When it comes to forex trading in the Philippines, finding the right forex broker can make all the difference. Whether you’re just starting out or you’ve been in the game for a while, the best forex brokers offer the tools, features, and support you need to succeed. But with so many options available, it’s tough to know which ones really stand out. That’s why we’ve put together this guide to help you find the top brokers in the Philippines for 2026. These platforms not only make it easy to trade forex, but they also come with competitive fees, great customer support, and reliable trading platforms. We know that forex traders need more than just low fees—they need strong security, good regulation, and access to a range of trading strategies. In this article, we’ll cover everything from the best forex trading accounts to the customer support each broker provides. Whether you’re looking for the best forex broker to get started or want to switch to a more advanced platform, we’ve got you covered. Let’s break down the top forex brokers in the Philippines to help you make an informed choice in 2026!

Overview of Forex Trading in the Philippines

Forex trading in the Philippines has seen significant growth in recent years, with more Filipino traders participating in the foreign exchange market. This increase in interest is driven by the accessibility of online trading platforms, better internet connectivity, and a growing awareness of the potential profits in forex. Both beginner traders and experienced traders are drawn to the flexibility that forex trading offers, such as the ability to trade 24/5 and the use of various trading strategies to capitalize on price movements in different currency pairs. In 2025, the Securities and Exchange Commission (SEC) in the Philippines continues to emphasize the importance of regulation in the financial markets. While there are no forex brokers locally regulated by the SEC, the agency advises Filipino traders to work with internationally regulated brokers to ensure safety and compliance. Choosing a regulated forex broker is essential, as it protects traders from fraud and ensures that the brokers adhere to strict industry standards. As a result, many of the best forex brokers operating in the Philippines are regulated by bodies such as the FCA, ASIC, or CySEC. The rise of online trading platforms has made it easier than ever for Filipinos to trade forex securely, offering features like low trading fees, access to various trading instruments, and even algorithmic trading for more sophisticated strategies.

How to Choose the Best Forex Broker in the Philippines

Choosing the best forex broker in the Philippines doesn’t have to be overwhelming. Whether you're a seasoned trader or just starting out, there are a few essential factors to keep in mind that can help you make the right choice. It's important to focus on regulation, fees, the quality of the trading platforms, and the security of your funds. Once you know what to look for, it becomes easier to decide which broker meets your needs. It’s important to note that there are currently no SEC-regulated brokers that offer forex trading in the Philippines. This means traders must work with internationally regulated brokers, often regulated by reputable authorities such as the FCA, ASIC, or CySEC. Here are the key things to consider:

- Regulation: Ensure the broker is regulated by reliable authorities like the FCA or ASIC.

- Trading Costs: Look for brokers that offer competitive trading fees with low spreads, commissions, and no hidden costs.

- Trading Platforms: The platform should be stable and user-friendly, providing all the essential tools like real-time charts and market analysis.

- Account Types: Check the variety of trading accounts available. Some brokers offer lower minimum deposits for beginners, while others cater to professional traders with higher deposit options.

- Security of Funds: Ensure the broker provides solid fund protection, such as negative balance protection and segregated accounts for extra safety.

- Customer Service: A good broker will offer reliable customer support, accessible through multiple channels like live chat, email, or phone.

- Demo Accounts: Having access to a demo account is valuable for testing strategies without risking real money.

- Mobile Trading: In today’s fast-paced environment, mobile-friendly trading platforms are a must for trading on the go.

- Educational Resources: Look for brokers that offer tutorials, webinars, or market analysis to help you learn and improve your trading skills.

The 45 Best Forex Brokers in the Philippines

#1. XM: Best Overall for Traders in the Philippines

What is XM?

XM is a popular broker in the Philippines, known for its flexibility, low entry requirements, and range of financial instruments. With a minimum deposit as low as $5, XM caters to both beginner and experienced traders. The broker provides access to MetaTrader 4 and MetaTrader 5, which are widely used trading platforms for forex and CFDs. XM offers high leverage of up to 1:1000, depending on the account type and jurisdiction. Additionally, the broker supports over 1,400 financial instruments, including forex, cryptocurrencies, stocks, commodities, and indices, making it one of the best choices for traders in the Philippines who are looking for a variety of trading options.

Advantages and Disadvantages of XM

XM Commissions and Fees

The fee system at XM differs depending on the account type. For Micro and Standard accounts, there are no commissions, and traders can enjoy spreads starting at approximately 1.6 pips on major currency pairs during normal trading periods. The Zero (or “Zero Spread”) account, however, features spreads beginning from 0.0 pips and a commission of USD 3.50 per lot per side (USD 7 round-trip). XM also applies swap or overnight charges for open positions held beyond the trading day and may include an inactivity fee for accounts that remain unused over time.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

#2. AvaTrade

What is AvaTrade?

AvaTrade is a well-established and internationally regulated broker, making it one of the top choices for traders in the Philippines. Known for its user-friendly platforms like MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO, AvaTrade caters to both beginners and advanced traders. It offers commission-free trading on most accounts with spreads starting as low as 0.9 pips on major currency pairs like EUR/USD. Additionally, AvaTrade supports a wide range of instruments including forex, cryptocurrencies, commodities, and CFDs. One of the standout features is its risk management tool, AvaProtect, which allows traders to mitigate losses on specific trades. While there are no deposit or withdrawal fees, an inactivity fee of $50 kicks in after three months of inactivity.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

AvaTrade offers a straightforward pricing structure. The broker charges no commissions on most accounts, and spreads start as low as 0.9 pips on major currency pairs like EUR/USD. AvaTrade also stands out for having no deposit or withdrawal fees, although it does apply an inactivity fee of $50 after three months of no trading, and an additional $100 administration fee after 12 months of inactivity. This fee structure, combined with its user-friendly platforms, makes AvaTrade an affordable and appealing choice for traders in the Philippines.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#3. IG

What is IG?

IG is one of the top brokers in the Philippines, known for its long-standing reputation and advanced trading tools. Offering a wide range of trading platforms including MetaTrader 4, ProRealTime, and its own IG platform, it provides a flexible and professional environment for traders. IG is particularly favored by professional traders due to its Direct Market Access (DMA), which allows access to raw spreads from liquidity providers. Additionally, traders benefit from over 17,000 financial instruments to choose from, including forex, stocks, indices, and cryptocurrencies, making it an ideal broker for those seeking comprehensive market access and advanced trading tools.

Advantages and Disadvantages of IG

IG Commissions and Fees

When it comes to fees and commissions, IG is known for its transparent pricing. Forex traders enjoy commission-free trading with spreads starting as low as 0.6 pips on major currency pairs like EUR/USD. For other instruments such as stocks, IG charges a commission, but it offers tiered pricing, meaning high-volume traders can benefit from reduced fees. IG does not charge account maintenance or deposit fees, although inactivity fees may apply after two years of no trading activity. This structure makes IG a cost-effective option for both active and professional traders.

OPEN AN ACCOUNT NOW WITH IG MARKETS AND GET YOUR WELCOME BONUS

#4. FP Markets

What is FP Markets?

FP Markets, established in 2005, is a globally recognized Forex and CFD broker offering access to a wide range of financial instruments, including forex, indices, commodities, stocks, and cryptocurrencies. The broker operates under the regulation of the Australian Securities and Investments Commission (ASIC), ensuring compliance with stringent financial standards and providing a secure trading environment. FP Markets is acclaimed for its tight spreads, fast execution speeds, and support for advanced trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView, making it a top choice among Forex brokers.

Advantages and Disadvantages of FP Markets

FP Markets Fees and Commissions

In the Philippines, FP Markets offers competitive fees and commissions across its account types. The Standard Account features zero commissions, with costs incorporated into the spread, starting from 1.0 pips for major currency pairs. The Raw Account provides spreads from 0.0 pips, with a commission of $3 per lot per side. Notably, FP Markets does not impose inactivity fees or account maintenance charges.

OPEN AN ACCOUNT NOW WITH FP MARKETS AND GET YOUR WELCOME BONUS

#5.

InstaForex

What is InstaForex

Founded in 2007, InstaForex is an international Forex and CFD broker that offers online trading services to its clients across the globe. InstaForex is known for its high level of customer service, range of trading instruments, and generous bonus programs. They provide traders access to the Forex market via the MT4 trading platform.

Advantages and Disadvantages of Trading with InstaForex

Commissions and Fees

InstaForex primarily operates on a spread-only model and does not charge any commissions on trades. The broker offers fixed spreads that start from 3 pips on major currency pairs. However, the spread can be high compared to industry averages for certain instruments.

#6. IC Markets

What is IC Markets?

IC Markets is a well-known broker throughout the world that offers narrow spreads and fast execution. This makes it one of the finest options for traders in the Philippines who want to trade forex at a low cost and have easy access to the market. It distinguishes out in the area since it offers raw spreads that are good for both small and expert traders who wish to trade at a low cost.

Advantage and Disadvantage of IC Markets

IC Markets Commission and Fees

There are two types of accounts at IC Markets. The Standard Account offers no fee and spreads that start at about 0.6 pips. It's for traders who want to include trading costs in the spread. The Raw Spread Account has spreads that are almost zero and a cost of roughly $7 per regular lot (round turn) on FX. This account is for traders who want tighter spreads and don't mind paying a commission. MT4, MT5, and cTrader are some of the platforms that are supported. Other capabilities include algorithmic trading, copy trading, and VPS hosting. You can use leverage up to 1:500.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#7. Exness

What is Exness?

Exness is a popular global broker that is becoming more popular in the Philippines because it boasts low trading costs, quick withdrawals, and an easy-to-use setup. This makes it one of the best options for both beginner and experienced traders.

Advantage and Disadvantage of Exness

Exness Commission and Fees

Exness does not charge deposit or withdrawal fees, while banks or providers may. They offer these accounts, Standard Accounts are commission-free with wider spreads, but Raw Spread, Zero, and Pro Accounts have spreads starting at 0 pips with commissions ranging from 0.20 to 3.50 US dollars per lot per side, depending on the instrument. Overnight swap fees apply to positions held overnight, and an inactivity fee is imposed after 90 days without trading. Platforms supported include MT4 and MT5, with leverage of up to 1:2000.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

#8. FP Markets

What is FP Markets?

FP Markets is an Australian-based broker noted for its clear pricing and direct market access, making it an excellent alternative for Philippine traders who appreciate fair execution. It has established a reputation for providing dependable trading conditions in forex, CFDs, and equities, backed by several platforms and low fees.

Advantage and Disadvantage of FP Markets

FP Markets Commission and Fees

FP Markets has two major account types. The Raw Account offers spreads starting at 0.0 pips with a cost of approximately 3 US dollars per lot each way on forex and metals, or per-share rates for equities, making it ideal for aggressive traders looking for cheap spreads. The Standard Account is commission-free and offers broader spreads that incorporate the broker's charges, making it ideal for casual traders who desire a simpler pricing structure. Overnight swaps, Islamic account administration charges, and IRESS market data fees are all examples of additional expenses. The minimum deposit is $100 US, with leverage offered up to 1:500 on the MT4, MT5, and IRESS platforms.

OPEN AN ACCOUNT NOW WITH FP MARKETS AND GET YOUR WELCOME BONUS

#9. Tickmill

What is Tickmill?

Tickmill is a broker that is regulated all over the world and is known for having a low-cost trading environment. This makes it one of the finest options for Filipino traders who seek solid execution with low fees. Because of its competitive spreads and easy-to-understand account options, it is very popular with active forex traders.

Advantage and Disadvantage of Tickmill

Tickmill Commission and Fees

The costs at Tickmill vary depending on the type of account. There are no commissions on the Classic Account, and spreads start at about 1.6 pips. This account is good for traders who don't want to pay commissions. The Raw Account has spreads as low as 0.0 pips and charges roughly 3 US dollars per lot per side for forex and precious metals. This makes it a good choice for scalpers and traders who care about costs. The TradingView Raw Account charges roughly $3.50 per lot each side in commissions and has equally narrow spreads. It is meant for people who like the TradingView platform. All accounts do not charge a fee for trading CFD indices, cryptocurrencies, oil, or bonds. MT4, MT5, and TradingView are some of the platforms that work with it, and you can use up to 1:500 leverage.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR WELCOME BONUS

#10. HFM (HotForex)

What is HFM (HotForex)?

HotForex, or HFM, is a well-known broker that traders in the Philippines like since it offers a lot of different account kinds and has very low entry criteria. Because it has flexible terms, solid international rules, and a simple way for newcomers to get started, it is thought to be one of the best in the area.

Advantage and Disadvantage of HFM (HotForex)

HFM (HotForex) Commission and Fees

The fees for HFM depend on the account. There is no commission on Premium and Pro Accounts. The fees are included into the spreads, which start at about 1 pip. The Zero Account has raw spreads and a commission that starts at roughly $3 per lot. There are no broker fees for deposits and withdrawals, and the Premium account has options that don't charge for swaps. The minimum deposit is $5, the maximum leverage is 1:1000, and the platforms that work with this broker are MT4 and MT5. You can trade forex, CFDs, indices, commodities, shares, and cryptocurrencies.

OPEN AN ACCOUNT NOW WITH HFM AND GET YOUR WELCOME BONUS

#11. OANDA

What is OANDA?

OANDA is a well-known broker with a good reputation around the world. They offer clear prices and rigorous regulatory control. Because its platforms are easy to use and it is reliable for both forex and CFD trading, it is one of the finest brokers for traders in the Philippines.

Advantage and Disadvantage of OANDA

OANDA Commission and Fees

OANDA uses a core pricing methodology, which means that the spread includes charges for most FX and metals trades. The spreads on major forex pairings, such EUR/USD, can be as low as 0.1 pips. The effective commissions range from roughly 0.35 to 1.00 US dollars per 100,000 transacted, depending on the pair. There may be extra fees for CFDs on stocks and indices. After 12 months of not trading, an inactivity fee of 10 units of the account currency is imposed per month. Financing (rollover) fees apply to positions that are held overnight. Retail traders from other countries can use MT4 and OANDA's own platform, with leverage up to 1:200.

OPEN AN ACCOUNT NOW WITH OANDA AND GET YOUR WELCOME BONUS

#12. Admirals (Admiral Markets)

What is Admirals (Admiral Markets)?

Admirals, which used to be called Admiral Markets, is a broker that is regulated all over the world and offers both innovative trading tools and robust investor protection. Traders in the Philippines might think about this choice because it has competitive spreads, a wide range of instruments, and powerful add-ons for MT4 and MT5.

Advantage and Disadvantage of Admirals (Admiral Markets)

Admirals (Admiral Markets) Commission and Fees

Admirals has a number of different types of accounts. The Zero Account gives you raw spreads starting at 0.0 pips and charges roughly $3 per lot per side for forex trades. You can open an Invest Account with just $1, and the account charges $0.02 per share for stocks and ETFs. The Standard Account also charges a $0.02 per share commission on stocks. The difference between the buy and sell prices on popular currency pairs like EUR/USD is usually between 0.1 and 0.6 pips. After 24 months of inactivity, you will have to pay a cost of 10 EUR every month. MT4 and MT5, with the Admirals Supreme Edition, are supported platforms. Under multinational entities, leverage can go as high as 1:500.

OPEN AN ACCOUNT NOW WITH ADMIRAL AND GET YOUR WELCOME BONUS

#13. MultiBank Group

What is MultiBank Group?

MultiBank Group is a broker that is regulated around the world. It was founded in 2005 and focuses on forex and CFD trading with a strong emphasis on transparency and protecting investors. It is one of the top brokers for traders in the Philippines since it offers a variety of account types, tight spreads, and access to several trading platforms, all while following stringent rules.

Advantage and Disadvantage of MultiBank Group

MultiBank Group Commission and Fees

There are three types of accounts available from MultiBank Group. With the Standard Account, there are no commissions and spreads start at 1.5 pips. There are no commissions on the Pro Account either, and spreads start at 0.8 pips. With the ECN Account, you can get raw spreads starting at 0.0 pips and pay roughly $3 to $4 per lot per side in commissions. A 60 US dollar monthly maintenance cost is paid for accounts that have been dormant for three months in a row. There are also overnight switch fees. Most of the time, brokers don't charge anything for deposits and withdrawals. You can use MT4, MT5, and WebTrader, and you can get up to 1:500 leverage.

OPEN AN ACCOUNT NOW WITH MULTIBANK GROUP AND GET YOUR WELCOME BONUS

#14. Eightcap

What is Eightcap?

Eightcap is an ASIC-regulated Australian broker noted for its low-cost forex trading and extensive support for MT4 and MT5 platforms. It is one of the best brokers in the Philippines since it offers low pricing and access to both the FX and crypto CFD markets.

Advantage and Disadvantage of Eightcap

Eightcap Commission and Fees

Eightcap provides two main accounts. The Standard Account is commission-free, with spreads starting at 1.0 pips (costs are included into the spread). The Raw Account offers raw spreads starting at 0.0 pips, with a commission of around 3.50 US dollars per side (7 US dollars round turn) every typical lot on forex and CFDs. Overnight swap fees apply to positions held overnight; deposits are free of broker fees, but some withdrawals may incur provider fees. The minimum deposit is $100 US dollars, with leverage up to 1:500. MT4 and MT5 are supported platforms, and you can trade FX, indices, commodities, stocks, and cryptocurrencies.

OPEN AN ACCOUNT NOW WITH EIGHTCAP AND GET YOUR WELCOME BONUS

#15. FxPro

What is FxPro?

FxPro is a UK-based broker that is authorized by top organizations including the FCA and CySEC. It offers forex and CFD trading with high execution quality. Because of its solid regulation, wide range of platforms, and clear pricing structures, it is one of the top brokers for the Philippines.

Advantage and Disadvantage of FxPro

FxPro Commission and Fees

There are three primary types of accounts at FxPro. There is no commission on MT4/MT5 Standard Accounts, and fees are included in spreads that start at about 1.2 pips. For forex and metals, MT4/MT5 Raw Spread Accounts can have spreads as low as 0.0 pips. There is a commission of 3.50 US dollars per lot each side (7 US dollars round turn). For cTrader Accounts, the commission is $35 for every $1 million traded, which is the same as $3.50 for each side of a regular lot. If you hold positions overnight, you'll have to pay swap fees. If you don't trade for 12 months, you'll also have to pay a $5 inactivity fee. The minimum deposit is $100, and you can borrow up to $500. MT4, MT5, cTrader, and FxPro EDGE are some of the systems that work with it.

OPEN AN ACCOUNT NOW WITH FXPRO AND GET YOUR WELCOME BONUS

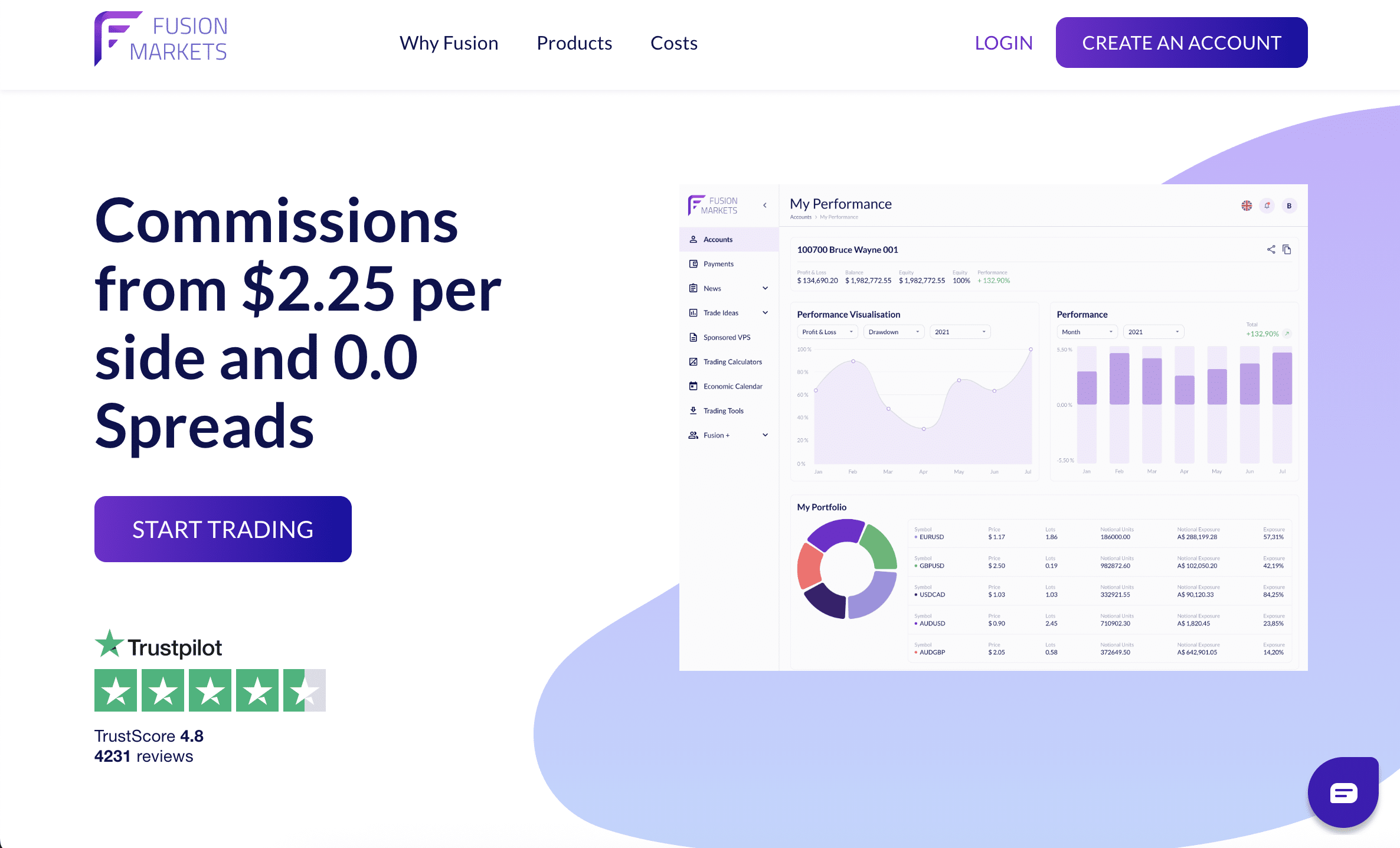

#16. Fusion Markets

What is Fusion Markets?

Fusion Markets is an ASIC-regulated Australian broker that is known for having very cheap trading expenses and a clear pricing structure. It is thought to be one of the top brokers for the Philippines because it has some of the lowest commissions in the world and offers a variety of account types that work for both new and experienced traders.

Advantage and Disadvantage of Fusion Markets

Fusion Markets Commission and Fees

There are two main accounts at Fusion Markets. The Zero Account has raw spreads that start at 0.0 pips and a commission of 2.25 US dollars per lot per side (4.50 US dollars round turn) for currency and commodities. There are no commissions on the Classic Account, and spreads start at 0.9 pips. There are no commissions on US share CFDs, and there are also account choices that don't charge swaps. You don't have to pay any fees to make a deposit, and there is no minimum amount you have to deposit. If you trade less than 2.5 lots, you will have to pay a Fusion+ copy service cost of $10 per month. There are swap costs for positions that are open overnight. MT4 and MT5 are two of the platforms that offer leverage of up to 1:500.

OPEN AN ACCOUNT NOW WITH FUSION MARKETS AND GET YOUR WELCOME BONUS

#17. Vantage

What is Vantage?

Vantage is an ASIC-regulated Australian broker that lets you trade forex and CFDs. They emphasize on giving low prices and a flexible interface. It is one of the finest brokers for the Philippines since it offers both commission-free and low-cost ECN accounts. This makes it good for both new and experienced traders.

Advantage and Disadvantage of Vantage

Vantage Commission and Fees

Vantage has two basic categories of accounts. The Standard STP Account has no commissions and spreads that start at 1.0 pips. It's great for people who trade for fun. For forex trading, the Raw ECN Account offers raw spreads starting at 0.0 pips and a fee of $3 per lot each side (or $6 round turn). Depending on where you live, ETFs, precious metals, and share CFDs may have extra fees. You have to pay overnight swap costs for positions that are open overnight, although deposits don't cost anything from the broker. You need to put in at least 50 US dollars. You can use MT4, MT5, and TradingView, and you can get up to 1:500 leverage.

OPEN AN ACCOUNT NOW WITH VANTAGE AND GET YOUR WELCOME BONUS

#18. FBS

What is FBS?

FBS is a global forex and CFD broker that is licensed by several organizations. It is noted for being easy for newcomers to use because it has minimal minimum deposits and cent accounts. It is one of the top brokers for the Philippines since it has customizable account formats and low trading expenses that are perfect for small and medium-sized traders.

Advantage and Disadvantage of FBS

FBS Commission and Fees

FBS usually doesn't charge fees on forex trades. Instead, the expenses are integrated into the spreads, which start at roughly 0.7 pips on popular pairings. A 0.7% charge per trade value applies to stock CFDs. FBS doesn't impose fees for deposits and withdrawals, however payment processors may charge processing fees. You have to pay swap fees for overnight holdings, although there are also switch-free Islamic accounts. Depending on the type of account, the minimum deposit can be as low as $1. You can use MT4, MT5, and the FBS Trader app, and you can use leverage up to 1:3000.

OPEN AN ACCOUNT NOW WITH FBS AND GET YOUR WELCOME BONUS

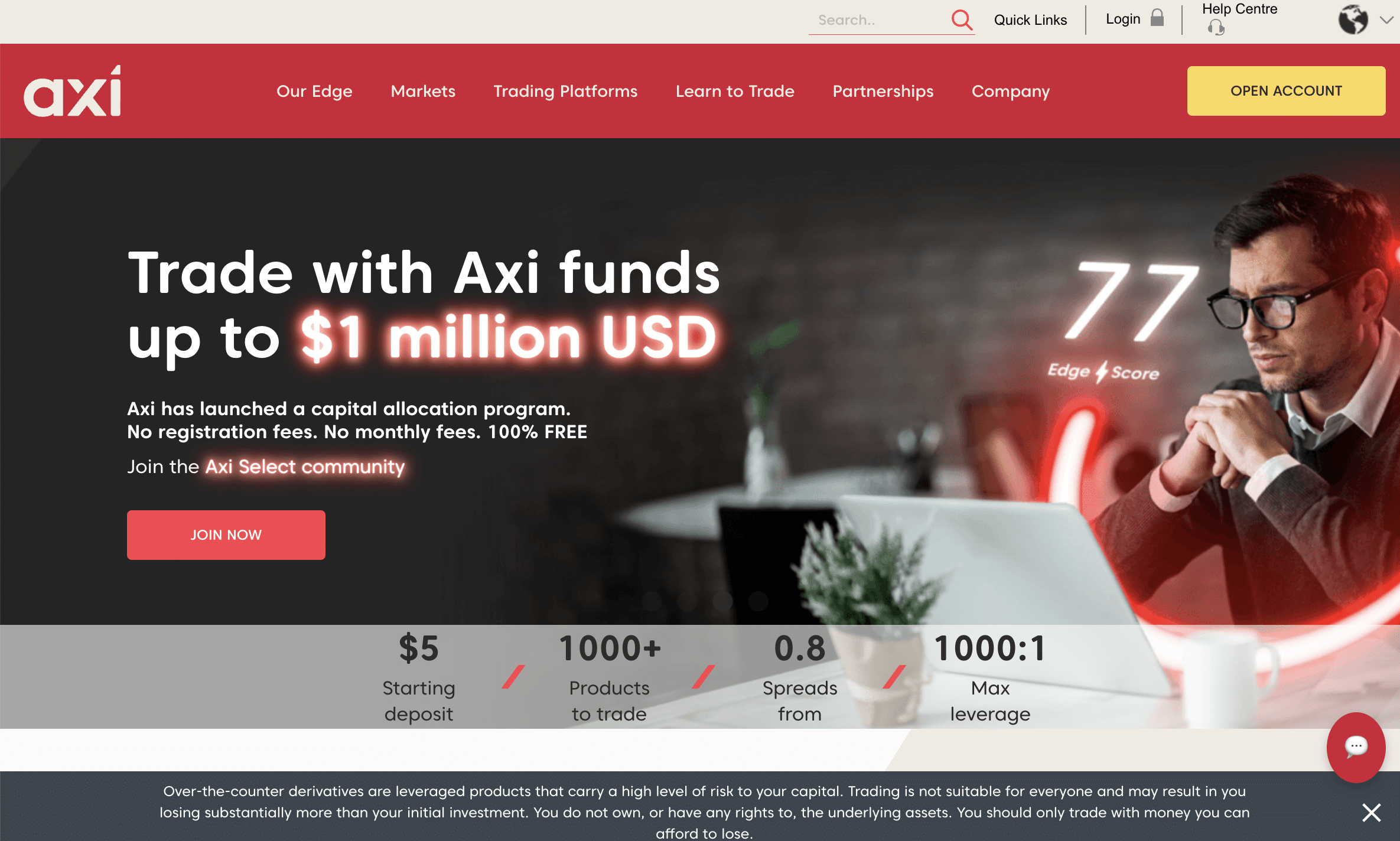

#19. Axi

What is Axi?

Axi is a well-known broker around the world that is authorized by leading agencies like ASIC and the FCA. Because it has low-cost trading choices, clear pricing, and access to professional-grade tools like Autochartist and VPS hosting, it is one of the finest brokers for the Philippines.

Advantage and Disadvantage of Axi

Axi Commission and Fees

Axi has a tiered account system. There are no commissions on the Standard Account, but the spreads are bigger. The Pro Account charges $3.50 in commission for each lot that goes back and forth, and spreads start at 0.0 pips on popular pairings like EUR/USD. The Elite Account has a minimum deposit of $25,000, spreads that start at 0.0 pips, and no commission on crypto trades. Every day, overnight positions have to pay financing costs (swaps). For transactions under $50 (not including crypto), there is a $25 withdrawal fee. There are no fees for deposits, and MT4, Autochartist, VPS services, and leverage up to 1:500 are all supported.

OPEN AN ACCOUNT NOW WITH AXI AND GET YOUR WELCOME BONUS

#20. XTB

What is XTB?

XTB is a broker that is traded on the stock market and is regulated by prominent authorities like the FCA, CySEC, and KNF. Because it has a simple platform, no commissions on CFD trading, and stock investment, as well as solid regulation and openness, it is one of the finest brokers for the Philippines.

Advantage and Disadvantage of XTB

XTB Commission and Fees

XTB lets you trade forex and CFDs without paying commissions. The spreads on EUR/USD are usually between 0.6 and 0.9 pips. There are no commissions on trades of stocks and ETFs up to €100,000 per month. A 0.2% charge occurs after this point, with a minimum of €10 per transaction. If you trade in a different currency, you will have to pay a 0.5% fee to convert the money. There are no custody fees for amounts up to €250,000. After that, there is a 0.02% yearly fee (minimum £10). Most of the time, deposits and withdrawals are free, but some credit cards in some areas may have a 1.5% withdrawal fee. The supported platform is xStation 5, which has enhanced charting, news, and built-in education. However, MT4 and MT5 are not supported. Filipino traders can use leverage of up to 1:500.

OPEN AN ACCOUNT NOW WITH XTB AND GET YOUR WELCOME BONUS

#21. Moneta Markets

What is Moneta Markets?

Moneta Markets is a broker that is regulated by ASIC, FSCA, CIMA, and FSA. It offers forex, CFDs, and stocks in more than 1,000 markets. It is one of the top brokers for the Philippines since it has a lot of different account types, high leverage, and low-cost ECN trading that works for both new and experienced traders.

Advantage and Disadvantage of Moneta Markets

Moneta Markets Commission and Fees

There are three kinds of accounts at Moneta Markets. There are no commissions on the Direct STP Account, and spreads start at roughly 1.2 pips. The Prime ECN Account has raw spreads starting at 0.0 pips and a $3 commission per lot each side ($6 round-turn). The Ultra ECN Account has raw spreads starting at 0.0 pips and a lower cost of $1 per lot each side ($2 round-turn), but it needs more money to open. There are no commissions on US share CFDs. There are no costs for deposits or inactivity, and clients can make one free withdrawal per month. Any extra withdrawals will cost money. You can use MT4, MT5, ProTrader, and AppTrader, and you can get up to 1:1000 leverage.

OPEN AN ACCOUNT NOW WITH MONETA MARKETS AND GET YOUR WELCOME BONUS

#22. Saxo Bank

What is Saxo Bank?

Saxo Bank is a Danish investment bank and global broker that is regulated by top-tier regulators (FCA, ASIC, MAS, FINMA). It gives you access to FX, CFDs, stocks, ETFs, bonds, futures, and options. Its wide selection of products, powerful proprietary platforms, and institutional-grade reliability make it one of the top options for the Philippines.

Advantage and Disadvantage of Saxo Bank

Saxo Bank Commission and Fees

Saxo Bank has a tiered commission and charge system that depends on the product, the kind of account, and where you live. Forex spreads are roughly 1.6 pips on EUR/USD. CFDs have spreads as low as 0.7 on US500 and cheap fees. There is a fee of 0.03% for each trading in stocks and ETFs, with a minimum of €10 on various marketplaces. The cost of trading commodities starts at $2 per lot, while the cost of trading futures starts at $1 per contract. The cost of trading listed options starts at $0.75 a contract. Custody fees (for example, 0.12% per year for Classic accounts on equities), currency conversion fees (up to +/-0.25%), and overnight finance charges for CFDs and futures are some of the other expenditures that may come up. SaxoTraderGO and SaxoTraderPRO are two of the platforms that support this. They give you access to more than 40,000 markets and powerful professional tools.

OPEN AN ACCOUNT NOW WITH SAXO BANK AND GET YOUR WELCOME BONUS

#23.VT Markets

What is VT Markets?

VT Markets is an Australian-based multi-asset broker founded in 2015, regulated by ASIC, FSCA, and FSC, making it a secure option for Filipino traders. It stands out in the Philippines as one of the best brokers because it combines global regulation with local accessibility, offering fast account verification, competitive ECN pricing, and access to over 1,000 instruments across forex, stocks, indices, commodities, and crypto. With support for MT4, MT5, TradingView, and WebTrader, plus features like copy trading and loyalty rewards, VT Markets caters to both beginners and experienced traders who want reliable, low-cost trading backed by strong international oversight.

Advantage and Disadvantage of VT Markets

VT Markets Commission and Fees

There are two types of accounts at VT Markets. There are no commissions on the Standard STP Account, and spreads start at 1.2 pips. With a $3 per lot per trade commission (approximately $6 round-turn on a 100,000-unit standard lot), the RAW ECN Account has spreads as low as 0.0 pips. If you hold a position overnight, you will have to pay swap costs. These fees vary per pair and market rates. Most of the time, withdrawals are free, but if you want to make more than one wire transfer transaction in the same month, you'll have to pay $20. You can use MT4, MT5, WebTrader, and VT Markets' mobile app. You can also trade FX, indices, commodities, ETFs, metals, and crypto CFDs with leverage of up to 1:500.

OPEN AN ACCOUNT NOW WITH VT MARKETS AND GET YOUR WELCOME BONUS

#24. Capital.com

What is Capital.com?

Capital.com is a CFD broker that is regulated all over the world (by the FCA, ASIC, CySEC, SCB, and SCA). It is noted for its low fees, superior proprietary technology, and prices that are good for investors. It is thought to be one of the finest brokers for beginners and intermediate traders in the Philippines because it has no commissions, clear spreads, and a lot of training materials.

Advantage and Disadvantage of Capital.com

Capital.com Commission and Fees

Capital.com charges no commissions and generates revenue from spreads, which are the difference between the bid and ask price. Deposits and withdrawals are free, however third-party banks may levy additional costs. There are no inactivity fees, thus it is ideal for beginners. When positions are held overnight, an overnight financing (swap) cost is charged, which varies depending on the asset class and leverage. However, there are no overnight costs for stock and cryptocurrency CFDs held at 1:1 leverage. When you trade assets in a currency other than the base currency of your account, you will incur a currency conversion fee. Furthermore, Guaranteed Stop-Loss Orders (GSLO) cost money only if they are executed. Spreads on key forex pairs, such as EUR/USD, typically begin around 0.6 pips, and the platform supports web, mobile, and TradingView integration, with leverage of up to 1:500 depending on regulation.

OPEN AN ACCOUNT NOW WITH CAPITAL.COM AND GET YOUR WELCOME BONUS

#25. InstaForex

What is Instaforex?

InstaForex is a global broker registered by the BVI FSC that provides forex, CFDs, commodities, indices, and cryptocurrency. It stands out in the Philippines for its $1 minimum deposit, high leverage of up to 1:1000, and access to both the MT4 and MT5 platforms, making it appealing to both beginners searching for low entry barriers and advanced traders looking for copy trading tools.

Advantage and Disadvantage of Instaforex

Instaforex Commission and Fees

InstaForex costs vary by account type. The Insta.Standard Account is commission-free, with costs incorporated into fixed spreads (which are frequently wider than ECN brokers). The Insta.Eurica Account has 0-pip spreads but charges between 0.03% and 0.07% commission per trade, depending on the product. Certain CFD trades carry a 0.1% fee. After 12 months of inactivity, an account charge is levied. Withdrawal costs vary according to method, ranging from 1.39% for Skrill/Neteller to 2% for bank wire transfers. Deposit fees are often waived, though third-party charges may apply. Leverage up to 1:1000 is available, with platforms including MT4, MT5, and proprietary mobile apps.

OPEN AN ACCOUNT NOW WITH INSTAFOREX AND GET YOUR WELCOME BONUS

| Rank | Forex Broker in the Philippines | Description |

| 26 | Pepperstone | Pepperstone is a popular low-cost ECN-style broker known for deep liquidity, tight raw spreads, and fast execution across MT4/MT5 and cTrader, plus native TradingView integration. For Filipino traders who prefer pricing transparency, Pepperstone’s Raw account passes through interbank spreads (often near 0.0) with a small per-lot commission, while the Standard account bakes costs into the spread. Educational resources, copy-trading options, and APIs make it friendly to both beginners and systematic traders. Pepperstone is multi-regulated (FCA, ASIC, CySEC, BaFin, DFSA, CMA Kenya, SCB Bahamas), with most non-EU clients typically onboarded under SCB or CySEC entities depending on location. That means segregated client funds and negative balance protection under the applicable entity. You’ll also find 24/5 support, broad CFD coverage (FX, indices, commodities, cryptos, shares/ETFs as CFDs), and optional VPS hosting for robots. Overall: a strong “execution + tooling” choice when you want institutional-style flow without bank-level minimums. Always check which Pepperstone entity will service your account and the protections that apply in your country. |

| 27 | CMC Markets | CMC Markets is a veteran broker with a powerful proprietary platform, comprehensive market coverage, and a strong compliance footprint. Beyond MT4 support, its flagship Next Generation platform shines with granular charting, 12,000+ instruments (availability varies by entity), and advanced order types. CMC is regulated across multiple jurisdictions (e.g., UK, Australia, Singapore, Canada), holds client funds in segregated accounts, and adheres to strict money-handling rules under its local regulators. Traders in the Philippines typically onboard with an offshore entity, but still benefit from CMC’s risk controls, reliable pricing, and rich research suite (Morningstar equity data, in-platform news, client sentiment). Costs are spread-only on most FX products, with competitive minimums; equity/ETF CFDs use a commission model depending on region. The overall package targets active traders who value platform depth, stability, and reputable oversight. If you plan to trade multi-asset beyond FX (indices, shares, treasuries, commodities), CMC’s breadth is a differentiator. As always, verify which entity will host your account and the protections offered. |

| 28 | FOREX.com | FOREX.com (GAIN Capital, part of StoneX) offers robust execution, strong research, and a wide platform lineup: its own advanced web/desktop platform plus MT4/MT5. Algorithmic traders appreciate the depth of order types, integrated news, and market transparency pages. Pricing is available as spread-only or commission + raw spread for tighter quotes on major pairs. With global regulation across multiple entities, FOREX.com maintains segregated funds and clear disclosures on execution quality and costs. Filipino traders can access FX and a broad CFD lineup (indices, commodities, cryptos, availability varies). Education and market analysis are above average, and the mobile apps are polished. If you want a “big-brand,” research-heavy broker that still supports MT4/MT5 EAs, FOREX.com is a pragmatic pick. As always, confirm the servicing entity and leverage/compensation schemes before funding. |

| 29 | City Index | City Index (a StoneX brand) blends tight FX pricing with multi-asset reach and multiple platforms: MT4, its proprietary platform, and professional charting add-ons. It’s a long-standing UK broker (founded 1983) with strong regulation (FCA and others under its group), segregated client money, and institutional-grade infrastructure inherited from its parent. For active traders, the tech stack includes fast execution, smart order routing, and robust research tools. Product coverage spans FX, indices, equities, commodities, bonds, and options (availability varies by region). Costs on major FX pairs are competitive; shares/indices may carry commissions or spread-only depending on the market. Filipino clients typically trade via an international entity and should review the protections that apply. Overall, City Index is an all-rounder for traders wanting a seasoned, well-regulated brand with breadth and a professional feel. |

| 30 | Plus500 | Plus500 is a streamlined, “app-first” CFD broker built around its own platform with clean UX, instant funding options, and straightforward spread-only pricing. It’s designed for traders who value simplicity over platform customization; there’s no MT4/MT5, but in-platform charting and risk tools (including guaranteed stop orders where offered) are easy to use. Regulation spans several jurisdictions (including FCA/CySEC entities, among others), with clear fee pages listing spreads, overnight funding, and currency conversion costs. Filipino traders looking for a minimal learning curve may find Plus500’s interface appealing; more advanced algorithmic traders may prefer brokers offering MT4/MT5 or API access. Always review the costs on your chosen instruments (spreads can vary by asset and entity), and remember that GSLOs carry a premium if triggered. |

| 31 | eToro | eToro pioneered social and copy trading, letting you follow or copy other traders, while offering a broad list of CFDs and real stocks/ETFs (availability depends on entity). The platform emphasizes community features, curated portfolios (“Smart Portfolios”), and an intuitive mobile experience. It’s regulated across the UK (FCA), Cyprus (CySEC), Australia (ASIC), and other regions under group entities. For Filipino traders, the appeal is ease-of-use plus the ability to mirror experienced investors; the trade-off is fewer “pro” platform features than MT4/MT5-centric brokers, and variable spreads. eToro also publishes clear guidance on how your account is regulated and what protections apply. If you want a social trading experience with simple onboarding and education built in, eToro is a leading choice, just confirm products, fees, and your servicing entity before funding. |

| 32 | FXTM (Exinity) | FXTM combines competitive pricing with account flexibility (Advantage for commission + raw spreads, Advantage Plus for spread-only) on MT4/MT5. Under its various entities, FXTM is regulated in several jurisdictions and details commissions clearly, e.g., on Advantage accounts, FX commissions are per-lot or per-million with transparent tables. Filipino traders get a wide CFD menu (FX, metals, indices, commodities, crypto where available) plus extensive education and promotions from time to time. Execution is market-based, with negative balance protection depending on entity. FXTM balances beginner-friendly resources with pricing that can appeal to scalpers when configured via raw + commission. As always, check which FXTM/Exinity entity will host your account and applicable leverage/client-money protections in your region. |

| 33 | Octa (formerly OctaFX) | Octa focuses on simplified, low-cost trading with MetaTrader support and its own app, plus integrated social copy features. It’s aimed at traders who want fast setup, straightforward deposits/withdrawals, and competitive spreads without juggling multiple platforms. Research and education are concise and beginner-oriented. While Octa keeps messaging around “low spreads” and occasional zero-swap promos, always review the live costs on your instruments and the entity you’re opening with. For Filipino clients, Octa offers the core FX/CFD set (pairs, indices, commodities, select cryptos where available) with negative balance protection under the respective entity. Overall: a “keep it simple” broker, good for first-timers or side-account traders who primarily need MetaTrader and a friendly app. |

| 34 | RoboForex | RoboForex targets cost-conscious and copy-trade users with multiple platforms (MT4/MT5, R StocksTrader, cTrader) and diverse account types (including cent accounts). It is regulated in Belize (FSC/IFSC), and is a member of The Financial Commission, with segregated accounts and additional insurance indicated in its disclosures. RoboForex offers high leverage and frequent promotions, features that attract smaller-balance traders, but you should weigh that against the lighter investor-protection regime compared with top-tier regulators. Its platform variety and built-in copy ecosystem make it flexible if you want to experiment with strategies or signal providers. As with any offshore-regulated broker, carefully review risk statements, fees (including swaps and commissions), and the legal entity serving Philippine residents. |

| 35 | FXOpen | FXOpen built its brand on true-ECN connectivity, offering raw spreads and commissions with fast matching via MT4/MT5 and its own portals. The broker runs multiple entities (including those authorized by the FCA/ASIC/CySEC for certain regions as well as offshore registrations), so pricing and protections depend on where you onboard. Traders who value low-latency execution, tight spreads, and transparent ECN tickets will appreciate FXOpen’s model; minimum deposits for ECN are modest, and commissions per lot are clearly disclosed. For Filipino traders running EAs or scalping strategies, the ECN account is the draw. Education and research are functional, with the emphasis on trading conditions and stability. As always, verify the entity/terms, commission tables, and swap schedules on your chosen symbols. |

| 36 | HYCM | HYCM (est. 1977 under the Henyep group) combines long operating history with multi-jurisdiction regulation (FCA, CySEC, DFSA, CIMA). It offers MT4/MT5, a straightforward account lineup, and competitive spreads, especially on its raw-pricing tiers, plus negative balance protection per entity. Education and market updates are frequent, and funding options are broad. Filipino traders who value an older, well-known brand with conventional platforms may find HYCM a comfortable fit. The product range covers the usual CFDs (FX, indices, commodities, metals, some shares/crypto by entity). HYCM emphasizes transparent client-money handling and clear instrument specs. Before you fund, confirm which HYCM entity will service you, the leverage available, and any region-specific fees or restrictions. |

| 37 | ATFX | ATFX blends MT4/MT5 access with quality education (including Trading Central/Autochartist where available) and global regulation under multiple group entities (FCA, ASIC, CySEC, FSCA/FSC/FSA depending on the subsidiary). It targets both first-timers and intermediate traders with simple account types, raw-spread options, and periodic local promotions. In Southeast Asia, ATFX has built mindshare via awards and region-specific initiatives. Filipino clients can expect the standard FX/CFD lineup and multilingual support, with clear fee tables for spreads/commissions. If you want a broker that balances classroom-style education with respectable pricing on MT4/MT5, and occasional TradingView/web-trader integrations, ATFX is worth shortlisting. Always check your onboarding entity and protections. |

| 38 | ThinkMarkets | ThinkMarkets (TF Global) is a multi-regulated broker supporting MT4/MT5, its ThinkTrader app, and native TradingView connectivity. It caters to active traders with raw-spread + commission options and offers equities, indices, commodities, cryptos (by entity), and more. ThinkMarkets also invests in education and in-app analytics to shorten the learning curve. Filipino traders who favor modern mobile apps and TradingView order-routing will find setup simple; automation via MT4/MT5 remains available for desktop EAs. As always, verify which ThinkMarkets entity will service you (regulatory frameworks vary), the precise fee tier you’re on, and any region-specific leverage caps or protections. It’s a well-rounded choice if you want TradingView + MT5 under one roof. |

| 39 | Trade Nation | Trade Nation differentiates with fixed spreads on its TN Trader platform (also compatible with TradingView), creating predictable costs during volatile sessions. The broker highlights transparent pricing and global regulation across several authorities (e.g., FCA, ASIC, FSCA, FSA Seychelles, SCB Bahamas via group entities). For Filipino traders who scalp or trade news, fixed spreads can simplify risk budgeting, just confirm the specific fixed quote on your pair and trading hours. While MT4 support exists historically, the in-house platform is the focus, with clean UX and strong customer service. If you care more about “know-your-costs” than raw-ECN variability, Trade Nation is a compelling, simple alternative. |

| 40 | Swissquote | Swissquote is the banking-grade option: a listed Swiss group regulated by FINMA (and FCA via its UK arm), offering FX/CFDs alongside multi-asset investing (stocks/ETFs/funds, options & futures, crypto via its SQX venue). The draw for Filipino traders is institutional stability, platform breadth, and strong disclosures, ideal if you prefer a bank-backed counterparty over a pure CFD broker. Trading platforms include Advanced Trader, MT4/MT5 (varies by entity), and rich research. Costs are competitive rather than “ultra-low,” trading off a small premium for the brand’s reliability and product set. If you want one account to trade FX/CFDs and also invest longer-term in listed markets under a globally recognized financial group, Swissquote fits the brief, just confirm which Swissquote entity will serve you and its fee schedule. |

| 41 | Dukascopy | Dukascopy Bank SA (Geneva) is FINMA-regulated as a bank/securities firm and runs the ECN-style Swiss FX Marketplace. Its proprietary JForex platform offers advanced algos in Java, VPS-friendly deployment, and rich tick-level data, positioning Dukascopy for quant/EAs as well as discretionary traders who want institutional depth of book. Filipino clients typically onboard with the bank or group subsidiaries (Europe/Japan) subject to availability. Pricing is raw + commission with detailed tiering; execution quality and transparency are core to the brand’s value proposition. Beyond FX/CFDs, Dukascopy supports metals, crypto-CFDs (entity-dependent), and more. Choose Dukascopy if you value bank-grade oversight, ECN transparency, and a platform built for power users. |

| 42 | Skilling | Skilling is a Cyprus-born broker that emphasizes speed and simplicity with multiple platforms, its own web trader, cTrader, MT4, and integrations with TradingView on certain accounts. Regulation spans CySEC and additional entities (plus UK permissions in certain contexts), with negative balance protection and clear margin policies. For Filipino traders who favor cTrader’s depth of market and sleek UI, Skilling provides competitive spreads (raw + commission available) and easy account opening. Research is lighter than the biggest brands, but platform quality and pricing make it a good “execution-first” option. As ever, confirm which entity will serve you and the exact costs on your preferred symbols before you go live. |

| 43 | ActivTrades | ActivTrades is a London-headquartered broker regulated by the FCA (with EU entities too), offering MT4/MT5 and its in-house ActivTrader platform. It focuses on platform stability, risk controls (like negative balance protection under applicable entities), and steady customer support. Pricing is competitive on major FX pairs, with a mix of spread-only and commission models depending on product. For Filipino traders who want a conservative, long-standing UK brand with clean tech and solid disclosures, ActivTrades is a sensible middle ground between bank-grade and ultra-discount brokers. ActivTrader’s interface is beginner-friendly yet offers advanced order types and tools as you progress. |

| 44 | GO Markets | GO Markets is an Australia-origin broker with multi-entity regulation (e.g., ASIC, CySEC, FSC Mauritius, FSA Seychelles, SCA UAE via group companies). It supports MT4/MT5 and often adds cTrader/TradingView access depending on region, with competitive raw-spread accounts and low commissions. Filipino traders get the typical FX/CFD lineup and promotional education/webinars. GO Markets is a good fit if you want a familiar Australian brand with flexible platforms and aggressive ECN-style pricing. As always, check which entity will service you, since investor compensation and leverage caps differ by jurisdiction. |

| 45 | ACY Securities | ACY Securities (Australia) offers MT4/MT5 and its browser-based ACY Trading Platform, plus multi-asset CFDs with raw-spread pricing on pro tiers. Education and market analysis are frequent, and funding options are modern. For Filipino traders who want tight spreads on majors and quick mobile/web access, ACY’s stack is straightforward and EA-friendly. Regulation includes ASIC via group companies, with segregated funds per entity rules. As ever, confirm your onboarding entity and the exact commissions/swap costs on your chosen instruments. ACY positions itself as a cost-effective, platform-flexible alternative to the biggest AU brokers, especially if you plan to trade via MT5 or prefer a clean web terminal for day-to-day management. |

How to Get Started with a Forex Broker in the Philippines

Getting started with forex trading in the Philippines is much easier than it sounds. First, you'll want to choose a forex broker that fits your needs, whether you're just starting or have some experience. It's essential to find a broker that’s regulated, offers low trading fees, and gives you access to reliable trading platforms. Some brokers provide demo accounts, which is a great way to practice trading without any financial risk. Here’s how to get started step-by-step:

- Choose a Regulated Broker: Make sure your broker is well-regulated, offering security for your investments. Many of the best forex brokers are regulated by international authorities like the FCA or ASIC.

- Open a Forex Trading Account: You’ll need to provide personal details, proof of identity, and possibly your financial background. Many brokers in the Philippines allow low minimum deposits, so you can start small.

- Fund Your Account: Once your account is approved, you’ll need to deposit funds. Brokers often offer various methods such as bank transfers or e-wallets.

- Learn Trading Strategies: Before you begin, take the time to study different trading strategies and understand the risks of the forex market.

- Start Trading Forex: Stick to major currency pairs like EUR/USD initially, as they tend to have lower spreads and are easier for beginner traders.

Conclusion

Choosing the best forex broker in the Philippines for 2026 ultimately comes down to what you need as a trader. Whether you’re a beginner looking for a platform with low minimum deposits or an experienced trader seeking advanced tools, there’s a broker out there for you. We've covered some of the top brokers that offer great trading platforms, competitive fees, and excellent customer support. Take the time to compare their features, try demo accounts if possible, and find the one that fits your trading style and goals. Remember, it’s important to focus on key aspects like regulation, fees, and the type of forex trading platform offered to ensure a safe and smooth trading experience.

Also Read: The 5 Best Forex Brokers in Taiwan in 2026

FAQs

1. Is Forex Trading Legal in the Philippines in 2026?

Forex trading is legal for individual Filipinos using international brokers, but it's unregulated by local authorities like the Securities and Exchange Commission (SEC) or Bangko Sentral ng Pilipinas (BSP). The SEC views leveraged forex as high-risk and has issued advisories against unlicensed operations, prohibiting local brokerages. Trading personal funds via offshore platforms is permitted, but no local protection exists for disputes. For legitimacy checks, see Asia Forex Mentor's Is Forex Legit.

2. What Are the Main Regulatory Bodies for Forex in the Philippines?

- Securities and Exchange Commission (SEC): Oversees securities but prohibits margin trading and unlicensed forex firms; focuses on anti-fraud advisories.

- Bangko Sentral ng Pilipinas (BSP): Regulates FX transactions via banks for spot deals, not retail leveraged trading; enforces AML rules. No dedicated forex regulator exists, traders rely on international oversight (e.g., ASIC, FCA).

3. Do I Need a License to Trade Forex Personally in the Philippines?

No license is required for personal retail trading. However, operating a forex business, managing funds for others, or running a brokerage is illegal without SEC/BSP approval, facing fines up to PHP 5 million or imprisonment. Stick to self-directed accounts with international brokers. Beginner tips in Asia Forex Mentor's Forex Brokers for Beginners.

4. How Do I Start Forex Trading in the Philippines as a Beginner?

Steps:

- Learn Basics: Use free resources or courses on platforms/currency pairs.

- Select an International Broker: Choose one accepting PH clients (see Q. 9).

- Open Account: Submit ID (passport/UMID), proof of address (bill/utility), and complete KYC (1-3 days).

- Fund Account: Minimum PHP 5,000–10,000 via bank transfer/GCash (some brokers support e-wallets).

- Demo Practice: Test strategies for 1-3 months.

- Live Trade: Start small; leverage max 1:30 for safety.

Demo essential, explore Asia Forex Mentor's Demo to Live Trading.

5. What Documents Are Required to Open a Forex Account in the Philippines?

- Government-issued ID (passport, driver's license, or UMID).

- Proof of address (recent utility bill or bank statement).

- Proof of income/bank details for funding.

- Selfie with ID for verification.

Non-residents (e.g., OFWs) use similar docs; processing is digital.

6. What Are the Best Forex Trading Platforms in the Philippines?

- MetaTrader 4/5 (MT4/MT5): Free, customizable with EAs; supports PHP.

- cTrader: ECN-focused for pros.

- TradingView: Charting integrated with brokers.

Mobile apps vital for PH traders. Compare Asia Forex Mentor's Best Forex Trading Platform.

7. What Leverage and Margin Rules Apply in the Philippines?

No local caps, but international brokers limit to 1:30–1:500 for majors (e.g., EUR/USD). Margins: 0.2–3.3%. BSP monitors spot FX; high leverage risks total loss, use calculators. Details in Asia Forex Mentor's What Does Leverage Mean in Forex.

8. Are There Taxes on Forex Trading Profits in the Philippines?

Yes, forex profits are taxed as ordinary income at 0–35% progressive rates (e.g., PHP 250,001–400,000: 20%). Report via BIR Form 1701 annually; losses deductible against gains. No capital gains tax for forex, but VAT (12%) may apply to fees. Non-residents taxed only on PH-sourced income. Consult BIR; track via Asia Forex Mentor's Forex Profit Calculator.

9. What Are the Best Forex Brokers in the Philippines for 2026?

Top picks accepting PH clients (international regulation):

- IG: #1 overall; FCA/ASIC; low spreads (0.6 pips EUR/USD); MT4 integration.

- Pepperstone: ASIC; tight spreads (0.0 pips); cTrader/MT5; PHP deposits.

- IC Markets: ASIC/CySEC; ECN; 1:500 leverage; fast execution.

- XM: CySEC/FSC; beginner-friendly; bonuses; MT4/5.

- FP Markets: ASIC; raw spreads; unlimited demo.

No local SEC-regulated forex brokers. Full list at Asia Forex Mentor's Best Forex Brokers in the Philippines.

10. How Do I Choose a Reliable Forex Broker in the Philippines?

Prioritize:

- Tier-1 regulation (ASIC/FCA/CySEC).

- Low spreads/commissions (0.0–1.0 pips majors).

- PH-friendly funding (GCash/Bank transfer).

- Negative balance protection.

- 24/5 support (English/Tagalog).

Avoid unregulated, use Asia Forex Mentor's Lowest Spread Forex Broker.

11. What Forex Trading Hours Should I Follow in the Philippines?

PH (PHT, UTC+8) sessions:

- Sydney: 5:00 AM–2:00 PM.

- Tokyo: 8:00 AM–5:00 PM (active for USD/JPY).

- London: 3:00 PM–12:00 AM.

- New York: 8:00 PM–5:00 AM.

Overlap (London-NY: 8:00 PM–12:00 AM) for volatility. Adjust for holidays. Track with Asia Forex Mentor's Forex Trading and Seasonality.

12. Are There Forex Trading Courses or Education in the Philippines?

Yes: Online Trading Academy Manila, Forex Trading PH seminars (free webinars), or broker academies (XM, FBS). KHDA-accredited options scarce; focus on global e-courses. Enrich with Asia Forex Mentor's Best Forex Trading Courses.

13. Is Forex Trading Halal in the Philippines?

Yes, via swap-free Islamic accounts (no overnight interest). Brokers like XM/IC Markets offer them. Consult a scholar for Sharia compliance. Guide: Asia Forex Mentor's Is Forex Trading Halal or Haram.

14. What Are Common Forex Trading Strategies for Philippine Traders?

- Scalping: Quick trades on majors during Tokyo/London.

- Swing Trading: Hold 2–5 days; suits OFW schedules.

- News Trading: PHP/USD on BSP announcements.

Strategies: Asia Forex Mentor's Best Forex Strategy for Consistent Profits.

15. How Can I Fund and Withdraw from Forex Accounts in the Philippines?

Via GCash, bank transfer (BPI/UnionBank), cards, or e-wallets (Skrill). Min: PHP 100–5,000; fees 0–2%; withdrawals 1–5 days. BSP monitors large transfers. Calculator: Asia Forex Mentor's Forex Profit Calculator.

16. What Risks Are Involved in Forex Trading in the Philippines?

- Unregulated brokers/scams.

- PHP volatility (inflation/remittances).

- Leverage losses (up to 89% retail accounts lose).

- No local recourse.

Mitigate: Asia Forex Mentor's Risk Management in Forex Trading.

17. How Prevalent Are Forex Scams in the Philippines, and How to Avoid Them?

High, SEC reports PHP 1B+ annual losses to fake seminars/apps promising “guaranteed” returns. Avoid: Unregulated brokers, MLM schemes, unsolicited FB/IG offers. Verify via SEC blacklist; use tier-1 regulated firms. Report to SEC/eCrime portal. Warnings: Asia Forex Mentor's Forex Trading Scams Exposed (adapt from general scam resources).

18. Can Expats or Non-Residents Trade Forex in the Philippines?

Yes, OFWs/non-residents use international brokers; no residency needed. Tax on PH-sourced income only for non-residents. Visa/trade: Asia Forex Mentor's Forex Trading for Retirement.

19. What Is the Role of the PHP in Forex Trading in the Philippines?

PHP (pegged loosely to USD) volatile due to remittances (10% GDP). Trade USD/PHP or majors; BSP intervenes for stability. Pairs: Asia Forex Mentor's Understanding Currency Pairs.

20. How Does the Philippine Economy Impact Forex Trading?

Remittances (USD 37B/year) stabilize PHP but inflation (4-6%) adds volatility. BSP rate hikes boost USD/PHP trades. Insights: Asia Forex Mentor's Forex vs Stocks.

21. What Mobile Apps Are Best for Forex Trading in the Philippines?

MT4/MT5 apps, TradingView, or broker-specific (XM App). GCash integration key. Apps: Asia Forex Mentor's Best Forex Mobile Apps 2025.

22. How to Backtest Forex Strategies in the Philippines?

MT5 Strategy Tester or TradingView replay. Free data from brokers; test 100+ trades. Tutorial: Asia Forex Mentor's Backtesting Trading Strategies.

23. What Community or Events for Forex Traders in the Philippines?

Manila Forex Expos, Reddit (r/phinvest), or Forex Trading PH webinars. BSP seminars on FX risks.

24. Can I Trade Forex on a Tourist Visa in the Philippines?

Yes, via international brokers; no local residency required. Tourists use VPN if needed. Start: Asia Forex Mentor's How to Start Trading Forex.

25. What Future Trends for Forex in the Philippines (2026+)?

BSP exploring digital peso; rise in AI/copy trading. SEC may tighten advisories amid scam surge. Trends: Asia Forex Mentor's The Role of AI in Forex Trading.

26. How to Recover from Forex Losses in the Philippines?

Journal trades, refine strategy, seek free counseling (BSP). Dispute via broker's regulator (e.g., FCA). Recovery: Asia Forex Mentor's Trading Journal.

27. Is Automated Forex Trading Allowed in the Philippines?

Yes, EAs on MT4/5 permitted; no local restrictions. Ensure broker supports. Automation: Asia Forex Mentor's Automated Forex Trading.

28. What Forex Pairs Are Most Popular in the Philippines?

Majors: EUR/USD, USD/JPY. USD/PHP for locals; AUD/USD (trade ties). Pairs: Asia Forex Mentor's Best Forex Pairs to Trade.

29. How to Set Up a Forex Trading Business in the Philippines?

Illegal without SEC/BSP license (rarely granted). Focus on education/signal services. Business: Asia Forex Mentor's Best PAMM Account Brokers.