Finding a quality forex trading course in the Netherlands can speed up your learning, sharpen risk control, and help you avoid costly errors. See the Best Forex Trading Courses in the Netherlands and where Dutch traders build skills fast with real-world frameworks.

Ready to master forex trading? Request a demo or join our One Core Program today!

Why forex courses matter for traders in the Netherlands

A structured Forex Trading Course shortens the learning curve. You learn position sizing, trade planning, market structure, and how to read risk and reward. Global FX turnover reached about $7.5 trillion per day in April 2022, so liquidity is deep and fast; without a plan, mistakes compound quickly .

What a strong course includes • A clear framework from analysis to execution • Risk management with tested rules, not guesswork • Live or recorded examples across assets (majors, crosses, gold, indices) • Backtesting and journaling steps you can repeat • Support community or mentor access

Dutch context matters. ESMA rules cap retail leverage at 30:1 on major pairs, 20:1 on most others, and require negative balance protection . Good training shows how to size trades within these limits and still aim for healthy risk-adjusted returns.

What makes a good forex course: skills and benefits

Skills you should walk away with

- Market structure and price action that works across FX, indices, and commodities

- A single trade plan template you can reuse

- Risk controls: position sizing, R-multiples, and daily loss limits

- Macro and news awareness that fits Dutch-European hours

Benefits for Netherlands-based traders

- Practical tactics for EU trading sessions

- Clear leverage use under ESMA and AFM product intervention for CFDs

- Measurable progress via a journal and backtests

For context, the Dutch Authority for the Financial Markets (AFM) has continued CFD product intervention, aligning with EU standards to protect retail traders. A program that teaches responsible sizing and margin close-out rules helps you trade safely inside the Dutch framework.

Top 10 Forex Trading Courses and Formations in Netherlands

1) Asia Forex Mentor – Best Forex Trading Courses and Formations In Netherlands

🌍 Welcome to Asia Forex Mentor – Where Real Traders Are Made

Asia Forex Mentor (AFM) is the ultimate destination for anyone serious about mastering the art of trading Forex, Stocks, Commodities, Crypto, and beyond. Rated the #1 Forex Trading Course in Asia by Investopedia, Benzinga, and other major publications, our proven training system has helped transform complete beginners into 6-figure full-time traders and even fund managers.

If you’re looking for a real trading mentor who walks the talk, executes trades worth six figures, and trains institutional bank traders and retail students alike, you’re in the right place.

Learn the AFM Proprietary System

We don’t just teach theory, we teach results. The AFM One Core Program is built on a proprietary, math-backed, ROI-driven trading strategy that works across all financial markets. Whether you're trading Forex, Crypto, Stocks, Indexes, Commodities, or even Mutual Funds, if it has a chart, our system applies.

“Ezekiel Chew’s scientific approach to the markets is unmatched. His strategy delivers real profits, not just predictions.”

Raymond Wong, Newbie Turned Full-Time Trader

Who Is Behind AFM?

Ezekiel Chew, the founder of Asia Forex Mentor, is a professional trader widely recognized for his ability to generate six figures per trade and his influence at global trading expos and financial institutions.

He’s trained:

- Traders from DBP – the 2nd largest bank in the Philippines with over $13B in assets

- Proprietary trading firms and investment houses

- Thousands of retail traders across Singapore, India, UK, USA, Japan, Netherlands, and more

His method has turned $24,000 into $300,000 in a month, and his live trades have made over $100,000 in a single day all using the same principles he teaches inside his flagship program.

Why Thousands Trust AFM:

- Mathematics-backed price action system with a focus on ROI

- Proven record of transforming beginners into profitable full-time traders

- Weekly live trading sessions with Ezekiel Chew himself

- Not just strategies we teach the thinking behind the trades

- Thousands of ★★★★★ student reviews worldwide

- 20+ years of real-world market experience

- Corporate training provider for major banks and financial firms

What You’ll Learn

Inside the AFM One Core Program, you’ll master:

- How to analyze any chart in minutes

- High-probability trading setups with precise entry and exit

- Risk management that protects capital while growing it fast

- Techniques to trade any vehicle (forex, stocks, crypto, etc.)

- The AFM mindset: Think like a pro, trade like a fund

Plus, weekly live sessions to watch how Ezekiel plans, executes, and reviews real trades in real markets.

Your Free Gift: 5-Part Trading Masterclass

Before joining the One Core Program, get free access to Ezekiel’s exclusive 5-Part Training Series an in-depth look at how top traders make consistent, life-changing profits.

🔥 It’s 100% FREE, no strings attached.

📥 Claim it now before the offer expires.

Real Success Stories

- Amardeep made $70,000 within 12 months of joining the program

- Casey saw a 30% account growth in just 40 days

- Sam Manning became a full-time trader after starting with zero experience

“The best investment I've made. AFM gave me the confidence and clarity to trade full-time.”

Verified Student Review

🥇 Awards & Recognition

- 🏆 Best Forex Trading Course – Investopedia

- 🏆 Best Comprehensive Trading Course – Benzinga

- 🏆 Best Trading Education Provider in Singapore

CLICK HERE TO GET THE AFM PROPRIETARY ONE CORE PROGRAM!

What to Do Next:

STEP 1: Download the FREE 5-Part Trading Masterclass. Learn the exact system that turned thousands of students into profitable traders.

STEP 2: When you’re ready, enroll in the AFM One Core Program, the most advanced, comprehensive trading education available today.

You’re Not Just Learning… You’re Investing in a Life-Changing Skill

Trading isn’t a hobby. It’s a high-income, recession-proof skill that can change your life forever, whether you want more freedom, wealth, or simply control over your financial future.

At Asia Forex Mentor, we make this transformation possible.

Services

Resources:

– Forex Position Size Calculator

– Forex Brokers Review & Rating

💡 The earlier you start, the faster you master the game.

📞 Let’s Talk

Got questions? Need a personal recommendation?

Reach us anytime at:

📍 Address: 6 Raffles Boulevard, #03-308, Singapore 039594

📱 WhatsApp: +65 8786 8319

🌐 AsiaForexMentor.com

2) Forex Trading Training Course in Amsterdam – The Knowledge Academy

Amsterdam sessions focus on strategy basics, chart reading, risk management, and trading psychology for beginners and improvers. The program typically blends lectures and practical exercises, with attention to order types, stop placement, and position sizing suited to ESMA limits.

Pros • Classroom dates in Amsterdam • Covers risk rules and trade planning • Suitable for new traders

Possible cons • Short duration; follow-up practice needed

3) Forex Training Course – Netherlands

A Netherlands delivery that explains spot, forwards, and swaps, plus how the interbank market functions. Attendees learn common FX instruments, pricing drivers, and how to build a simple trade checklist.

Pros • Useful for those who want market structure (spot/forwards/swaps) • Introduces institutional terminology • Helps bridge theory to retail platforms

Possible cons • Heavier on theory; pairing with practice helps

4) Trading: Expert Forex, Crypto & Stocks – The Institute of Trading

Amsterdam-based training with focus on multi-asset trading process and risk control. Good for learners who want a broad view (FX plus crypto/equities) and a rules-based approach to journaling and review.

Pros • Amsterdam location • Multi-asset mindset with FX core • Risk management emphasis

Possible cons • Specific FX depth varies by cohort

5) Training Financial Markets Professional (FiMa) – TLM Academy

A post-graduate style formation aimed at professionals. While broader than FX, it frames currencies within macro, rates, and derivatives. Useful if you want a career-oriented badge and a strong theoretical base that complements active trading.

Pros • Dutch academic context • Macro-rates-FX integration • Alumni network and credibility

Possible cons • Time commitment is higher

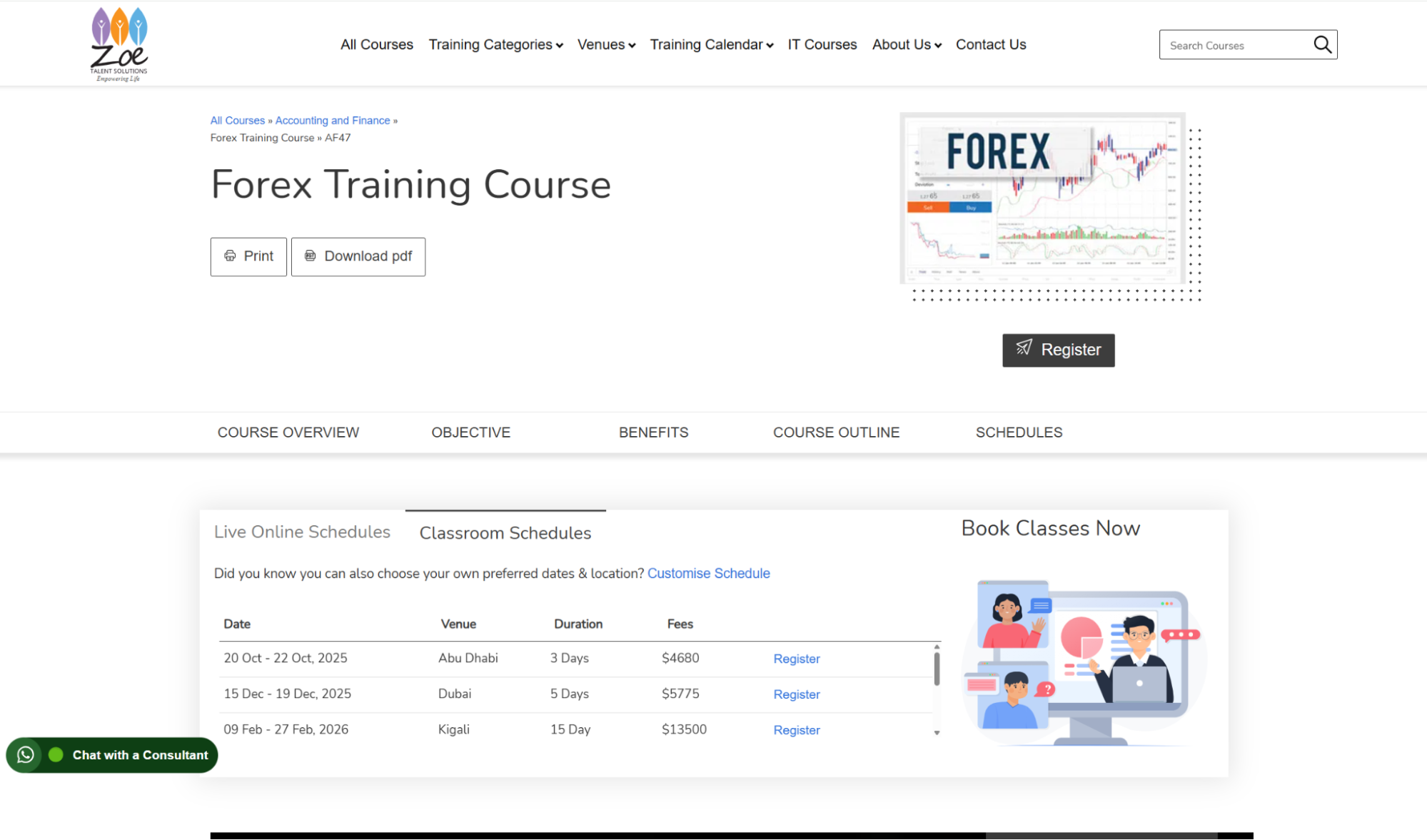

6) Forex Certification Course – ZOE Talent Solutions

Corporate-style workshops often scheduled in Amsterdam, walking through FX fundamentals, chart analysis, and risk management.

Pros • Instructor-led, practical sessions • Walkthroughs of entries/exits • Suitable for teams or individuals

Possible cons • Schedules depend on demand

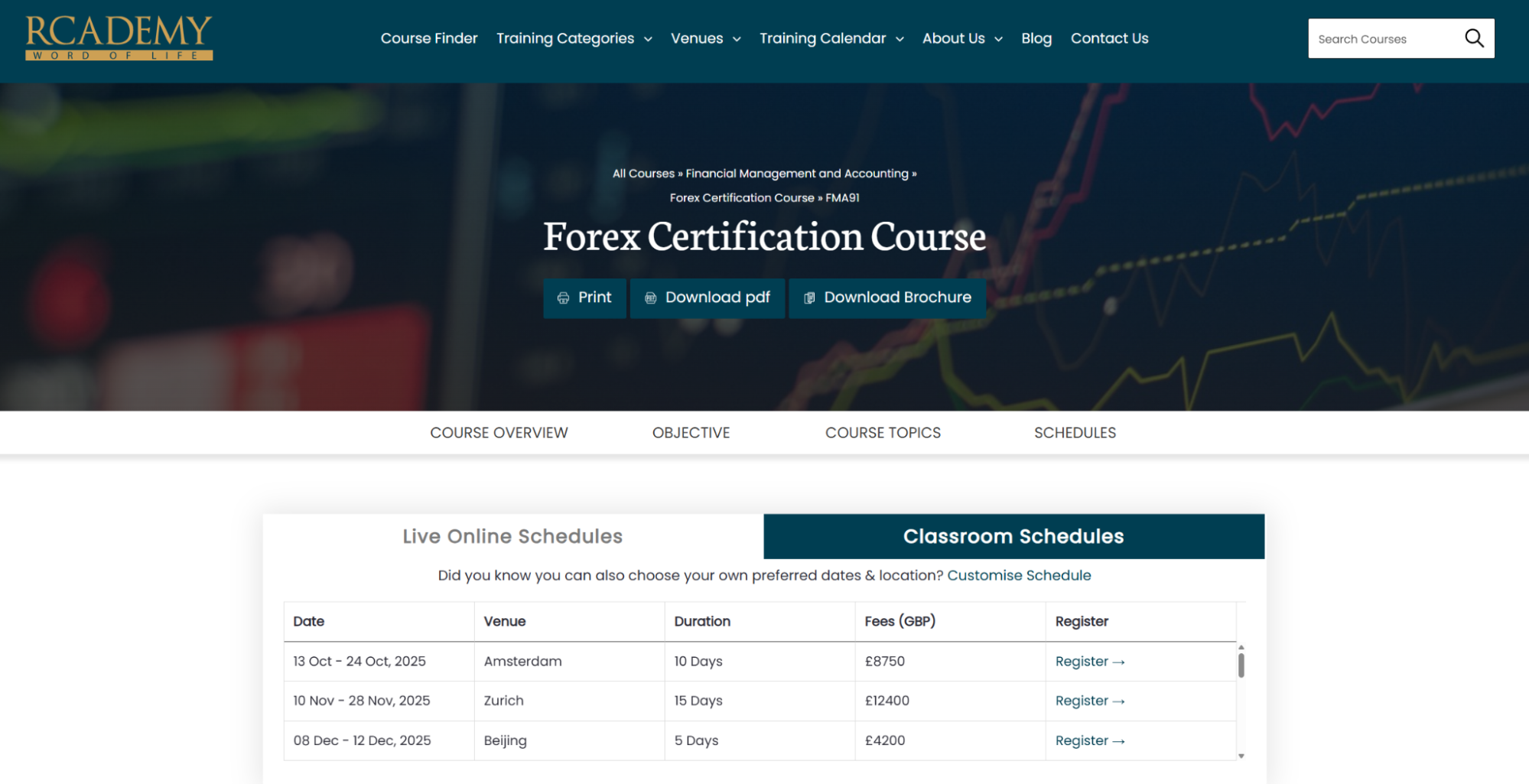

7) Forex Certification Course – Rcademy

Interactive lectures and case studies on technical and fundamental analysis, plus risk management checklists.

Pros • Hands-on activities • Suits beginner to intermediate level • Focus on practical templates

Possible cons • May require extra mentoring after class

8) FX Academy – Online Course for Netherlands Learners

An online option accessible from the Netherlands that explains charts, strategies, and risk. Good as a primer before a deeper program.

Pros • Self-paced lessons • Clear beginner modules • Free entry point for basics

Possible cons • Limited mentor interaction

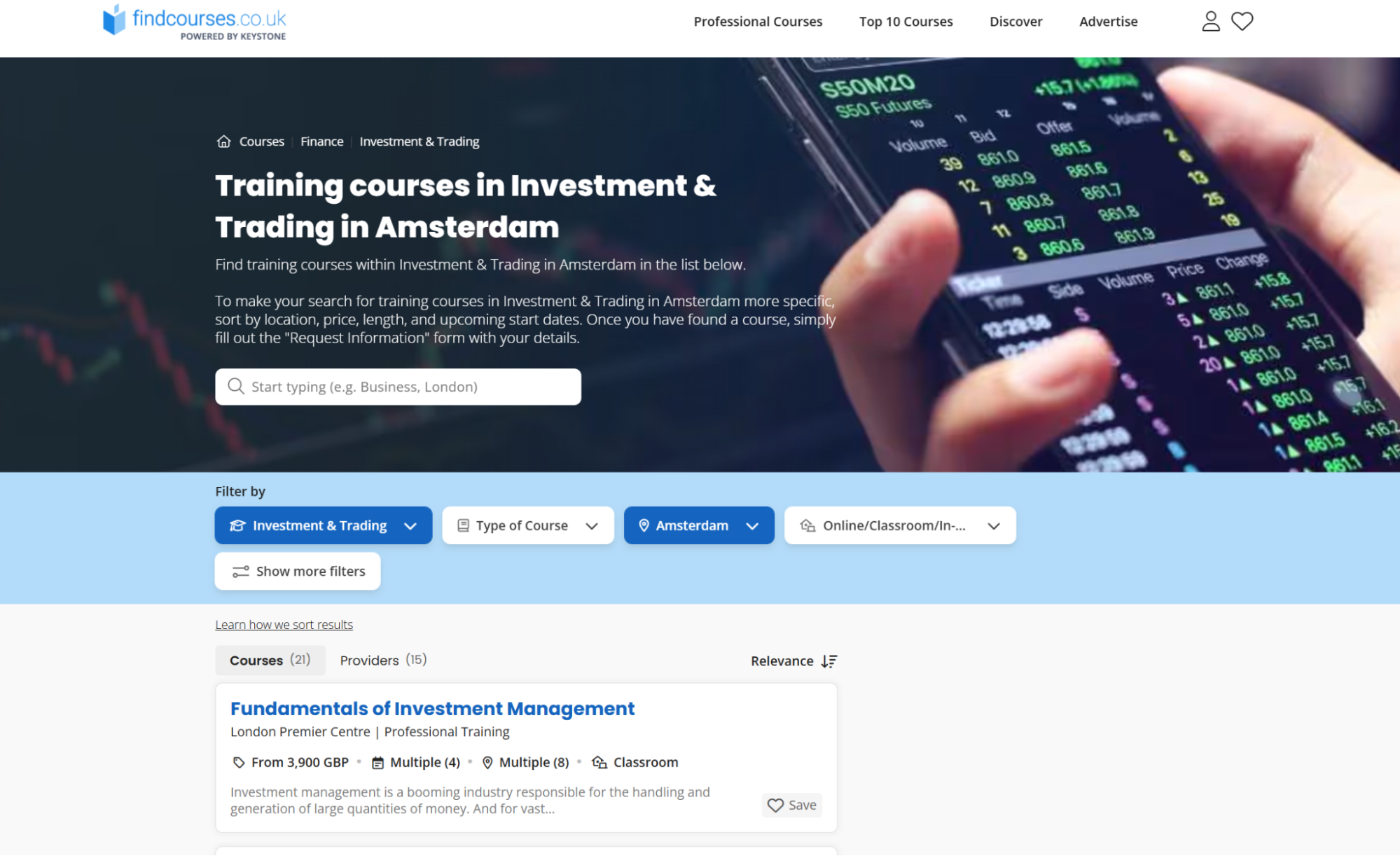

9) Findcourses – Currency Trading Short Courses

Course listings that sometimes feature Amsterdam workshops focusing on FX strategies and risk management.

Pros • Flexible durations • Entry-level friendly • Good for quick skill boosts

Possible cons • Quality differs across providers

10) BeTrader Academy – Options/Futures Intensive

While focused on options/futures, the skill set supports FX traders who hedge or diversify. Sessions are accessible to Netherlands residents and stress discipline and execution.

Pros • Execution mindset • Real-account practice elements • Useful risk techniques

Possible cons • FX content indirect

| Rank | Provider/Program Name | Description |

| 11 | Bizintra Forex Trading Academy | Bizintra offers live, interactive forex education designed for Dutch residents wanting real-time guidance. Their online platform connects learners to professional traders for daily webinars, trading setups, and market analysis. Students receive trade alerts and can apply strategies immediately in simulated or funded accounts. Bizintra builds skill from beginner through advanced levels and offers mentorship from verified instructors with decades in the field. There’s a strong focus on risk management, with weekly performance reviews and custom teaching, ensuring Dutch traders understand leverage and local compliance requirements. The program’s global community also enables networking, peer support, and Q&A sessions to help overcome specific trading challenges. Bizintra’s tiered access makes it easy for both hobbyists and aspiring professionals to find a suitable entry point, while its position as a recognised European brand adds credibility for learners seeking serious financial careers. |

| 12 | Trading College NL | Trading College NL is a Netherlands-based formation targeting those who want classroom and online instruction in Dutch and English. The structured curriculum covers technical and fundamental analysis, trade planning, and money management within ESMA leverage constraints. Their small-group settings allow for personalized attention, and interactive modules provide trade simulations with feedback. Students benefit from regular market updates and follow-up workshops, making Trading College NL a popular choice for practical Dutch forex education. The school maintains ties with brokers and provides ongoing alumni support. Many graduates report fast skill building and increased trading discipline thanks to hands-on case studies and personal coaching. Their course emphasizes responsible trading, journal keeping, and routine performance critique, all embedded in a supportive learning community. |

| 13 | The TFD Trading Program | The TFD Trading Program is an intensive live and online forex course delivered in Amsterdam and accessible nationwide. Established by experienced traders, the program focuses on modern FX strategies, including algorithmic trading, scalp trading, and macro-driven swing tactics. Dutch learners gain exposure to a comprehensive curriculum that walks them through chart interpretation, position sizing, and regulatory compliance. TFD specializes in preparing students for actual trading careers, offering personal mentorship and group coaching as well as regular market challenges to test skill development. Their alumni frequently land junior roles at trading desks or develop the independence needed for consistent private trading. TFD’s reputation for high-performance coaching and community events makes it a top pick for those who want to network and learn at an accelerated pace. The program’s unique blend of theory, practical assignments, and real-time trading review sets it apart from standard online courses. |

How to choose the right forex course in the Netherlands

- Match the course level to your current skills

- Ask for a sample lesson or outline

- Check how they teach risk (sizing, stops, max daily loss)

- Prefer step-by-step frameworks you can repeat

- Confirm the time zone fit for EU sessions

Netherlands forex market overview & regulations

The Netherlands follows EU markets regulation. ESMA’s product measures shape leverage and risk protections for retail traders across the bloc, while the AFM applies and renews product intervention locally for CFDs. For macro context, DNB provides dashboards and reports tracking exchange rates and market stress in Dutch sub-markets. Use this data awareness to plan risk and align trading hours.

FAQ

1) What should I look for in a forex course tailored to Dutch traders?

Look for a clear syllabus (foundations → strategy → risk → psychology), verified results (case studies, student reviews), hands-on practice (demo + live trade reviews), and EU-specific compliance (ESMA rules, AFM context). Courses that teach platform mastery and risk first are ideal. For structured learning paths, see the Best Forex Trading Courses and Formations – Netherlands and the broader Best Day Trading Courses roundup.

2) Do EU/Netherlands rules change how courses are taught?

Yes. EU ESMA rules (e.g., retail leverage caps, negative balance protection, margin close-out) shape responsible curricula. Dutch-relevant programs should emphasize realistic position sizing and risk. To match education with brokers that support risk control, compare Best Low-Spread Forex Brokers and Best ECN Brokers.

3) What core modules should a serious forex formation include?

- Market structure, sessions, order flow

- Strategy playbooks (trend, pullback, breakout, mean reversion)

- Indicators & confirmation (ATR, ADX, price action)

- Risk & trade management, journaling, psychology

- Backtesting & forward testing Deep-dives: How to Use the ATR Indicator Like a Pro, Average Directional Movement Index, Backtesting Trading Strategies.

4) Are beginner-friendly courses different from advanced ones?

Beginners need strong foundations, risk, and routine. Advanced courses add system design, multi-asset correlations, and data-driven validation. Compare tracks using Forex Brokers for Beginners and a step-by-step start: How to Start Forex Trading.

5) Do I need a trading journal? What should it include?

Yes, journaling speeds skill-building. Log setup, entry/exit, risk, emotions, and post-trade notes. See tools and workflows in 10 Best Trading Journals.

6) What’s the best way to practice before going live?

Use a demo to validate rules, then micro-lots with strict risk. Combine practice with MT4 Forex Brokers or Best MT5 Brokers and log everything in your journal (see Q5).

7) Which platforms and tools should a Netherlands-focused course cover?

Look for coverage of MT4/MT5, TradingView, and broker platforms. Platform comparisons: Best Forex Trading Platform and cross-device options: Best Forex Mobile Apps 2026.

8) Will a course teach me one strategy or many?

Good courses show a few robust, testable setups (trend-following, pullback, momentum) and how to adapt them. Explore strategy primers: Momentum Trading, Mean Reversion, How to Spot Trend Reversals.

9) Do courses include risk management that fits EU retail leverage?

They should. Expect modules on sizing at 0.5–1% risk per trade, volatility-adjusted stops, and scaling rules. Reinforce with Stop Market Orders and order basics: What Is Market Order?, Stock Order Types.

10) Are signals a replacement for education?

No. Signals can supplement learning but shouldn’t replace your system. See realistic picks and due diligence in Top 10 Best Forex Signal Providers.

11) Will courses help me evaluate brokers for Dutch residents?

They should teach due diligence (regulation, costs, fills, support). Useful shortlists: Best Forex Brokers in Europe, Best Raw-Spreads Brokers, FCA-Regulated Forex Brokers (for comparison of strict regimes).

12) Is there a recommended learning path for total beginners?

Yes:

- Concepts → 2) Risk → 3) One core setup → 4) Backtest → 5) Demo → 6) Small live → 7) Scale. Use: Forex Trading Course – Confusion to Confidence and Why You Should Never Trade Live Without a Proper Course.

13) Should I learn indicators or pure price action?

Learn both, price action for structure; indicators for confirmation and risk calibration. Start with Average Directional Movement Index and ATR usage.

14) How important is backtesting in a Dutch/EU context?

Crucial, markets differ across sessions and pairs. EU hours + news sensitivity require robust validation. Read Backtesting Trading Strategies.

15) Do courses cover psychology and discipline?

They should, check for routines, pre-mortems, loss recovery rules, and accountability (journaling, reviews). Pair with How to Spot Trend Reversals to reduce bias.

16) Are there Netherlands-specific career paths after a course?

Common paths: independent trading, prop/funded programs, research/analysis, or education/mentoring. Explore Best Funded Trader Programs.

17) Should my course include mobile workflows?

Yes, alerts, partial management, and journaling can be mobile. See Best Forex Mobile Apps 2026.

18) Do I need a separate course for crypto markets?

Not necessarily, core TA and risk transfer well, but crypto has 24/7 volatility. For diversification literacy, see What Are Stablecoins? and Crypto vs. Stock Market.

19) How do I choose a broker to match my course’s strategy?

Scalpers: tight spreads, fast execution (Best Low-Spread Brokers). Swing/position: swap policy, instruments breadth (Best ECN Brokers, Best Raw-Spreads Brokers). Beginners: education + support (Forex Brokers for Beginners).

20) Are “formations” with live markets more valuable than pre-recorded videos?

Live elements (Q&A, trade reviews) accelerate learning if combined with structured modules and assignments. Use on-demand lessons for repetition; live sessions for nuance. If you need a quick primer, start with How to Start Forex Trading.

21) What’s a realistic timeline to become consistently profitable?

Commonly 6–18 months with consistent practice and journaling; faster with coaching, slower without structure. Avoid rushing leverage. Reinforce the process with Trading Journals and Backtesting.

22) Will a Netherlands-focused course teach EU macro/news trading?

The best ones will, EU CPI, ECB decisions, and USD/EUR news flow all matter. Strategy modules should cover pre-news risk reduction and post-news patterns.

23) Do courses teach order types and execution in depth?

They should. Knowing when to use market/limit/stop and how to stage orders is essential. Read Stock Order Types, What Is Market Order?, and Stop Market Orders.

24) Are there specialized modules for Dutch traders who work full-time?

Look for swing/position frameworks on higher timeframes, plus alert-driven routines that fit EU business hours. Mobile complements: Best Forex Mobile Apps 2026.

25) How do I verify a course’s credibility?

Check instructor track record, transparent performance samples (with context, not hype), student outcomes, and refund/guarantee policies. Compare with the editorial standards in Best Forex Trading Courses & Formations – Netherlands.

26) Will my course recommend signal groups or copy trading?

Responsible courses may show how to evaluate signals, but still require your own plan. If you explore signals, start with due diligence in Top 10 Signal Providers and risk modules (Q9).

27) What indicators are most useful for EU session trading?

ATR (volatility), ADX (trend strength), and simple price-action anchors (S/R, structure). Start here: ATR, ADX.

28) Should I learn stocks first, then forex?

Not required, but cross-market literacy helps. If you’re curious, compare curricula with Best Stock Trading Courses.

29) Do courses cover trade management (partials, break-even, scaling)?

They should teach evidence-based rules: partials at structure, move to BE after XR, trail via ATR or swing points. Practice on demo with MT4 or MT5.

30) Will I learn how to build a complete trading plan?

Yes, look for templates covering: strategy rules, risk, markets/time windows, journaling cadence, and review process. For a structured start, see Confusion to Confidence.

31) Is there value in courses that include prop/funded challenges training?

If your goal is external capital, yes, ensure they cover drawdown rules, daily loss limits, and scaling plans. Reference list: Best Funded Trader Programs.

32) How can I avoid information overload?

Pick one core setup, limit indicators, automate journaling, and schedule weekly reviews. If you need curation, start with the Netherlands list: Best Forex Trading Courses and Formations – Netherlands.

33) Can I learn effective intraday strategies that fit EU mornings?

Yes, focus on London session flows, opening ranges, and news windows. Strategy guides: Momentum Trading, Pullback Trading.

34) Do courses teach me to choose instruments (majors vs. minors vs. gold)?

Good ones will. Start with majors for spreads/liquidity, then expand. Complement learning with broker shortlists like Best Raw-Spreads Brokers.

35) How do I keep improving after the course ends?

- Weekly trade reviews

- Quarterly strategy audits

- Periodic re-backtesting

- Peer/accountability groups Use a robust journal (Top Journals) and refresh core skills (Backtesting).

Join the One Core Program – learn a math-backed, repeatable system designed for real-world