Day trading has developed into a science that is evolving constantly, and the building blocks are technical indicators, that steer traders on the right course in the market to make a profit.

Analysis tools are used on charts to estimate market movement, and the patterns are usually constructed from candlesticks, that indicate support and resistance levels, which are the focal point for identification in any market trend.

What is really important for investors is to follow the price and volume, they are the key to a profitable trade on the market. The price is telling you what is happening with the asset at the present and past moment, and volume is indicative of how it's happening with a commitment or lack of commitment.

The advertised benefit of the three-bar play is that it is only required for an investor to be active for an hour in the day so he can make a profit.

The routine is for brokers to scan potential assets on the market for about 20 minutes and then start trading for up to 45 minutes. If you have nothing better to do you can have a long day, being active for as long as 90 minutes.

It sounds too good to be true and, in most cases, it is, the 3-bar play is profitable but only if you know what you are doing.

When using it it's crucial to be aware that it is a momentum trade, looking for when the third bar breaks the high of the first and second bar is the signal for entry.

Also read: Forex Trading Price Action: Pin Bar

Contents

- Narrow Ranged Bar

- 3-Bar Play: Not for Rookie Traders

- 3 Bar Play and ORB Strategy

- 3 Bar Play Long

- Example of 3 Bar Play Short

- Practicing the 3 Bar Play -First Bar

- Methods of Trade Management

- Problems in Using 3 Bar Play

- Learn from Live Traders

- Conclusion

- FAQs

Narrow Ranged Bar

One thing that you will notice on a chart is consolidation but the next day it gap under support, In all of the clean space you get a wide range igniting bar, the only negative is the topping tail, and the bar number three is the entry.

The safest option is to use the 3-bar reversal pattern indicates a change in the market. A common problem for day traders is that they observe the three-bar reversal frequently on their trading chart.

There's a more to it than observing for a 3BP on a chart. Traders have to understand how to interpret level II's, EMA, recognize resistance and support.

The three-bar is productive in offering data but the investors have to make the call if he should enter a trade and they should not be done just by observing the pattern is on the chart it needs to be supplemented with other information.

3-Bar Play: Not for Rookie Traders

Newbie investors may have trouble getting the full benefit from the 3-bar plays because of the huge quantity of extra data research needed to learn when the set-up can be used in a trade and when it's not.

The initial bar needs to be extremely long to signal a strong potential move in the direction of that bar. The bars that fallow can be used as verification that the investment is going in the right direction.

The potential for a payoff from the strategy is dependent on the combination of making tight stop-losses and loose take-profits, producing affirmative risk-reward ratio, as well as to adapting to the anticipated win rate by being stricter or looser as mentioned previously.

The benefit of the strategy is the option to place proper tight stop-losses and loose take-profits that create a positive risk-reward ratio. The initial bar has to be unusually long to indicate a possible direction change. The bars following will confirm if the trader is on the right course.

3 Bar Play and ORB Strategy

The 3-bar play is developed by Jared Wesley was aimed at creating a simple and reliable systematic path to trading. His method is actually efficient.

Let’s check the simple 3 bar play.

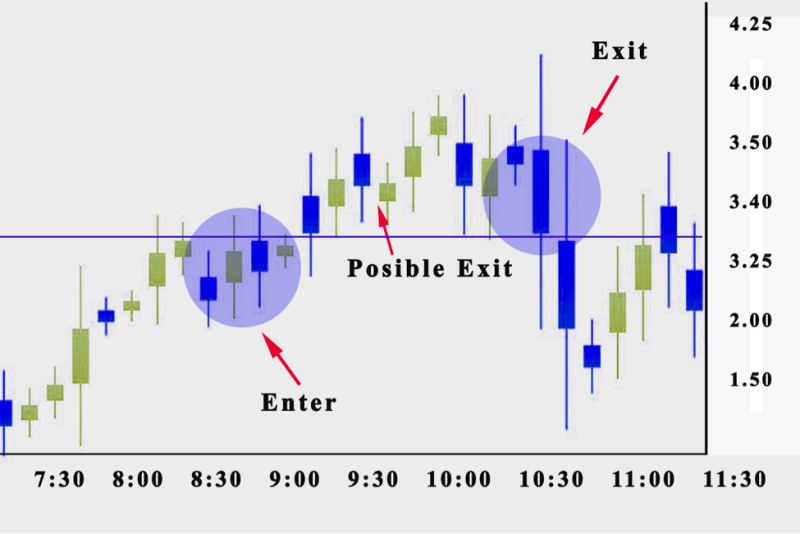

Make a close inspection of the chart displayed below. It's a simple illustration but it's very reviling about the 3-bar play and how it is used in the market for profitable trades.

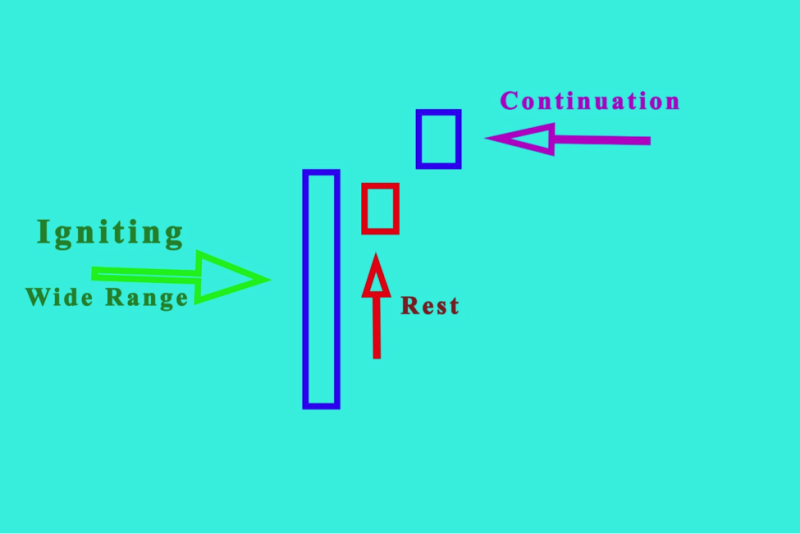

1st bar – wide-ranged igniting candlestick. This is an above-average-sized bar. It has to be the first bar of the move and needs to go over the resistance level. Certain traders concede it to be the second bar, but investors need to keep it simple. Use it as the first bar.

2nd bar – narrow ranged bar. It remains at the overhead quartile of the preceding candlestick. It is a rest bar.

3rd bar – an extension of the upward move. It breaks over the upper section of the preceding resting bar. This is the entry point.

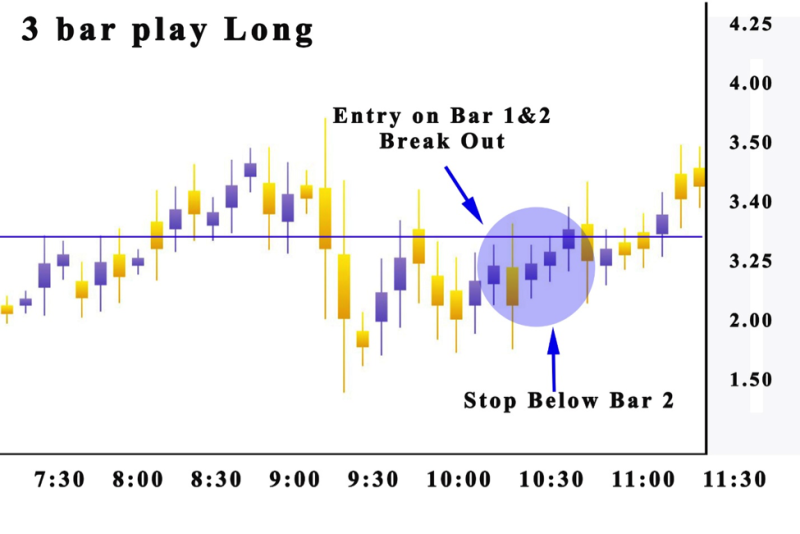

3 Bar Play Long

The best option for using the 3-bar play in the market is as a continuation pattern. If the asset is extending, perfectly traders need a continuation over resistance from a standard market level. A mix of both schemes is preferable!

When the investor was ready to start his day, the stock was extending appreciably in the market with a fine merger in the open.

The asset goes up on the initial candle, and if consolidates for one bar, then advances in the course of the extending.

The other candle in the pattern is an orderly withdrawal on lower volume. The best option is if investors set their entry over this candle and the initial candle. The breakout offers a good profit from your entry in a fast time period.

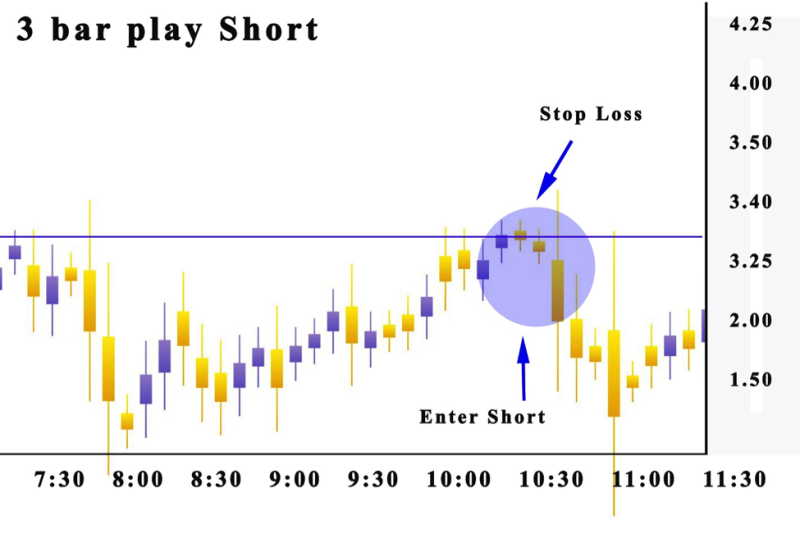

Example of 3 Bar Play Short

The best option with the 3 Bar Play strategy is that brokers can use it in the opposite way. Investors can be searching for assets that are extending up and/or detaching itself from the daily time period, the identical thing can be used for stocks partitioning.

The advantage of the technique is that brokers can easily look for differences at the beginning of the day. They need to investigate the larger time period for a good continuation move when the market starts.

Practicing the 3 Bar Play -First Bar

Investors are aware that no strategy is full prof, thinking that by just using the 3 bar play the money will start rolling in the bank account. You must be ready to calculate the chances for success with simulated trades, if you are not doing that and just going to the market then you are not trading but gambling.

It is recommended you make a search in the simulator for assets that are gapping up or down in the premarket with some volume. After that use that list of stocks and locate the best candidates for a 3 Bar Play.

Start practicing paper trading that way you can test strategies and safely examine the result of the 3 bar play and improve by analyzing the daily chart your trades in is an essential part of developing your overall concept.

You can use these examples of what that scan filter can look like for gap ups:

In this filter example, we’ve chosen stocks above $10 with a premarket gap minimum of 8% and at least 200k shares traded.

Methods of Trade Management

A good toolset for locating areas to sell are pivot points, while others prefer to use fibonacci lines, but you should keep it simple, and locate assets ether oversold or if you find overextended and sell with them.

Identifying this, brokers will cover strengths or weaknesses, expecting the rally can arrive at any time.

The overextension is visualized if you judge how prolonged a stock is from its usual moving averages.

There is a plethora of options to control trades, they offer advantages and disadvantages. It’s dependent on the broker to understand what practice works best most effective in order to recognize earnings potential.

Problems in Using 3 Bar Play

Day trader using structures like resistance levels need to ask himself how he can be sure the level is genuine. The indicators you select can be of no significance for the market so you have to determine the procedure you use to create stable levels.

Because a position is initiated at a gap in the third candlestick, investors need to place the stop loss at a distance from the first price. It is really true when the momentum bar takes out two bars in the verification phase.

Learn from Live Traders

If somebody is interested in learning about the three-bar they can get more information from Jared Wesley who developed the 3-bar play and who goes in-depth on his YouTube channel Live Traders.

You can watch a video about day trading strategies that will teach brokers how to make money by trading stock from companies active on the market.

Conclusion

Investors can freely combine 3 bar play with other indicators or price patterns to locate probability trade setups. The winning example is an excellent combination of a head and shoulders formation and a three-bar reversal.

Looking for the trigger bar on the chart is finding the entry point and you guys need to feel confident in the result. But as any day trader knows a rich quick scheme is not possible.

Using the 3-bar play means also using stop loss so the risk is controlled and the advertising success manifests.

Also Read: Day Trader salary and their profit target – A Short Guide

FAQs

What Is a 3 Bar Play?

It’s a popular but simple strategy of recognition of reversal based on 3 bars that signify a bullish or bearish trend after a sustaining trend in the opposite direction.

How Can You Tell a 3 Bar Play?

The pattern is recognizable by an unusually long candle body, followed by one or two resting candle bodies, and then a third that is high.

What Is a Three-Bar Pattern?

The three-bar is basically a price action pattern that is used to indicate a reversal of a short or long-term trend in the market.

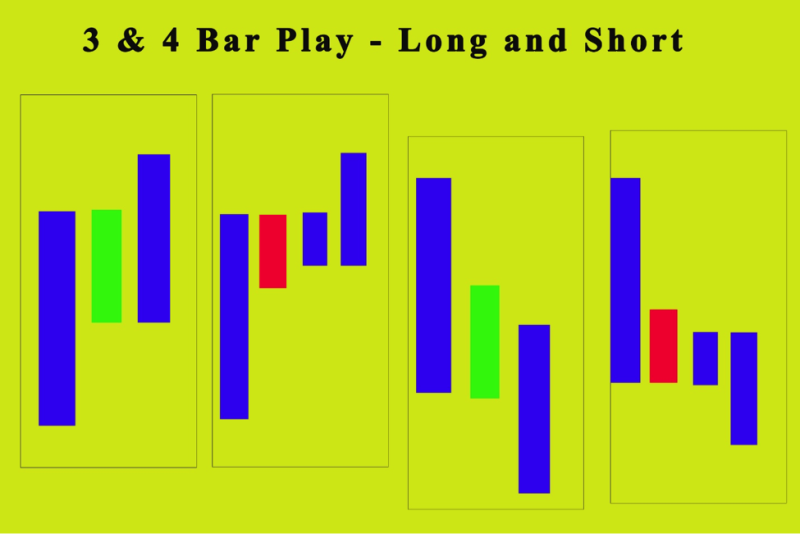

What Is a 4 Bar Play?

It is the same concept as the 3-bar play, but now you have two resting bars. Stop lost can be on bar number two or three, you can use entry at bar number two low.