If you're looking to start trading forex in 2026, choosing the right forex broker is key to success, especially in a fast-growing hub like Dubai. The United Arab Emirates (UAE) has become a hotspot for both beginner traders and seasoned pros thanks to its strong regulatory environment, with authorities like the Dubai Financial Services Authority (DFSA) and the Securities and Commodities Authority (SCA) keeping things in check. But with so many options, how do you know which are the best forex brokers in Dubai?

We’ve put together a list of the top forex brokers regulated in the UAE to help you make an informed choice. Whether you're interested in forex and CFD trading, need a solid trading platform, or want lower trading costs, we've got you covered. From beginner traders to experienced traders, this guide will help you find the best forex broker that fits your trading style and goals in the forex market. Let’s get started!

What to Look for in a Forex Broker in Dubai

When it comes to forex trading in Dubai, choosing the right forex broker is essential for success. But what exactly should you look for in a broker? From regulation to customer service, there are several factors that can make or break your trading experience. Let’s break it down so that whether you're a beginner or an experienced trader, you can pick the best forex broker for your needs.

Here are the key factors to consider:

- Regulatory framework: Make sure your broker is regulated by trusted authorities like the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority. This helps ensure that the forex brokers you deal with follow the laws of the United Arab Emirates and provide a safe trading environment.

- Trading platforms: Look for brokers offering top platforms like MetaTrader 4 or MetaTrader 5. These platforms are ideal for both beginner traders and advanced traders, offering a range of tools to fit different trading styles.

- Fees and spreads: You want to minimize trading costs. Compare brokers that offer competitive spreads and low fees to get the most out of your trades. Always check if they charge for withdrawals or account maintenance.

- Customer service: Especially in the United Arab Emirates UAE, having access to responsive customer service in both English and Arabic can be a game changer. Look for brokers that offer local support, helping you resolve issues quickly.

- Security: Your money's safety should be a priority. Choose brokers that provide secure deposit and withdrawal options, ensuring your funds are well-protected.

The 20 Best Forex Brokers in Dubai

#1. AvaTrade: Best Overall for Traders in Dubai

What is AvaTrade?

AvaTrade is a well-established global forex and CFD trading broker that has been operating since 2006. It is regulated by multiple top-tier authorities, including the Central Bank of Ireland and the Securities and Commodities Authority (SCA) in the United Arab Emirates (UAE). AvaTrade is known for offering a wide range of trading platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO platform. With Islamic accounts available and strong regulatory backing, AvaTrade is one of the best brokers in Dubai, ensuring safe and compliant trading for its clients.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

AvaTrade offers commission-free trading on most accounts but compensates with spreads starting at 0.9 pips on EUR/USD. There are no fees for deposits or withdrawals, but the broker charges inactivity fees for dormant accounts after three months.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Pepperstone

What is Pepperstone?

Pepperstone is a top-rated forex broker offering low spreads, fast execution, and access to over 60 currency pairs. It is regulated by the Dubai Financial Services Authority (DFSA) and offers Islamic accounts for traders in the UAE. Pepperstone is known for its versatile range of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, making it ideal for both beginner and experienced traders looking for advanced tools and low-cost trading.

Advantages and Disadvantages of Pepperstone

Pepperstone Fees and Commissions

Pepperstone provides competitive pricing with spreads starting from 0.0 pips on its Razor account, with a small commission on each trade. The Standard account offers commission-free trading with slightly higher spreads. There are no deposit or withdrawal fees, but inactivity fees may apply.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

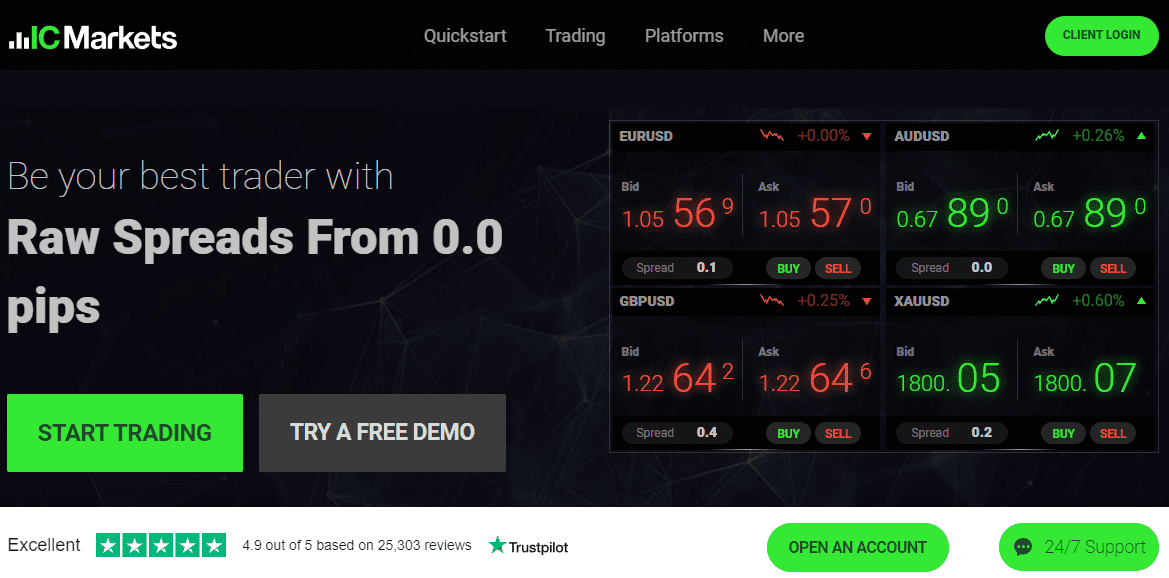

#3. IC Markets

What is IC Markets?

IC Markets is a popular choice for forex traders in Dubai due to its ultra-low spreads, lightning-fast execution, and support for Islamic accounts. Regulated by the Securities and Commodities Authority (SCA) in the UAE, IC Markets is a great option for traders who need access to algorithmic trading with platforms like MetaTrader 4, MetaTrader 5, and cTrader. It stands out for its strong focus on institutional-grade liquidity and minimal slippage.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets offers raw spread accounts with spreads starting from 0.0 pips and charges a small commission per trade. The Standard account offers commission-free trading, but with higher spreads. There are no fees for deposits or withdrawals, but an inactivity fee applies.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

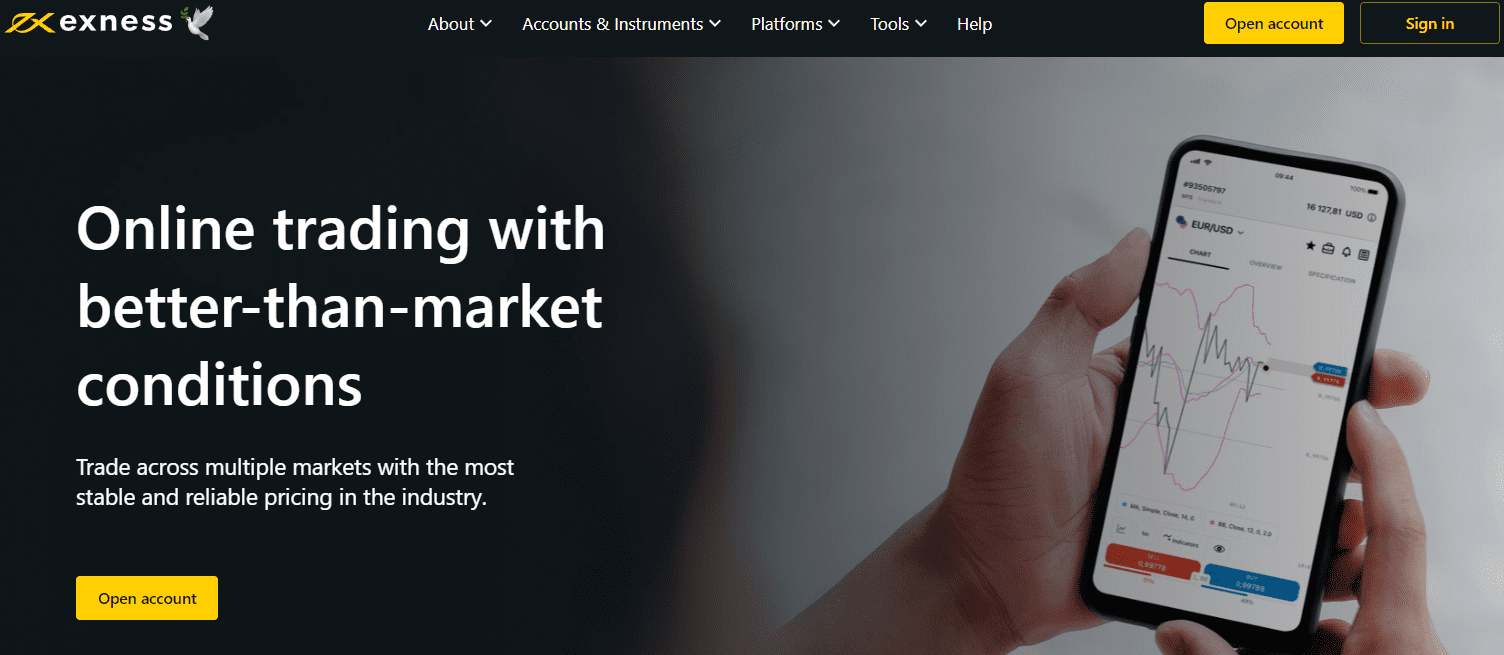

#4. Exness

What is Exness?

Exness is a highly trusted forex broker that is known for its high leverage options and ultra-fast withdrawals. It offers Islamic accounts to its Dubai clients and is regulated by the Securities and Commodities Authority (SCA) in the UAE. Exness offers access to both MetaTrader 4 and MetaTrader 5, with a focus on providing a seamless and flexible trading experience for both retail and professional traders.

Advantages and Disadvantages of Exness

Exness Fees and Commissions

Exness is known for its zero-commission trading on many accounts, offering spreads as low as 0.3 pips. The broker does not charge for deposits or withdrawals and offers tight spreads with no overnight fees for Islamic account holders.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

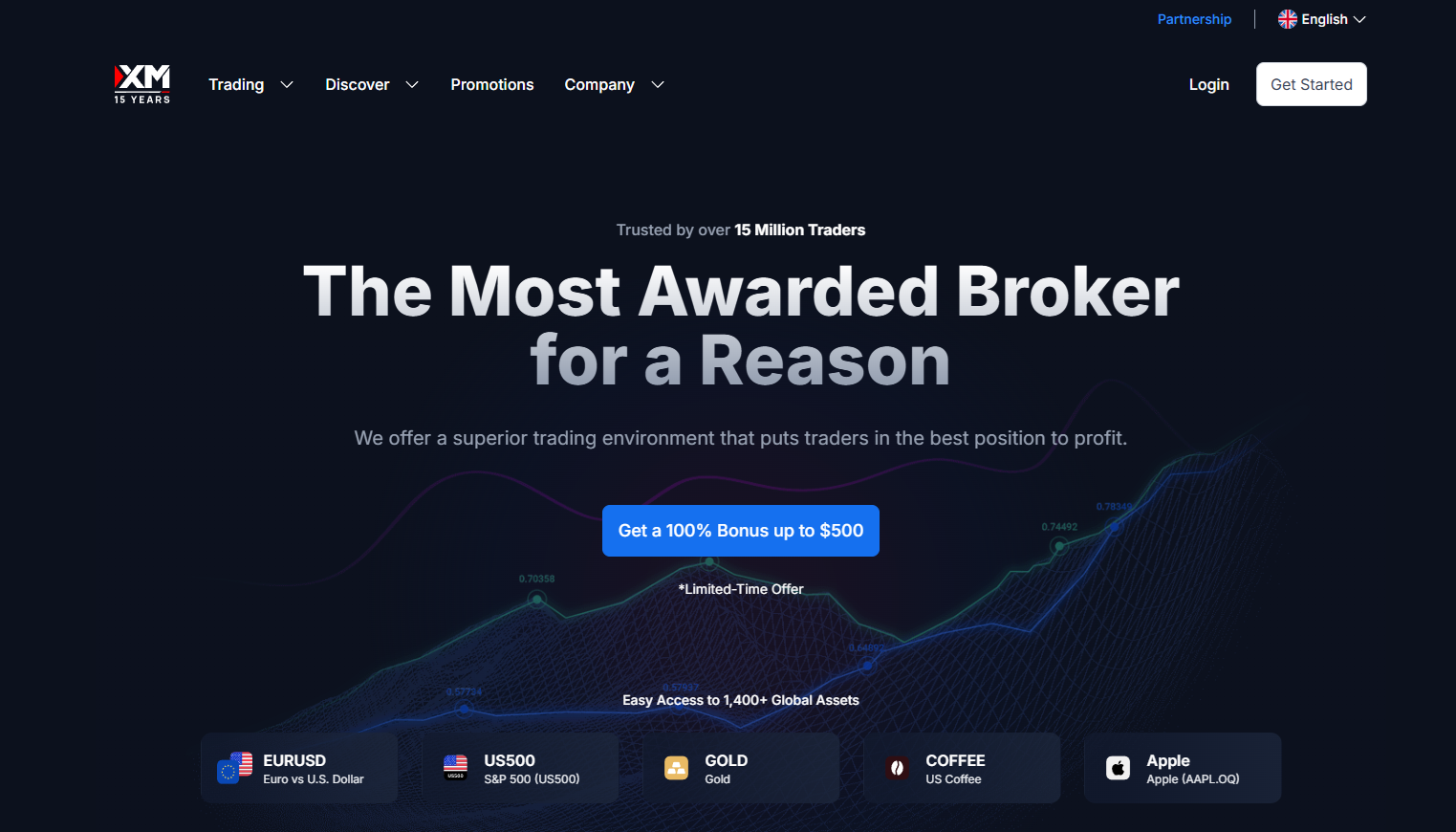

#5. XM

What is XM?

XM is a global online broker offering a full-suite of trading services—including forex, CFDs, stocks, indices, and commodities—via the popular MetaTrader 4 and MetaTrader 5 platforms, designed for all levels of traders. It boasts a low minimum deposit, tight spreads, and high degrees of trading flexibility through features like maximum leverage up to 1:1000. From a regulatory standpoint, XM is multi‐regulated globally and has recently expanded its presence in the UAE by obtaining a Category 5 licence from the Securities and Commodities Authority (SCA) in Dubai, as well as recognition from the Dubai Financial Services Authority (DFSA) for its Dubai-based entity—this provides UAE clients with a stronger regulatory foundation. Given its strong regulation, diverse product offering, and competitive trading conditions, XM stands out as one of the best brokers for UAE-based traders seeking both safety and performance.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM charges no per-lot trading commission on its Micro and Standard accounts, meaning all trading costs are incorporated into the spread, which for the Standard account starts at around 1.6 pips on major currency pairs. Traders holding positions overnight may incur swap/rollover fees, and an inactivity fee typically applies if the account remains inactive for 90 days or more.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

| Rank | Broker | Description |

| 6 | Swissquote | Swissquote is renowned for its secure, DFSA-regulated environment serving both retail and institutional traders in Dubai. The broker’s advanced platforms, extensive market access (over 400 forex and CFD instruments), and robust multilingual support make it a go-to for professionals. Swissquote provides strong fund safety policies and premium research, but its $1,000 minimum deposit and spread levels make it best-suited for experienced traders prioritizing protection and analytical tools. |

| 7 | FP Markets | FP Markets combines low costs (spreads from 0.0 pips for ECN), leverage up to 1:500, and instant access to nearly 9,000 instruments. Its regulation by ASIC and CySEC ensures solid oversight. The minimum deposit is $100, and MetaTrader support appeals to all trading styles. While educational content is lighter, FP Markets stands out for reliable executions and value for active Dubai traders. |

| 8 | FXTM | FXTM, or ForexTime, offers access to forex, stocks, indices, and commodities with high leverage and fast execution. Regulated globally, it offers a $10 minimum deposit, transparent pricing, advanced mobile/web platforms, and a focus on education. It’s adaptable for both beginners and advanced users, but has fewer non-forex commodities compared to some rivals. |

| 9 | Saxo Bank | Saxo Bank is a Danish investment bank with a Dubai DFSA license, offering over 190 forex pairs and 71,000 instruments. With no minimum deposit, its proprietary SaxoTraderGO platform gives market-leading analytics and research. Client funds are highly protected, though fees tend to be above discounter levels. Saxo suits those who want all-in-one global access with premium safety. |

| 10 | Plus500 | Plus500 is regulated in multiple jurisdictions and known for its clean, user-friendly proprietary platform. With tight spreads (from 0.6 pips), no commissions, fully digital processes, strong risk tools, and a low deposit threshold, it’s ideal for beginners and casual CFD/forex traders in Dubai looking for simplicity and transparency. |

| 11 | Moneta Markets | Moneta Markets attracts Dubai clients with a $50 minimum deposit, MT4/5 and proprietary platforms, broad leverage (up to 1:500), and multilingual support. It is regulated by both VFSC and ASIC. Account opening is fast, but it has a limited long-term track record and average spreads are a little higher than top-tier rivals. |

| 12 | FXPro | FXPro is globally respected for regulation (FCA, DFSA, CySEC), competitive pricing (spreads from 0.6 pips), a transparent no-dealing desk model, and multiple platforms (MT4, MT5, cTrader). The broker supports both demo and Islamic accounts, makes no deposit charges, and offers multiple account currencies, making it well-suited for international expat traders in the UAE. |

| 13 | CFI | CFI, regulated by DFSA and long-established in the Middle East, excels on low spreads, MT4/MT5 access, fast execution, and education (webinars, training). It offers customer service in English and Arabic and has low minimum deposits plus Islamic and demo accounts, making it ideal for regional traders seeking transparency and reliability. |

| 14 | Eightcap | Eightcap is notable for leverage up to 1:500, easy online sign-up, competitive spreads, and modern technology focused on algorithmic and automation traders. It’s regulated by ASIC/SCB, works on MT4/MT5, and supports both novice and advanced users, though research depth is not as extensive as legacy brokers. |

| 15 | ADSS | ADSS is a DFSA-licensed broker based in Abu Dhabi, offering MetaTrader and OREX platforms, low minimum deposits, and customer service in Arabic/English. It supports a wide range of assets and Islamic accounts, plus transparent pricing, making it a major regional actor for both retail and institutional clients. |

| 16 | IG | IG is a leader in online trading with deep market coverage, advanced charting/analytics, solid platform variety, and strong DFSA regulation. It is best for active traders in Dubai who want cutting-edge tools, regulatory reliability, and market innovation. |

| 17 | XM | XM is known for accessible trading (min deposit $5), high leverage, MetaTrader support, and promotional bonuses. It attracts Dubai clients for its flexibility, strong digital support, and fully regionalized services, including Islamic accounts and local payment methods. |

| 18 | OANDA | OANDA delivers deep liquidity, transparent pricing, advanced tools, and a reputation for reliability, also supporting Islamic accounts in the UAE. It appeals to experienced traders seeking detailed analysis and tough regulatory protection. |

| 19 | Capital.com | Capital.com offers fee transparency, very low spreads, excellent educational resources, and a top-rated mobile app. It’s regulated and simple to join, appealing to traders wanting an intuitive, modern experience with strong client support. |

| 20 | Hantec Markets | Hantec Markets provides low trading costs, good platform usability, diverse instruments, and solid customer support for UAE newcomers. It charges no deposit/withdrawal fees and is competitively regulated, making it attractive for traders looking to expand into the Gulf markets. |

How to Get Started with a Forex Broker in Dubai

Getting started with forex trading in Dubai is pretty straightforward, especially with so many brokers offering services tailored to beginner traders. If you’re new to forex or just unfamiliar with the process, here’s a simple step-by-step guide to help you get going.

Step 1: Choose a Regulated Forex Broker

The first thing you need to do is pick a forex broker that’s regulated in the United Arab Emirates. Look for brokers licensed by the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority (SCA). These regulations ensure your trading is secure and compliant with local laws. Brokers like AvaTrade, Pepperstone, and IC Markets offer Islamic accounts, which is essential if you want to avoid interest on overnight trades.

Step 2: Open a Trading Account

Once you’ve chosen a broker, head to their website and open a trading account. You’ll typically need to provide personal details like your name, email, and phone number. Some brokers may also ask for a small initial deposit to activate your account, so have your funds ready. Many brokers offer multiple account types, so choose the one that suits your trading goals.

Step 3: Verify Your Identity

Before you can start trading, you’ll need to verify your identity. This is usually a quick process where you’ll upload copies of your passport or Emirates ID, along with proof of address, such as a utility bill. This step ensures the broker complies with Know Your Customer (KYC) regulations, keeping your account secure.

Step 4: Deposit Funds

After verifying your account, it’s time to deposit funds. Most brokers offer various options like bank transfers, credit cards, or e-wallets such as PayPal. Make sure to check if the broker charges any fees for deposits and withdrawals. Also, check if your broker provides an Islamic account if you want to avoid interest charges on your positions.

Step 5: Choose a Trading Platform

Most brokers in Dubai offer popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms provide tools for technical analysis and real-time price tracking. Some brokers also have their own platforms, which might be more beginner-friendly.

Step 6: Start Trading

Now that your account is set up and funded, you’re ready to start trading forex! Begin with small trades if you’re new to the market, and take advantage of any demo accounts offered by the broker to practice your strategies before investing real money. Don’t forget to keep an eye on spreads and fees to maximize your profits.

Conclusion

In conclusion, picking the best forex broker in Dubai depends on your individual trading needs, whether you're a beginner trader or an experienced one. Brokers like AvaTrade, Pepperstone, and IC Markets offer excellent platforms, competitive spreads, and Islamic accounts for traders who follow Sharia law. When selecting a broker, make sure they are regulated by trusted authorities like the Dubai Financial Services Authority or the Securities and Commodities Authority to ensure your trading is secure. Ultimately, choosing the right broker can make a huge difference in your forex trading experience, so it's worth taking the time to research and compare options.

Also Read: The 5 Best Forex Brokers in UAE in 2026

FAQs

1. Is Forex Trading Legal in Dubai?

Yes, forex trading is fully legal in Dubai and the UAE as of 2026, provided it's conducted through licensed brokers. It's overseen by key regulators to ensure transparency and investor protection. Unregulated trading or scams are illegal, with penalties including fines or bans.

For a deeper dive into the UAE's legal framework, see Asia Forex Mentor's guide on Is Forex Legit.

2. What Are the Main Regulatory Bodies for Forex in Dubai?

Dubai's forex landscape is governed by:

- Dubai Financial Services Authority (DFSA): Regulates firms in the Dubai International Financial Centre (DIFC), focusing on high-risk activities like brokerage.

- Securities and Commodities Authority (SCA): Oversees mainland operations and ensures compliance with anti-fraud laws.

- Central Bank of the UAE (CBUAE): Monitors overall financial stability and AML (anti-money laundering) rules.

Brokers must hold a Category 3A Brokerage License for forex services. Verify licenses on DFSA or SCA public registers.

3. Do I Need a License to Trade Forex Personally in Dubai?

No, individual retail traders don't need a personal license, just a verified account with a regulated broker. However, if you're starting a forex business (e.g., brokerage or prop firm), you'll require a DFSA or SCA license, costing AED 50,000–500,000 in setup fees.

For business setup tips, explore Asia Forex Mentor's Forex Brokers for Beginners.

4. How Do I Start Forex Trading in Dubai as a Beginner?

Follow these steps:

- Educate Yourself: Learn basics via free resources or courses.

- Choose a Regulated Broker: Select DFSA/SCA-licensed ones (see Q. 10).

- Open an Account: Provide Emirates ID/passport, proof of address, and complete KYC.

- Fund Your Account: Use AED via bank transfer or cards (no minimum for some brokers).

- Practice on Demo: Test strategies risk-free.

- Go Live: Start with small trades; use leverage wisely.

Demo trading is key, check Asia Forex Mentor's Demo to Live Trading.

5. What Documents Are Required to Open a Forex Account in Dubai?

- Valid Emirates ID or passport.

- Proof of residence (utility bill or tenancy contract).

- Bank statement or proof of funds.

- Completed KYC form for AML compliance.

Non-residents can trade via international brokers accepting UAE clients.

6. What Are the Best Forex Trading Platforms in Dubai?

Popular platforms include:

- MetaTrader 4/5 (MT4/MT5): User-friendly for charts and EAs.

- cTrader: Advanced for ECN trading.

- TradingView: Integrated for analysis.

Most brokers offer mobile apps. For platform comparisons, see Asia Forex Mentor's Best Forex Trading Platform.

7. What Leverage and Margin Rules Apply in Dubai?

Leverage is capped at 1:30 for major pairs under DFSA/SCA rules to protect retail traders, but higher (up to 1:500) is available via offshore brokers. Margins start at 3.33% for majors. Always calculate risk, use Asia Forex Mentor's What Does Leverage Mean in Forex.

8. Are There Taxes on Forex Trading Profits in Dubai?

No personal income or capital gains tax on forex profits for individuals in 2026, keep 100% of gains. Businesses face 9% corporate tax on profits over AED 375,000. VAT (5%) may apply to fees. Expats should check home-country tax treaties (e.g., India-UAE DTAA).

Details in Asia Forex Mentor's Money Management Trading.

9. What Are the Best Forex Brokers in Dubai for 2026?

Top regulated options:

- ADSS: Local SCA-regulated, Arabic support, low spreads.

- Pepperstone: DFSA-licensed, ECN execution, MT4/5.

- IG: DIFC presence, advanced tools.

- BlackBull Markets: Diverse assets, 500:1 leverage.

- Swissquote: FINMA/DFSA-regulated for pros.

Compare via Asia Forex Mentor's Best Forex Brokers.

10. How Do I Choose a Reliable Forex Broker in Dubai?

Look for:

- DFSA/SCA license.

- Low spreads (0.0–1.0 pips on majors).

- Negative balance protection.

- Arabic/English support.

- Demo accounts and education.

Avoid unregulated ones, use Asia Forex Mentor's Lowest Spread Forex Broker.

11. What Forex Trading Hours Should I Follow in Dubai?

Dubai (GST, UTC+4) aligns with global sessions:

- Sydney: 1:00 AM–10:00 AM.

- Tokyo: 6:00 AM–3:00 PM.

- London: 11:00 AM–8:00 PM.

- New York: 4:00 PM–1:00 AM.

Peak volatility: London-New York overlap (4:00 PM–8:00 PM GST). Track with Asia Forex Mentor's Forex Trading and Seasonality.

12. Are There Forex Trading Courses or Education in Dubai?

Yes, options include:

- Mithun’s Money Market: Practical online/offline courses.

- Online Trading Campus: Live sessions by verified traders.

- Delta Trading Academy: KHDA-accredited, mentorship-focused.

- Free: Axi Academy or broker webinars.

Enroll in Asia Forex Mentor's Best Forex Trading Courses for global expertise.

13. Is Forex Trading Halal in Dubai?

Yes, if using swap-free (Islamic) accounts avoiding riba (interest). DFSA/SCA brokers offer these. Confirm Sharia compliance via certified boards.

See Asia Forex Mentor's Is Forex Trading Halal or Haram.

14. What Are Common Forex Trading Strategies for Dubai Traders?

- Scalping: Short-term on high-liquidity pairs like USD/AED.

- Swing Trading: Hold positions days/weeks, using Dubai's 24/5 access.

- News Trading: Capitalize on oil/GCC events.

Strategies in Asia Forex Mentor's Best Forex Strategy for Consistent Profits.

15. How Can I Fund and Withdraw from Forex Accounts in Dubai?

Use AED via bank transfers, cards, or e-wallets (Skrill/Neteller). Processing: Instant–3 days. No fees on most regulated brokers. Minimum deposit: AED 100–5,000.

Tips from Asia Forex Mentor's Forex Profit Calculator.

16. What Risks Are Involved in Forex Trading in Dubai?

- Market volatility (e.g., oil prices affecting AED).

- Leverage amplification.

- Scams (fake brokers).

- Emotional trading.

Mitigate with Asia Forex Mentor's Risk Management in Forex Trading.

17. How Prevalent Are Forex Scams in Dubai, and How to Avoid Them?

Scams cost UAE residents millions annually via fake apps/cold calls promising “guaranteed returns.” Red flags: Unregulated brokers, high-pressure sales, withdrawal blocks. Avoid by sticking to DFSA/SCA-licensed firms; report to police/eCrime app.

Warnings in Asia Forex Mentor's Forex Trading Scams Exposed (hypothetical; adapt from sitemap).

18. Can Expats or Non-Residents Trade Forex in Dubai?

Yes, via international brokers accepting UAE clients. Non-residents need a VPN for access if restricted. For residency, apply for Investor Visa (AED 2M investment) or Golden Visa.

Visa guide: Asia Forex Mentor's Forex Trading for Retirement.

19. What Is the Role of the AED in Forex Trading in Dubai?

The UAE Dirham (AED) is pegged to USD (3.67:1), reducing volatility for USD pairs. Trade AED crosses sparingly; focus on majors like EUR/USD.

Peg details in Asia Forex Mentor's Understanding Currency Pairs.

20. How Does Dubai's Economy Impact Forex Trading?

Oil dependency and diversification (tourism, tech) influence AED/USD. GCC events boost volatility. Trade oil-correlated pairs like USD/CAD.

Economic insights: Asia Forex Mentor's Forex vs Stocks.

21. What Mobile Apps Are Best for Forex Trading in Dubai?

- MT4/MT5 Mobile.

- Broker apps (e.g., ADSS Trader).

- TradingView for analysis.

Mobile guide: Asia Forex Mentor's Best Forex Mobile Apps 2026.

22. How to Backtest Forex Strategies in Dubai?

Use MT5's Strategy Tester or TradingView. Access free historical data from brokers.

Tutorial: Asia Forex Mentor's Backtesting Trading Strategies.

23. What Community or Events for Forex Traders in Dubai?

Join DIFC events, Meetup groups, or Reddit (r/dubai). Annual Dubai Forex Expo.

Connect via Asia Forex Mentor's Forex Trading Community (adapt).

24. Can I Trade Forex on a Tourist Visa in Dubai?

No, trading requires residency for banking/KYC. Use investor visa for long-term.

Visa info: Asia Forex Mentor's How to Start Trading Forex.

25. What Future Trends for Forex in Dubai (2026+)?

Rise of AI tools, crypto-forex hybrids, and SCA's digital asset push. Expect more Islamic accounts.

Trends: Asia Forex Mentor's The Role of AI in Forex Trading.

26. How to Recover from Forex Losses in Dubai?

Review trades in a journal, adjust strategy, seek mentorship. Use regulated brokers for disputes.

Recovery: Asia Forex Mentor's Trading Journal.

27. Is Automated Forex Trading Allowed in Dubai?

Yes, via EAs on MT4/5, but ensure broker compatibility. DFSA monitors algo risks.

Automation: Asia Forex Mentor's Automated Forex Trading.

28. What Forex Pairs Are Most Popular in Dubai?

Majors: EUR/USD, GBP/USD, USD/JPY. AED pairs for locals.

Pairs guide: Asia Forex Mentor's Best Forex Pairs to Trade.

29. How to Set Up a Forex Trading Business in Dubai?

- Choose structure (free zone/mainland).

- Get DFSA license.

- Secure office/bank account.

- Comply with AML.

Business: Asia Forex Mentor's Best PAMM Account Brokers.

30. Where to Get Forex Trading Support in Dubai?

DFSA helpline, SCA complaints portal, or communities like Dubai Traders Meetup.

Support: Asia Forex Mentor's Forex Trading Coach.