Have you ever wondered why most traders fail even after following every swing trading strategy they find online?

Many traders chase quick profits through day trading, but they often end up stressed, glued to screens, and emotionally drained. Swing trading , on the other hand, offers a balanced trading style that focuses on short term price movements with less pressure. Instead of reacting to every tick in stock prices, swing traders study support and resistance levels to spot better trading opportunities. This approach allows them to enter trades calmly, plan clear entry and exit points, and manage risk effectively.

A good swing trading strategy blends technical analysis with patience and discipline. Unlike day traders , a swing trader holds positions for a few days or weeks, aiming to profit from medium term price movements. By studying chart patterns, price action, and moving averages, traders can create a trading plan that suits their risk appetite. Successful swing trading doesn’t rely on luck, it’s built on structure, timing, and smart decisions backed by technical indicators and solid risk management.

Best Swing Trading Strategies

Let’s explore five profitable swing trading strategies that have stood the test of time. Each swing trading strategy offers a unique way to read the market and plan trades effectively. By mastering these approaches, every swing trader can improve timing, boost confidence, and make better trading decisions.

Strategy #1: Market Structure

Image Reference

A – Market high, higher high

B – Higher low , Pullback point

C – Lower high, Failure to break the previous high

D – Entry point

E – Last down candle of pullback

F – Take profit

How about trading profitably without any indicators eg. ATR Indicator? This swing trading strategy does not involve any indicators, only price action trading, doji candle and naked charts.

Charts are the foundation of every swing trading strategy because they reveal clear price movements across different market conditions. Swing traders use them to study stock prices and identify strong support and resistance levels. By observing these patterns, a swing trader learns how prices tend to react when momentum builds or weakens. This trading style focuses on catching short and medium-term price movements without the pressure of day trading. It gives traders time to plan entry and exit points with confidence and control.

Understanding market structure through technical analysis helps traders spot when a trend is changing. When prices stop creating higher highs and begin forming lower lows, it signals weakness. This pattern often appears before a reversal, giving swing traders an early clue to adjust their swing trades. Combining this insight with technical indicators like moving averages makes each trading decision more precise. The best swing trading strategies often depend on how well traders read these shifts.

For example, when a price breaks below the last pullback candle, it confirms a change in structure. A swing trade can then be entered, targeting the next support level as a profit goal. The stop loss is usually placed above the last resistance level to control risk. This trading strategy works well for those who prefer a calm, patient approach over multiple trades per day. It’s one of the best swing trading strategies for beginners because it offers structure, discipline, and clear exit points within a few weeks.

Strategy #2: Fibonacci Retracement

This swing trading strategy uses the power of the Fibonacci tool to calculate the entry, exit, and also the target points.

The Fibonacci retracement tool is one of the most reliable guides for swing trading. It helps swing traders identify precise support and resistance levels that show where price movements might reverse. This trading style allows traders to plan clear entry and exit points instead of rushing into trades. Each Fibonacci level, from 23.6% to 78.6%, marks a possible reaction zone where prices tend to pause or turn. By combining Fibonacci levels with simple technical analysis, a swing trader can create a structured approach that fits short or medium-term price movements better than day trading.

In practice, a swing trader studying the EURUSD chart can draw Fibonacci lines from a swing high to a swing low. When the price retraces around the 61% or 75% levels, that becomes a possible trade entry zone. The stop loss is usually placed near the 100% level or the previous swing high, while take profit targets are set at -38% and -61%. This trading strategy allows traders to manage risk wisely while capturing profits over a few days or weeks. Unlike day traders who react to every candle, swing traders focus on quality swing trades with patience and planning.

Still, Fibonacci retracement works best when supported by additional technical indicators. Combining this method with moving averages or RSI helps confirm the strength of a setup. These tools show whether the market momentum supports your swing trade or signals possible price fluctuations. As market conditions shift, learning how to read support and resistance levels accurately gives traders more confidence. That’s what makes Fibonacci retracement one of the best swing trading strategies for consistent results and smarter trading decisions.

Strategy #3: Trend-based Indicator Trading

The number one rule in investing is simple, trend is your friend, so always follow the direction of the trend carefully. Swing traders study higher time frames to identify the overall trend and then look for swing highs and swing lows on lower charts to plan trades. When a swing trader spots an uptrend on the weekly or monthly chart, they wait for a pullback that forms a swing low before placing buy orders. This swing trading strategy often uses moving averages or trendlines to confirm direction and improve trade accuracy across different market conditions.

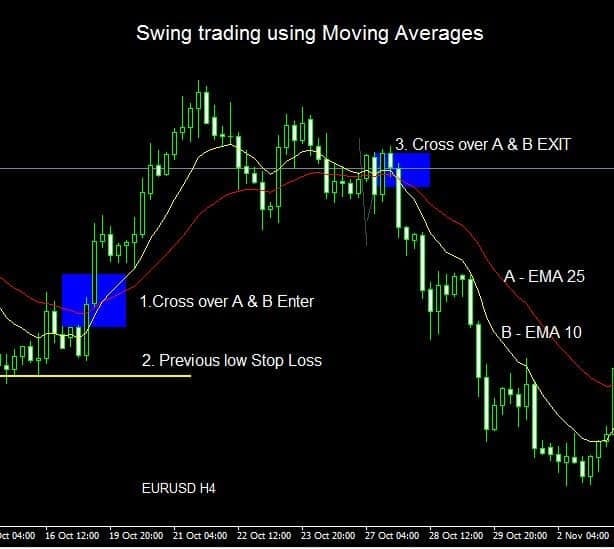

Moving averages are one of the most popular tools used in swing trading across different markets and trading styles. They help traders smooth out price fluctuations and clearly see the overall market direction. This trading style works well for those who prefer a structured, less stressful approach compared to day trading.

In swing trading, the exponential moving average or EMA is often used to spot trend changes early. A swing trader may use two EMAs, a 10-period fast line and a 25-period slow line, to identify trade opportunities. When the fast EMA crosses above the slow EMA, it signals a new upward move, giving traders a clear trade entry signal.

The stop loss is usually placed near the recent swing low, while exits happen when another crossover occurs. This swing trading method helps traders capture strong short-term price swings over a few days. However, smart traders still confirm with technical analysis tools like support and resistance before executing swing trades for safer results.

Strategy #4: Bollinger Bands

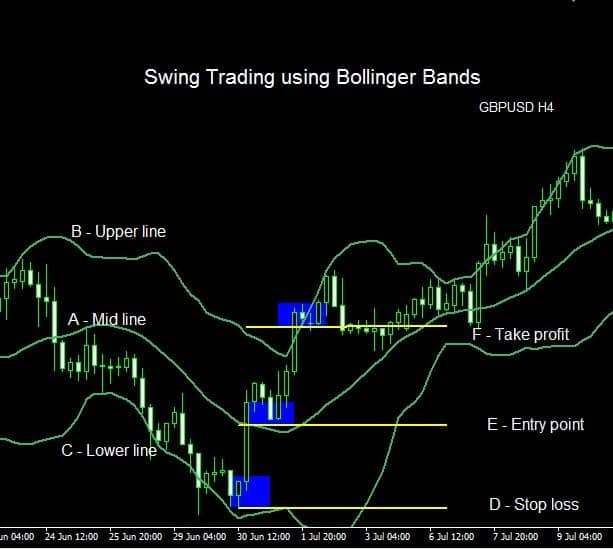

One of the most successful swing trading strategies is to use Bollinger Bands Forex. Bollinger bands are one of the most commonly used technical indicators in forex trading. Bollinger bands consist of 3 lines, the midline is the simple moving average of the closing prices for a certain number of periods. The upper line and lower lines are calculated and drawn at a distance of 2 standard deviations from the midline.

- Line A – Midline – simple moving average (SMA) of the closing prices for the last 20 periods.

- Line B – Upper band – Midline (SMA) shifted up to Standard deviation +2.

- Line C – The lower band – Midline (SMA) shifted down to Standard deviation -2.

In swing trading, Bollinger Bands are a reliable tool for identifying potential reversals and trading opportunities. Traders watch for prices to touch the lower band, signaling oversold conditions and possible exhaustion of the current trend. Once prices stabilize and cross the middle band, it often confirms a swing trade toward the upper band. This trading strategy allows traders to capture profits from short-term price fluctuations while maintaining a clear structure for every trade.

A swing trader typically uses technical analysis to plan precise entry and exit levels. The entry point is placed near the middle band, while the stop loss stays below the lower band for protection. The upper band serves as the take-profit zone, allowing the trade to follow natural price patterns. This method reduces emotional trading and offers better control than day trading, especially during ranging market conditions.

Bollinger Bands work best when the market moves sideways with moderate volatility. When the bands narrow, it warns traders of an upcoming price breakout or sudden change in market direction. Skilled swing traders use this signal to prepare early, adjust their trading strategy, and stay aligned with the current trend. By combining Bollinger Bands with sound technical analysis, traders gain consistency and confidence in every swing trade they make.

Strategy #5: Range Trading

ChatGPT said:

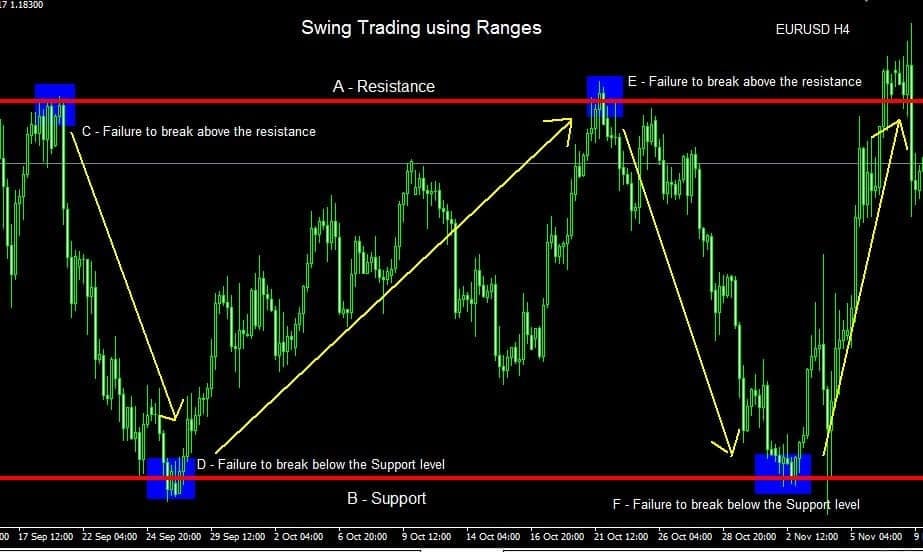

Support and resistance are key elements in swing trading because they show where prices usually stop or reverse. Traders study previous price data to mark these zones and plan better trading opportunities. Once the support level and resistance level are defined, a swing trader can identify ideal entry points and profit targets.

When prices move between these levels, they create a trading range that guides swing trades for a short period. For example, when price drops near support, buying pressure builds, and when price nears resistance, selling pressure often increases. If a breakout occurs beyond these lines, it can signal a new move or trend change worth watching.

To trade this strategy successfully, swing traders combine support and resistance with candlestick patterns. These tools help confirm price rejection and improve accuracy. Unlike day traders who react fast during trading sessions, swing traders use this patient approach to capture steady profits within clear boundaries.

Risks of Swing Trading Strategies

- Trend trading focuses on following the market’s main direction instead of fighting against it. Traders use price patterns and momentum to identify strong trends. This approach helps build confidence by moving with the market rather than guessing tops or bottoms.

- Breakout trading is a popular strategy where traders wait for price to move beyond key support or resistance zones. Once the breakout occurs, a single trade can gain strong momentum. Traders then manage exit positions carefully to secure profits.

- A solid investment strategy uses both patience and discipline to avoid emotional decisions. Traders study past performance and price levels before entering trades. This approach helps reduce risk and supports smarter long-term investment decisions.

- Reading stock charts is a basic skill every trader must master. Charts reveal hidden price movements, volume changes, and important turning points. With consistent study, traders can spot trading opportunities and react faster.

- Successful trading requires understanding your holding period and planning each trade with intent. Some trades last a short period, while others take a longer period to mature. Knowing when to hold or exit builds discipline and protects profits.

Also Read: Fibonacci Circle What It Is and How It Works in Trading

Conclusion

Swing trading is one of the best ways to trade calmly and consistently without the pressure of constant monitoring. It teaches patience, planning, and discipline, key traits that separate a professional trader from a beginner. By mastering technical analysis and studying how price reacts around support and resistance, traders can find more confident trade setups. Each swing trade becomes a learning experience that builds skill and helps develop a personal trading style that fits their goals.

The secret to success in swing trading is not about chasing quick profits but managing risk and trusting the process. A solid trading plan defines clear entry and exit points, guiding traders to stay consistent through changing market conditions. Every trade, whether a win or loss, adds valuable insight that shapes better decision-making. With practice and patience, swing traders can achieve balance, stability, and lasting success in their trading journey.

FAQ's

1. What is swing trading?

Swing trading is a trading style where traders hold positions for a few days or weeks. The goal is to profit from short- to medium-term price movements using technical analysis and support and resistance levels.

2. How is swing trading different from day trading?

Day trading involves entering and exiting trades within the same day, while swing trading allows more time for trade setups to develop. Swing traders rely on patience and analysis instead of constant screen-watching during trading sessions.

3. What is the best swing trading strategy for beginners?

The best swing trading strategy for beginners often combines moving averages, Fibonacci retracement, and price action confirmation. These tools help identify clear entry and exit points while improving consistency and reducing emotional trading.

GET THE PROPRIETARY ONE CORE PROGRAM (The same system I use to make 6 figures a trade with)