Finding the best Forex brokers in the UAE is essential for traders looking to succeed in the fast-growing forex market in the region. With the rising popularity of forex and CFD trading, having a broker that provides competitive trading costs, secure platforms, and strong regulatory oversight from the Securities and Commodities Authority or the Dubai Financial Services Authority is critical. The forex trading platforms in our list of top brokers for 2025 offer a range of tools, from user-friendly interfaces for beginners to advanced analytics for seasoned traders, ensuring everyone can find the right fit for their trading journey.

The best forex brokers in the United Arab Emirates offer features such as Islamic accounts, low fees, and a variety of trading platforms like MetaTrader 4 and MetaTrader 5. These brokers provide access to forex and CFD trading with strong customer support and local banking options, making them ideal for UAE-based traders. Whether you're a beginner or an expert, choosing a regulated broker ensures your funds are safe and that you’re trading with a trusted partner in the forex market.

Why Regulation is Key When Choosing a Forex Broker in the UAE

When trading Forex in the United Arab Emirates, choosing a regulated broker is critical for ensuring your funds are protected and the broker operates fairly. Regulatory bodies like the Dubai Financial Services Authority (DFSA), Abu Dhabi Global Market (ADGM), and the Securities and Commodities Authority (SCA) oversee the Forex and CFD trading markets in the UAE. These organizations enforce strict standards on brokers, ensuring they operate transparently and protect traders’ interests.

Overview of DFSA, ADGM, and SCA Regulatory Bodies

- DFSA (Dubai Financial Services Authority): Regulates brokers within the Dubai International Financial Centre (DIFC), enforcing high standards of transparency and protecting client funds.

- ADGM (Abu Dhabi Global Market): A financial hub in Abu Dhabi with its own regulatory body, ensuring strict compliance with international best practices.

- SCA (Securities and Commodities Authority): The main regulator overseeing Forex brokers across the UAE, ensuring brokers adhere to local laws and regulations to protect traders.

Importance of Choosing a Regulated Broker for Fund Protection

Choosing a regulated broker ensures your money is kept safe in segregated accounts, meaning your funds are separate from the broker’s operational money. This protects your deposits in case the broker runs into financial difficulties. Additionally, regulated brokers must comply with anti-money laundering (AML) and know-your-customer (KYC) protocols, adding further security to your trading experience.

What to Check in a Broker’s Regulatory Status

When selecting a forex broker, always verify their licensing by checking their registration with either DFSA, SCA, or ADGM. Ensure they follow client fund protection practices, maintain capital reserves, and offer transparent trading conditions. Brokers should publicly display their licenses, and you can confirm their status by contacting the regulatory bodies directly.

The 5 Best Forex Brokers in UAE

#1. AvaTrade: Best Overall for Traders in UAE

What is AvaTrade?

AvaTrade is a globally recognized Forex and CFD broker offering a wide range of trading instruments, including Forex, stocks, commodities, and cryptocurrencies. Regulated by multiple top-tier authorities like the Dubai Financial Services Authority (DFSA), ASIC, and the Central Bank of Ireland, AvaTrade ensures a secure trading environment for traders in the UAE. The broker provides access to popular platforms like MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO mobile app, making it a versatile choice for both beginners and experienced traders. With additional features such as Islamic accounts and social trading tools like ZuluTrade, AvaTrade is a popular choice for traders seeking flexibility and Sharia-compliant options.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

AvaTrade offers commission-free trading, with profits made through competitive spreads. For major pairs like EUR/USD, the spreads start at 0.9 pips, which is fairly standard in the industry. The broker also does not charge fees for deposits or withdrawals, and the Islamic accounts have no swap fees, making it ideal for Sharia-compliant trading. However, there is an inactivity fee for accounts that remain dormant for a period of time. Overall, AvaTrade provides transparent fee structures that cater to a wide range of traders in the UAE.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Plus500

What is Plus500?

Plus500 is a leading Contracts for Difference (CFDs) trading platform, offering access to a wide range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. The platform is recognized for its user-friendly interface, real-time market data, and advanced charting tools, catering to both novice and experienced traders. Operating under multiple regulatory frameworks globally, Plus500 ensures compliance with international standards, providing traders in the UAE with a secure and reliable trading environment. Its commitment to transparent pricing, competitive spreads, and robust risk management features makes Plus500 a preferred choice among traders in the UAE.

Advantages and Disadvantages of Plus500

Plus500 Commissions and Fees

Plus500 operates on a commission-free model, primarily generating revenue through the bid/ask spread. Traders should be mindful of certain fees that may apply, such as the overnight funding fee, which is either added to or subtracted from your account when holding a position after a specified time. Additionally, a currency conversion fee of up to 0.7% is applied to trades on instruments denominated in a currency different from your account's base currency. Notably, Plus500 does not charge for deposits or withdrawals, and there are no fees for inactive accounts. This transparent fee structure enhances Plus500's appeal as a cost-effective trading platform for traders in the UAE.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

OPEN A DEMO ACCOUNT ON PLUS500

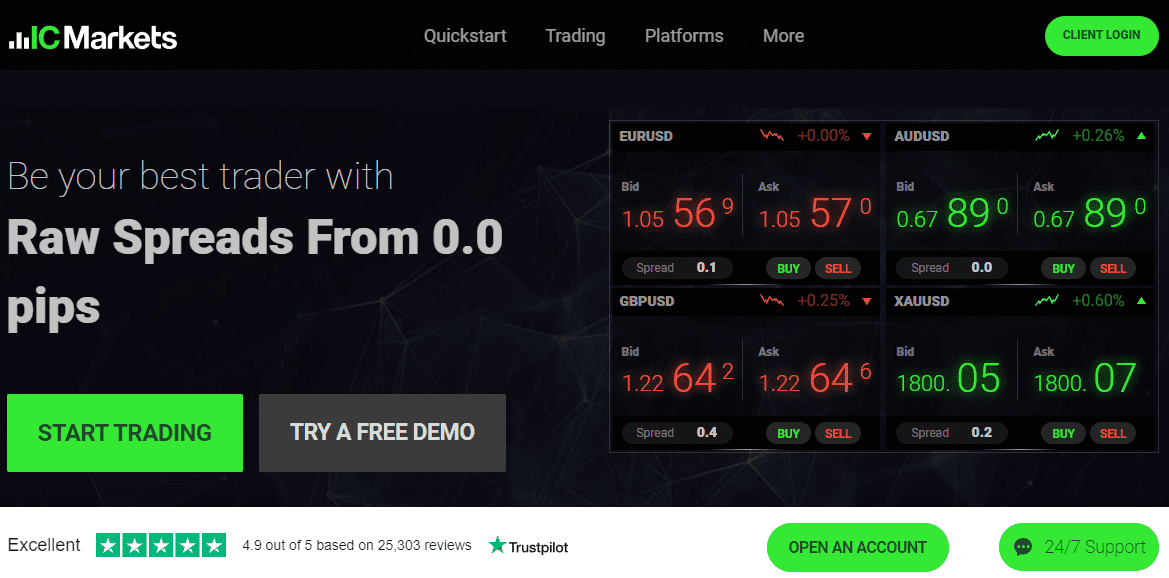

#3. IC Markets

What is IC Markets?

IC Markets is a highly regarded Forex and CFD broker known for its tight spreads, fast execution speeds, and reliable trading platforms. It is regulated by top-tier authorities like the Dubai Financial Services Authority (DFSA), ASIC, and CySEC, ensuring a secure and transparent trading environment for traders in the UAE. IC Markets offers access to a wide range of financial instruments, including Forex, commodities, indices, and cryptocurrencies, with popular platforms like MetaTrader 4, MetaTrader 5, and cTrader. Its reputation for low trading costs and Islamic accounts makes it a top choice for both beginners and experienced traders in the UAE.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets is known for its low spreads, especially on its Raw Spread accounts, where spreads start from 0.0 pips with a commission of $3.50 per lot per side. The Standard accounts offer commission-free trading, with spreads starting from 1.0 pips. There are no deposit or withdrawal fees, making it affordable for traders. Islamic accounts are also available, which allow traders to avoid overnight swap fees, adhering to Sharia law. This transparent and competitive fee structure makes IC Markets a favored broker in the UAE.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#4. Exness

What is Exness?

Exness is a globally recognized Forex and CFD broker, well-known for its low spreads, fast execution speeds, and user-friendly trading platforms. Founded in 2008, it is regulated by several top-tier authorities, including CySEC, FCA, and FSCA, ensuring high levels of security and transparency. Exness offers access to a wide range of markets, including forex pairs, metals, cryptocurrencies, and stocks, through popular platforms like MetaTrader 4 and MetaTrader 5. With its commitment to instant withdrawals and its offering of Islamic accounts for Sharia-compliant trading, Exness stands out as one of the best brokers for traders in the UAE.

Advantages and Disadvantages of Exness

Exness Fees and Commissions

Exness offers a variety of account types with different pricing structures. For example, the Standard and Standard Cent accounts have no commission fees and feature spreads starting from 0.3 pips. More experienced traders may prefer the Raw Spread or Zero accounts, which offer spreads starting from 0 pips but charge a commission of up to $3.5 per lot. The Pro account offers floating spreads from 0.1 pips with no commissions, making it suitable for those who want more comprehensive trading features.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

#5. XM

What is XM?

XM is a global online brokerage platform that offers forex and CFD trading across 1,400+ instruments, including currency pairs, precious metals, commodities, stocks, and indices. It supports both the MetaTrader 4 and MetaTrader 5 platforms, provides a low minimum deposit, and offers high trading flexibility with leverage up to 1:1000 (where allowed). From a regulatory standpoint, XM is multi-regulated, including oversight by the Dubai Financial Services Authority (DFSA) under reference number F003484 for its UAE-serving entity. Thanks to its strong regulatory credentials, combined with competitive trading conditions and account types tailored to traders in the UAE, XM stands out as one of the best brokers for Dubai-based traders.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM offers a transparent and straightforward fee structure: its Micro and Standard accounts are completely commission-free, with trading costs built into the spreads, which start from around 1.6 pips on major currency pairs. For traders opting for the “Zero” account type (designed for tighter spreads), a small commission is charged (typically around US,$3.50 per standard lot per side) in exchange for spreads from as low as 0.0 pips. Additionally, XM applies an inactivity fee (e.g., approximately US,$5 per month) after 90 days of no trading or deposits/withdrawals.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

| Rank | Broker | Description |

| 6 | IUX | IUX is rapidly growing among UAE traders due to its very low minimum deposit ($10), competitive spreads, and exceptionally high leverage offering (up to 1:3000). The broker is multi-regulated, including the FSC in Mauritius, and offers popular trading platforms such as MetaTrader 5 and IUX WebTrader. IUX provides swap-free Islamic account options, supporting compliance with Sharia law for local investors. The broker’s excellent customer support is available in multiple languages and their onboarding process is simple, for both live and demo accounts. Traders can access a wide selection of forex pairs alongside indices and commodities. With strong platform reliability, quality risk-management tools, and a flexible fee structure, IUX is recommended for UAE clients prioritizing affordability, fast execution, and leverage flexibility. |

| 7 | Deriv | Deriv is a globally trusted broker with over 25 years of experience and a growing regional presence in the UAE. It offers diverse CFD trading options, including forex, commodities, indices, ETFs, and crypto, on several platforms including MetaTrader 5, Deriv’s web DTrader, and its mobile app. Traders here benefit from tight spreads (starting at 0.5 pips), leverage up to 1:500, and a minimum deposit as low as 40 AED (approx. $10). UAE clients especially value Deriv’s 24/7 multilingual customer support (including Arabic), swap-free Islamic account types, and strong educational resources. The broker’s local approach includes features for risk management and easy onboarding, making it a strong fit for a wide spectrum of UAE traders from beginner to expert. |

| 8 | FP Markets | FP Markets is recognized for ultra-competitive trading costs, reliable execution, and broad market access in the UAE. It’s regulated by ASIC, CySEC, and FSA and offers MetaTrader 4, MetaTrader 5, and IRESS, suiting both beginners and pros. Minimum deposit is $100, and Islamic accounts are available. FP Markets supports 9,000+ trading instruments (forex pairs, indices, commodities, equities). Its strengths include award-winning customer service, robust educational tools, and a research-driven trading experience, making FP Markets highly popular with day traders, scalpers, and investors seeking diversity and value in the UAE. |

| 9 | Pepperstone | Pepperstone is widely regarded for competitive spreads (from 0.0 pips on Razor accounts), top-tier regulation (DFSA, ASIC, FCA), and trading platform variety (MetaTrader 4/5, cTrader). Minimum deposit starts at $0, which is ideal for accessibility. Islamic accounts are offered for Sharia compliance and customer support is especially efficient and praised in the region. Pepperstone’s suite of advanced trading tools, fast onboarding, and strong global reputation make it an industry leader for UAE-based traders wanting secure, low-cost, and tech-friendly forex trading. |

| 10 | AvaTrade | AvaTrade stands out for its tight regulatory control (DFSA, CBI, ASIC, FSCA), versatile trading platforms (MT4/5, AvaTradeGO), and accessible $100 minimum deposit. AvaTrade offers both commission-free trades and competitive spreads (from 0.9 pips for major pairs). Islamic (swap-free) accounts and extensive educational resources have built a broad UAE client base. Moreover, AvaTrade maintains strict fund safety (segregated accounts) and provides multilingual support. The broker is recommended for transparency, regional regulatory compliance, platform choice, and beginner-friendly features. |

How to Get Started with a Forex Broker in UAE

Getting started with a forex broker in the UAE is simpler than it seems. With the right steps, you can begin trading efficiently and securely. Here’s a step-by-step guide to help you start.

Step 1: Choose a Reputable Broker

The first and most crucial step is to select a regulated broker. In the UAE, look for brokers regulated by authorities like the Securities and Commodities Authority (SCA), Dubai Financial Services Authority (DFSA), or Abu Dhabi Global Market (ADGM). This ensures that your broker follows local laws and keeps your funds safe.

Step 2: Open a Trading Account

Once you've chosen a broker, you’ll need to open a trading account. Most brokers offer several types of accounts, including Islamic accounts for Sharia-compliant trading. You will need to provide some identification documents and proof of address to complete the process.

Step 3: Fund Your Account

After your account is set up, the next step is to deposit funds. Many brokers in the UAE offer local payment methods such as bank transfers and allow deposits in AED. Make sure the broker provides secure and transparent payment options.

Step 4: Start Trading on a Demo Account

Before committing real money, it's a good idea to practice with a demo account. This allows you to trade with virtual funds and get familiar with the broker's trading platform without risking your own money.

Step 5: Develop a Trading Plan

Once you’re ready to start live trading, create a trading plan. Set goals, define your risk tolerance, and stick to your strategy to avoid emotional decisions during trades. Having a solid plan is key to long-term success in forex trading.

Conclusion

In conclusion, finding the best Forex brokers in the UAE comes down to understanding your needs as a trader. Whether you're looking for low spreads, advanced trading platforms, or Islamic accounts, the brokers we've listed offer great options. Brokers like Pepperstone, AvaTrade, and IC Markets stand out for their strong regulation under authorities like DFSA, competitive fees, and excellent customer support. Remember, choosing a regulated broker is key to ensuring your funds are safe and you have the best tools for trading success. Now, you're ready to take the next step and start trading with confidence in 2025!

Also Read: The 5 Best Forex Brokers in Indonesia in 2025

FAQs

Legality, regulation & safety

1) Is forex trading legal in the UAE? Yes, forex trading is legal. Brokers serving UAE residents should be regulated by credible authorities (e.g., local regulators like DFSA/SCA via on-shore entities, or top-tier global regulators). New traders can start with a primer on how FX works here: What Is Forex Trading and How Does It Work?

2) Which regulators matter for UAE traders? Look for DFSA/SCA-regulated brands when available, and otherwise favor brokers under strong oversight (e.g., FCA/NFA/ASIC). Learn how regulation impacts your protections: Is Forex Legit? and NFA-Regulated Forex Brokers.

3) How do I verify a broker’s legitimacy? Confirm the license on the regulator’s register, check client fund segregation, and read independent reviews. Use these guides to spot red flags: Exposing Broker Scams (examples) • Beware: BFSForex • Whitecrow Market Risks.

4) Are offshore brokers safe for UAE clients? Some are, some aren’t. Prioritize strong regulation, transparent fees, and clean withdrawal history. Read: Best Offshore Forex Brokers and Picking the Right Forex Broker for You.

5) How do I avoid forex scams targeting the UAE? Beware guaranteed returns, pressure to deposit, and withdrawal obstacles. Cross-check with our scam library (e.g., RIF Capital, Monstrade, MaxTradePlus).

Accounts, platforms & tools

6) What trading platforms are popular in Dubai/UAE? MT4/MT5, cTrader, TradingView integrations, and proprietary platforms are common. Compare options here: Best Trading Platforms in Dubai and Best cTrader Brokers.

7) What’s the difference between ECN, STP, and market makers? ECN/STP route orders to liquidity providers; market makers internalize flow. Execution model affects spreads, commissions, and slippage. See: ECN Forex Brokers and Market Making.

8) Can UAE residents open swap-free (Islamic) accounts? Yes, most major brokers provide swap-free/Islamic accounts on request. For context on faith-compliant trading, read: Is Forex Trading Halal or Haram?.

9) What minimum deposit do UAE brokers require? It varies widely (from ~$50 to $500+), depending on account type and platform. Before funding, review risk basics: Risk Management in Forex.

10) Which brokers integrate with TradingView? A growing number allow TradingView order routing or charting. Explore pros/cons: Best TradingView Brokers.

11) Do UAE brokers offer demo accounts? Yes, most do. Use demos to test spreads, execution, and platforms risk-free. Start with: Forex Trading for Beginners.

Costs, execution & funding

12) What costs should I compare (spreads, commissions, swaps)? Tight spreads plus transparent commissions usually beat “zero-commission” with wide spreads. Understand pricing: What Does Spread Mean in Forex? and Buy Limit vs. Buy Stop (order costs context).

13) How important is execution speed and slippage? Very, especially for scalpers and news traders. Learn why slippage occurs and how to mitigate it: Slippage Trading.

14) What funding/withdrawal methods do UAE brokers support? Cards, bank wires, and e-wallets are common. Prioritize brokers with same-day processing and zero hidden fees. If a brand stalls withdrawals, treat it as a red flag (see our scam case studies above).

15) Are “commission-free” UAE accounts really cheaper? Not always, spreads may be wider. Compare all-in cost per trade using a live or demo account and this guide: Bid-Ask Spreads.

Leverage, risk & trade management

16) What leverage is typical for UAE retail clients? It depends on the broker and jurisdiction. Keep leverage modest and focus on position sizing: Position Sizing • Risk-Reward Ratio.

17) Do UAE brokers offer negative balance protection? Many do, but check the specific client agreement. Strengthen your own safeguards with: Stop-Loss vs. Trailing Stops.

18) How should beginners in the UAE manage risk? Risk 0.5–1% per trade, use hard stops, and avoid over-leveraging. Build your plan: Trading Plan and Risk Tolerance.

19) What’s the best account type for scalping? Usually ECN/Raw accounts with tight spreads and a per-lot commission. Compare scalper-friendly setups: Best Forex Brokers for Scalping.

20) Can I copy trade in the UAE? Yes, many brokers offer copy or social trading. Understand the pros/cons first: Copy Trading and tools like Social Trader Tools.

Instruments & strategies

21) Which pairs are most popular among UAE traders? Majors (EUR/USD, GBP/USD, USD/JPY), gold (XAU/USD), and oil-sensitive pairs. Learn volatility and pair behavior: Most Volatile Forex Pairs.

22) Do UAE brokers offer crypto, indices, gold, and oil? Most multi-asset brokers do. See instrument primers: Gold vs. Oil and Indices.

23) What analysis style suits UAE traders best (price action vs indicators)? Both can work, many use a blend. Explore: Price Action Trading and indicator guides like Bollinger Bands Strategy.

24) Is news trading viable in Gulf time zones? Yes, many key releases align with UAE afternoons/evenings. Start with the basics: Trading Economic News.

25) Are EAs/algos allowed? Generally yes, depending on broker/platform. Read: Algorithmic Trading Strategies and Trading Robots.

Education & resources

26) Where should UAE beginners start? Follow a structured path: Forex School, then build a routine with Daily Trading Routines.

27) How do I read charts and candlesticks? Master candlesticks first, then patterns. Start here: How to Read Candlesticks and Japanese Candlestick Basics.

28) What’s a realistic path to consistency? Journal every trade, refine a single edge, and control risk. Use: Trading Journal and Best Forex Strategy for Consistent Profits.

29) Do prop firms accept UAE residents? Many do (subject to compliance). Research firm rules and risk first: FTMO Review • Topstep Review • The Funded Trader Review.

30) Where can I learn risk, psychology, and routines tailored to FX? These pillars apply anywhere, including the UAE: Risk Management, Forex Trading Psychology, and How to Develop a Winning Trading Routine.

Practical UAE considerations

31) Which payment currencies are best for UAE clients? AED support is convenient, but USD/EUR accounts can offer better liquidity/pricing. Manage conversion costs and spreads: Bid-Ask Spreads.

32) Are bonuses common for UAE traders? Some offshore brokers advertise bonuses; read T&Cs carefully (turnover requirements, withdrawal limits). If it sounds too good to be true, review our scam alerts (see section above).

33) Do UAE brokers provide Arabic support and local service? Many do, check support hours, language coverage, and local numbers. Platform comfort matters: compare here: Best Trading Platforms in Dubai.

34) Are binary options the same as forex? No, binary options are different products with different risks. If you’re researching them specifically, see: Best Binary Brokers in UAE.

35) Should UAE traders prioritize brokers with regional presence? It helps for support, funding, and compliance clarity. But global, well-regulated brokers with strong history can also be excellent, evaluate case by case using this checklist: Picking the Right Broker.

Advanced topics

36) What’s the benefit of a raw/ECN account vs. standard? Raw accounts pair very tight spreads with a per-lot commission, often best for high-volume or scalpers. Dive deeper: ECN Forex Brokers.

37) How can UAE traders structure a diversified FX portfolio? Blend uncorrelated pairs, limit exposure to USD cycles, and size positions by volatility. Use tools like: Position Sizing and Volatility Indicators.

38) What’s the role of sentiment data for FX in the UAE? Retail sentiment can be a contrarian signal. Learn to read it: FX Sentiment Analysis.

39) How do I handle slippage during Gulf trading hours? Use limit orders where appropriate, avoid illiquid times, and test broker execution on a demo: Slippage Trading.

40) What risk metrics should I track? Max drawdown, win rate, R-multiple, and expectancy. Build the framework: Trading Plan and Strategy Tester.