make sure they apply sound risk-reward strategy for every single trade, novice traders often fail to do this. However, the risk and reward have to be calculated, adjusted, and accommodated to the technical forex trading strategies applied by the trader. Risk reward practices if applied to every individual trade and also to the balance of the trading account will provide an edge.

Contents

- Risk Reward calculation – Successful Traders Vs Novice Traders

- Risk Reward Ratio

- Risk reward ratio-Forex

- Risk reward – Account management

- Risk Reward analysis

- Risk Reward Chart

- Limitations

- Conclusion

Risk Reward calculation – Successful Traders Vs Novice Traders:

Novice traders look for a technical strategy and enter the market once they see an entry point. Only after the trade is opened, they look to calculate the stop loss or most probably don't, because they believe the trade will be in a profit. They exit when the pain of losing exceeds their level of toleration. They book the profits whenever they see the markets reverse.

Successful traders have a definite trade plan before they place the trade. The entry point, stop loss, take profit and the number of lots/ volume to be traded are clearly defined. They wait until they find a trade-in agreement with all the features of the trade plan.

Risk Reward Ratio:

Risk reward ratio measures the difference between the values of the following two points

-

Distance from the entry point and stop loss

-

Distance from the Entry point and Take profit

They calculate the expected profit if the position goes in the direction of the trade, and the anticipated loss if the position were to go against the trade direction.

In money management, the risk-reward ratio is calculated in terms of a percentage of the total balance of the account. Traders may use the value of account balance or account equity or free margin of the account to calculate an acceptable risk percentage.

The risk-reward ratio is an important component of a trading plan. It's always to the trader's advantage to know all the possible scenarios in advance and to be prepared to manage a trade accordingly. The important question in the mind before clicking the order button is, Is it worth taking this trade? or Is it worth taking this risk? If yes, then what will be the reward?

The risk and reward ratio can be calculated in terms of pips or money. Some traders use automated programs to make it easier to calculate.

Not all trades demand the same risk and reward ratio. Also, a risk and reward ratio cannot be applied generically to all the trading strategies. It is at the discretion of the trader to apply them based on the necessity of the technical strategy and also based on the money management strategy of the account. A combination of these factors will provide a sound risk-reward ratio, failing to do this will be detrimental to both the technical strategy and also to the account management.

Risk reward ratio-Forex:

Risk reward in forex is similar to any other investment when comes to money management, however, the difference lies in the trading strategy used in forex and other asset classes.

The risk-reward value is calculated by dividing the reward by the risk.

Calculating Risk reward in Pips:

Let's use the above example of a trade of EURUSD SELL 0.40 Standard lot

Entry = 1.1860, Stop loss = 1.1910, Take profit = 1.1760

The trade has a risk of 50 pips and a reward of 100 pips. The risk-reward ratio in the above example is 1 Risk: 2 Reward, the risk-reward value is 100/50 ( reward/risk ) = 2

Considering the above example the trader is willing to risk 50 pips for a potential profit of 100 pips. Let's calculate the result of 10 trades using a technical strategy that is 50% successful. Then the result with 5 profit trades and 5 losses will be ;

Profit trades 5 X 100 pips = 500 pips, Loss trades 5 X 50 pips = 250 pips

The trader will have a net gain of 250 pips. Using the 1:2 risk and reward ratio the trader can be profitable even if 50% of the positions moved in the favorable direction of the trade.

Risk reward – Account management:

Risk and reward ratio can be calculated similarly for account management purposes and calculate in terms of money value. The take profit and stop loss are calculated in terms of percentage of the account balance to enable the trader to prepare the account management plan.

Lot size calculation based on risk percentage:

Let's use the same trade example as above of EURUSD SELL at an Entry price of 1.1860 the trader identifies the following stop loss and take profit points with an account balance of 10,000 USD. The trader has an account management plan to risk 2 % of his account to make a profit of 4 %

Entry = 1.1860, Stop loss = 1.1910, Take profit = 1.1760, Account Balance 10,000 USD

Risk =2 % , Reward = 4% . Lot size = ? ( to be calculated )

Once the technical strategy is finalized the trader has to calculate the volume, or the number of lots to be traded to accommodate the stop loss and take profit levels within accepted risk and reward percentages, in line with the account management plan. The lot size can be calculated using the below formula.

General formula to calculate the lots size : ( (Risk per trade) / (Stop loss in pips) ) / 10 = Standard lots

Example : Risk per trade = ( 10,000 * 0.02 = 200 ) Account balance $10.000, 2% risk = $200 , Stop loss distance = 50 pips

Result: (200 / 50)/10 = 0.40 Standard lots

The trader will place 0.04 standard lots and execute the trade. Let's calculate the results for 10 trades with a 50% success rate.

Total win trades 5 X 4 % = 20 %, Total loss trades 5 X 2 % = 10 %, Net gain = 10 %

Considering the above example the trader is willing to risk 2 % of his account for a potential profit of 4 % per trade. The account will grow by 10 % if the trader manages to reach take profit levels of 50 % of trades.

Risk Reward analysis:

An optimum risk and reward ratio cannot be calculated in general. If a trader decided to risk 1 % of the account balance and look for 2 % gain, the growth of the account might be very slow. On the other hand, risking 5 % and anticipating 10% gain per trade may be a disaster if the trader experiences a sequence of bad trades or losses. However, every trader has his risk bearing capacity and should assess the account regularly to evaluate the risk and reward, to recalculate it if necessary.

Technical strategies do not necessarily provide the stop loss and target prices in exact multiples or a good ratio of each other. Technical strategies may require the trader to place stops and take profits according to the technical strategy in place. For example, in some scalping techniques, it may not be possible to have a 1:2 or 1:3 ratio.

So there cannot be an optimum risk reward ratio though a 1:2 risk-reward ratio is considered to be a good ratio in the forex market. Best traders wait for a market opportunity and enter the markets only if they find a trading plan according to their risk and reward ratio.

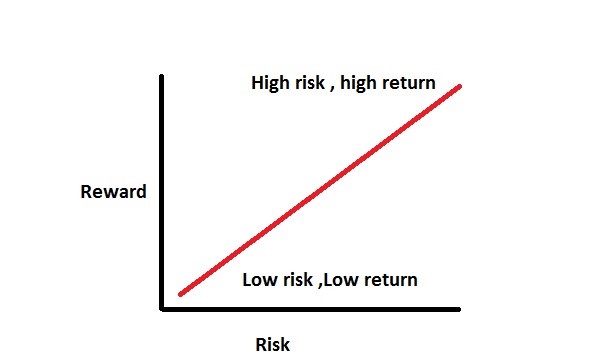

Risk Reward Chart:

Risk is fundamental to investing. You've got to understand that the market rewards people for investing money at different levels of risk. Risk is fundamental in all forms of financial products. To look for a positive return, you will need to take some risk. The market rewards people for taking a risk and investing appropriately.

In the above risk-reward chart, the relationship between risk and reward is depicted clearly. While investing in forex, you have to understand your risk tolerance and take the risk within this tolerance level, neglecting this step will be detrimental to your goals.

Every trader opens a trade with anticipation of a profit. Once the position moves to a profit holding them for long periods carries a risk of sudden market reversal and wiping out all the gains. On the other hand, holding a losing position for a longer time anticipating the market reversal may make things even worse. As long as the trade is open in the market place it is exposed to risk, no matter if it's in a profit or loss. Taking a position with higher risk does not guarantee higher returns, but anticipates the possibility of a higher return.

Limitations :

It's not always possible to equally apply risk-reward to every trade. Traders try to accommodate the risk and reward ratio without the necessary understanding of risk and end up adjusting the stop loss too close or placing the take profit in an unrealistic distance and eventually altering the whole trade plan.

Conclusion:

Many successful traders attribute their success to their sound risk-reward management and money management plan. In a trading world where market conditions are very volatile and always full of surprises, a risk reward ratio should form an integral component of the trade plan of every trader. Most technical trading tools, Doji Candle, indicators (such as ATR Indicator, Trendline Trading, Bollinger Bands Forex, RSI Forex Indicator), technical trading strategies (Swing Trading Strategies) provide a minimum success rate of 50%, if these tools are integrated with sound a risk reward ratio and applied to every single trade then it is highly likely to provide the trader with a rewarding and successful trading career.