Finding a quality forex trading course in Norway helps you build real skills and avoid common mistakes. This guide highlights the best options and how to choose well.

Ready to level up? Request a demo or join our One Core Program today!

Why forex courses matter for traders in Norway

A structured course turns scattered tips into a clear, repeatable process. You learn market structure, entries, exits, and risk control, skills that reduce guesswork and help you develop consistency. In Norway, the krone can react quickly to oil moves and rate expectations, so a rules-based method is valuable for timing and risk sizing. Global FX trading averaged about $7.5 trillion per day in April 2022, with swaps at 51% of turnover ; understanding how each instrument behaves helps you choose the right tools for your strategy.

Norway forex market overview and regulations

Norway aligns with EU/EEA investor protection rules via Finanstilsynet (the Financial Supervisory Authority). Brokers offering services to Norwegian residents must be authorized, and retail protections like standardized risk warnings and product interventions apply. ESMA’s measures include leverage caps (for example, up to 30:1 on major FX pairs) and negative balance protection, policies mirrored by national regulators across the EEA. Always verify a firm in Finanstilsynet’s registry and check investor alerts before sending funds.

Norges Bank participates in the BIS Triennial Survey: in April 2022, average daily trading in Norway’s FX market was about USD 24.5 billion, with NOK spot and forwards near NOK 450 billion per day. Current monetary policy also shapes NOK volatility and funding costs, so traders should track policy updates.

Top 6 Forex Trading Courses and Formations in Norway

1) Asia Forex Mentor – Best Forex Trading Courses and Formations In Norway

🌍 Welcome to Asia Forex Mentor – Where Real Traders Are Made

Asia Forex Mentor (AFM) is the ultimate destination for anyone serious about mastering the art of trading Forex, Stocks, Commodities, Crypto, and beyond. Rated the #1 Forex Trading Course in Asia by Investopedia, Benzinga, and other major publications, our proven training system has helped transform complete beginners into 6-figure full-time traders and even fund managers.

If you’re looking for a real trading mentor who walks the talk, executes trades worth six figures, and trains institutional bank traders and retail students alike, you’re in the right place.

Learn the AFM Proprietary System

We don’t just teach theory, we teach results. The AFM One Core Program is built on a proprietary, math-backed, ROI-driven trading strategy that works across all financial markets. Whether you're trading Forex, Crypto, Stocks, Indexes, Commodities, or even Mutual Funds, if it has a chart, our system applies.

“Ezekiel Chew’s scientific approach to the markets is unmatched. His strategy delivers real profits, not just predictions.”

Raymond Wong, Newbie Turned Full-Time Trader

Who Is Behind AFM?

Ezekiel Chew, the founder of Asia Forex Mentor, is a professional trader widely recognized for his ability to generate six figures per trade and his influence at global trading expos and financial institutions.

He’s trained:

- Traders from DBP – the 2nd largest bank in the Philippines with over $13B in assets

- Proprietary trading firms and investment houses

- Thousands of retail traders across Singapore, India, UK, USA, Japan, Norway, and more

His method has turned $24,000 into $300,000 in a month, and his live trades have made over $100,000 in a single day all using the same principles he teaches inside his flagship program.

Why Thousands Trust AFM:

- Mathematics-backed price action system with a focus on ROI

- Proven record of transforming beginners into profitable full-time traders

- Weekly live trading sessions with Ezekiel Chew himself

- Not just strategies we teach the thinking behind the trades

- Thousands of ★★★★★ student reviews worldwide

- 20+ years of real-world market experience

- Corporate training provider for major banks and financial firms

What You’ll Learn

Inside the AFM One Core Program, you’ll master:

- How to analyze any chart in minutes

- High-probability trading setups with precise entry and exit

- Risk management that protects capital while growing it fast

- Techniques to trade any vehicle (forex, stocks, crypto, etc.)

- The AFM mindset: Think like a pro, trade like a fund

Plus, weekly live sessions to watch how Ezekiel plans, executes, and reviews real trades in real markets.

Your Free Gift: 5-Part Trading Masterclass

Before joining the One Core Program, get free access to Ezekiel’s exclusive 5-Part Training Series an in-depth look at how top traders make consistent, life-changing profits.

🔥 It’s 100% FREE, no strings attached.

📥 Claim it now before the offer expires.

Real Success Stories

- Amardeep made $70,000 within 12 months of joining the program

- Casey saw a 30% account growth in just 40 days

- Sam Manning became a full-time trader after starting with zero experience

“The best investment I've made. AFM gave me the confidence and clarity to trade full-time.”

Verified Student Review

🥇 Awards & Recognition

- 🏆 Best Forex Trading Course – Investopedia

- 🏆 Best Comprehensive Trading Course – Benzinga

- 🏆 Best Trading Education Provider in Singapore

CLICK HERE TO GET THE AFM PROPRIETARY ONE CORE PROGRAM!

What to Do Next:

STEP 1: Download the FREE 5-Part Trading Masterclass. Learn the exact system that turned thousands of students into profitable traders.

STEP 2: When you’re ready, enroll in the AFM One Core Program, the most advanced, comprehensive trading education available today.

You’re Not Just Learning… You’re Investing in a Life-Changing Skill

Trading isn’t a hobby. It’s a high-income, recession-proof skill that can change your life forever, whether you want more freedom, wealth, or simply control over your financial future.

At Asia Forex Mentor, we make this transformation possible.

Services

Resources:

– Forex Position Size Calculator

– Forex Brokers Review & Rating

💡 The earlier you start, the faster you master the game.

📞 Let’s Talk

Got questions? Need a personal recommendation?

Reach us anytime at:

📍 Address: 6 Raffles Boulevard, #03-308, Singapore 039594

📱 WhatsApp: +65 8786 8319

🌐 AsiaForexMentor.com

2) FOREX – Online Trading Courses (FOREX)

An education hub that breaks trading into short, digestible modules. Lessons focus on market mechanics, order flow, risk sizing, and platform use. Quizzes and knowledge checks reinforce learning. It’s a good primer if you’re starting from scratch and want a structured self-paced path.

- Topics: core concepts, strategies, platform basics

- Pros: modular format, quizzes, glossary

- Extras: webinars, market commentary

3) FX Academy – Free Online Forex Trading Courses for Beginners (FX Academy)

A free curriculum aimed at building fundamentals, ideal if you want to test the waters before committing to paid study. The platform covers terminology, charting, and simple strategies with animations and short lessons. Use it to establish a base, then progress to deeper strategy work.

- Topics: terminology, charts, simple systems

- Pros: free access, beginner-friendly, visual content

- Extras: progress tracking, practice tasks

4) NAGA Academy – Free Trading and Investing Courses (NAGA)

Short, step-by-step modules that walk through market basics, risk, and psychology. The content is light and approachable, making it suitable for early-stage learners. Pair it with a more advanced program when you’re ready to specialize.

- Topics: market basics, risk, mindset

- Pros: free lessons, easy navigation, bite-sized videos

- Extras: periodic live sessions

5) The Knowledge Academy – Foreign Exchange Training Courses (The Knowledge Academy)

A broader set of FX offerings beyond the Oslo masterclass. Learners can choose intensive options that cover analysis methods, trading plans, and order execution. Works well for those who want a condensed, goal-oriented format.

- Topics: trading plans, risk methods, execution

- Pros: condensed schedule, experienced trainers

- Extras: course materials, certification

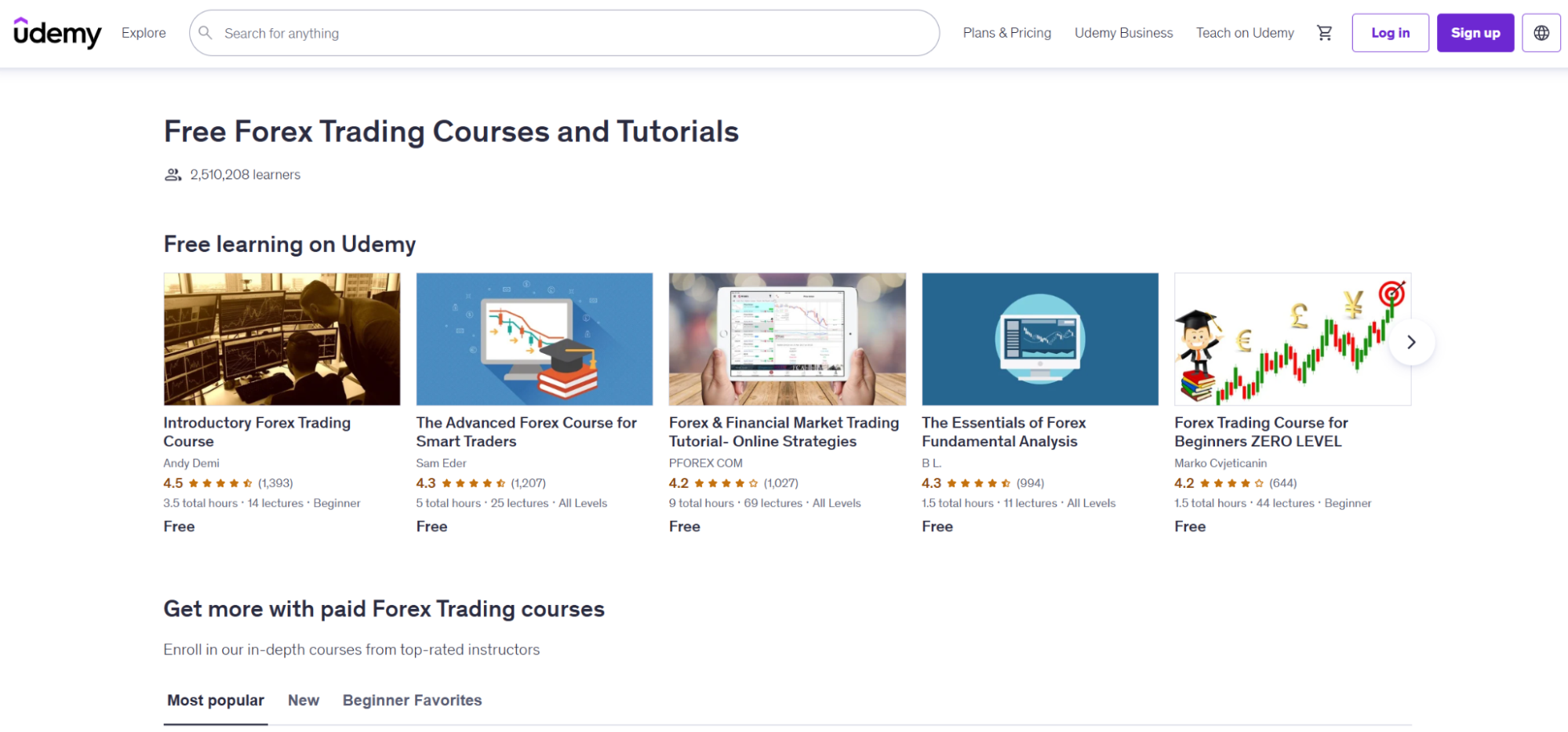

6) Udemy – Top Free Forex Trading Courses & Tutorials (Udemy)

A mix of user-rated courses ranging from beginner to intermediate topics. Quality varies, so check ratings and preview sections. Works best for targeted refreshers.

- Topics: mixed, price action, indicators, psychology

- Pros: large catalogue, low-cost/free options

- Extras: lifetime access to purchased courses

| Rank | Provider Name | Description |

| 7 | IG Academy (IG Group) | IG Academy offers a complete, FCA-regulated learning path designed for aspiring forex traders seeking both theoretical knowledge and practical exposure. Its modular program starts with essential market principles and progresses to advanced chart analysis, risk management, and psychology. Learners enjoy interactive courses, quizzes, and weekly live webinars, all supported by a community forum and downloadable resources. IG’s trading simulators and real-time market access add exceptional practical value, helping new traders apply techniques with confidence. The global reputation, regulatory backing, and comprehensive support resources make IG a trusted choice for those targeting mastery and professional advancement. |

| 8 | London Academy of Trading | London Academy of Trading (LAT) blends classroom, remote, and real-time learning, offering tailored programs for Norwegian and European students. From basic forex principles through portfolio management and trading psychology, LAT’s courses suit every stage of trader. The curriculum includes intensive bootcamps, academic certificates, and mentoring from top institutional traders, with direct access to live-trading platforms and regular webinars. Flexible pacing, alumni support, and a continuous update cycle ensure learners always have the latest insights. LAT’s European accreditation and deep industry ties make it the preferred school for aspiring professionals wanting recognized, career-building education. |

| 9 | ForexSignals.com | ForexSignals.com stands out via its live trading room, daily expert analysis, and vibrant peer Q&A, supporting learners through practical, forum-driven education. Material covers both foundational and advanced levels, with instructional video series, weekly live sessions, and downloadable guides. Students benefit from performance tracking, risk management workshops, and hands-on trade feedback. The result is a highly interactive experience that emphasizes real-world results, ongoing community accountability, and the practical tips traders need for continuous improvement. Particularly strong for those who value hands-on help and immediate access to actionable insights. |

| 10 | INFINITYTRADES FX | INFINITYTRADES FX is recognized for its structured UK-centric academy serving Norwegian traders online. It guides learners from zero to self-sufficient trading through progressive modules on analysis fundamentals, risk, and psychology. Students join live bootcamps, receive ongoing mentoring, and develop a systematic approach to discipline and adaptation. Regular updates, career networking events, and post-completion support are core components. INFINITYTRADES FX is sought-after by individuals who want structured development and proven methodology with significant support for long-term skill building and professional advancement in European markets. |

| 11 | FXTM Academy | FXTM (ForexTime) Academy is acclaimed for its global webinars, Norwegian content, and a broad training selection from basics to advanced trading. Offering practical demonstrations, interactive lessons, and live-market walkthroughs, FXTM focuses on actionable skills, chart reading, risk calibration, and adaptive strategies. The academy is especially known for flexibility, community interaction, and self-paced tracks suitable for evolving traders. FXTM’s blend of accessibility, in-depth theory, and pragmatic scenario analysis makes it a popular choice for those seeking flexible and extensive online training with direct local relevance. |

| 12 | Todd Capital Group | Todd Capital Group is a practical forex training provider accessible online for Norwegians at beginner or intermediate levels. Its curriculum draws from years of trading experience, focusing on core market skills, risk management, and individualized plans. Students engage through one-on-one mentorship, live webinars, and a variety of practical sessions. The group is praised for dedicated support, actionable guidance, and strong emphasis on discipline for long-term trading results. Ideal for those wanting approachable, career-focused mentoring and stepwise market immersion as they progress. |

| 13 | UK Trading Academy | UK Trading Academy delivers a twelve-week, fully-online course targeting new and intermediate forex traders. Features include weekly live webinars, recorded lessons, and continuous support from seasoned professionals. The curriculum balances real-world market scenarios with chart analysis basics, planning structure, and psychological readiness. Active alumni, frequent Q&A, and tailor-fit classes help learners move forward at any pace. Its practical, accessible, and supportive approach makes UK Trading Academy a strong pick for Norwegians wanting a structured yet flexible route into successful trading. |

How to choose the right forex course in Norway

- Match the curriculum to your goal. Day trading, swing trading, or building a multi-asset skill set each asks for different tools.

- Look for a rules-based method. Check if lessons include entry criteria, stop placement, and risk per trade.

- Ask for real practice. Good programs include drills, case studies, and trade logs you can copy.

- Check student reviews and support. A responsive community and clear feedback help you improve faster.

FAQs

1) What’s the best way to choose a forex course in Norway?

Start with outcomes (skills, certification, trading plan), then check syllabus depth (risk, psychology, strategy, platform labs), instructor credibility, community access, and post-course support. Compare curricula against our roundup of the Best Forex Trading Courses & Formations in Norway and broaden to Europe via Best Forex Trading Courses & Formations, Europe.

2) Are forex courses in Norway suitable for absolute beginners?

Yes, look for modules on terminology, orders, risk (1–2% rule), and platform basics. If you’re starting from zero, read How to Start Forex Trading first, then shortlist providers on the Norway courses page.

3) Do Norwegian courses cover regulation and broker safety?

Good ones do. Norway follows EEA standards (MiFID II/ESMA influence). Learn broker due-diligence with FCA-Regulated Forex Brokers and compare choices via Best Forex Brokers in Europe and Best Forex Brokers.

4) Which trading platforms should a course teach (MT4/MT5/cTrader)?

Beginner-friendly courses typically focus on MT4/MT5. Cross-check platform depth with Best Trading Platform, Best MT5 Brokers, and Best ECN Brokers.

5) What core topics must a serious forex curriculum include?

- Risk management & position sizing

- Strategy rules + backtests

- Execution & order types

- Psychology & journaling

- Platform labs Use these primers while vetting syllabi: Backtesting Trading Strategies, What Is Market Order?, Stop Market Orders, and Stock Order Types (concepts carry over to FX).

6) Do I need a broker account before enrolling?

Not necessarily. Many courses use demos. When ready, shortlist safe options with Best Low-Spread Forex Brokers, Best Zero-Spread Brokers, and Forex Brokers for Beginners.

7) How important is a trading journal?

Critical. Journals accelerate learning loops. Explore tools and workflows in 10 Best Trading Journals and apply them to coursework and live trading.

8) Will a Norwegian course help me build a strategy I can trust?

Look for programs that require rule-based systems and evidence via backtests/forward tests. Use 6 Game-Changing Trend Line Tips and indicators like Average Directional Movement Index to stress-test ideas.

9) Can courses guarantee profits?

No legit program can. Focus on process, probabilities, and risk control. Complement study with Momentum Trading and Mean Reversion foundations.

10) Should I learn macro events (FOMC, inflation data) during the course?

Yes, macro moves FX. Start with What Is FOMC? and use Fear & Greed Index (Bitcoin) to understand sentiment frameworks transferable to FX risk.

11) Do courses teach risk management beyond stop losses?

They should, expect VaR basics, R-multiples, and portfolio heat. Reinforce with Implied Volatility and Quad Witching (volatility context).

12) What certifications or “proof of completion” matter?

Completion certificates help job/funded-account applications but aren’t regulated licenses. If prop funding is a goal, compare Best Funded Trader Programs and ask courses about tailored prep.

13) Is there a path from course → demo → funded account?

Often: education → journaled demo milestones → small live account → challenge. Pair your learning with Best Forex Mobile Apps 2026 to practice anywhere.

14) Do Norwegian formations cover algorithmic trading?

Advanced tracks may. If not, self-study the building blocks (backtesting, indicators, risk) via Backtesting Trading Strategies and indicator pages like Engulfing Candle.

15) What about day-trading vs. swing trading in the syllabus?

You’ll want modules on time-frame selection, session behaviors, and holding costs. See How to Spot Trend Reversals and W-Pattern Trading to compare tactics.

16) Will a course help me avoid common beginner mistakes?

Yes, good programs address over-leverage, strategy hopping, and revenge trading. Pre-read Forex Trading Course: Confusion to Confidence and Why You Should Never Trade Live Without a Proper Forex Course.

17) How do I verify a course’s real-world relevance?

Ask for live trading examples, execution walkthroughs, and recent market case studies. Cross-reference with our Best Trading Platform guide to ensure platform parity.

18) Do courses include psychology and discipline training?

Top programs do. Expect modules on biases, routines, and journaling discipline. Reinforce with Trading Tips (mindset overlaps) and strict risk rules from the order-execution guides linked above.

19) What’s a reasonable timeline from novice to consistency?

Commonly 3–12 months with structured practice and journaling. Set milestones tied to Backtesting and Trading Journals rather than calendar dates.

20) Do I need special hardware or software for a Norwegian course?

A mid-range laptop and stable internet typically suffice. MT4/MT5 are standard; verify any paid tools before buying. See Best Trading Platform for compatibility notes.

21) Will I learn order execution in depth?

You should, ask for hands-on labs on market, limit, stop, and trailing stops, plus slippage and spread impacts. Read What Is Market Order? and Stop Market Orders in advance.

22) Are there Norway-specific tax topics in courses?

Most cover general record-keeping. For detailed tax matters, consult a licensed professional. Your journal from Best Trading Journals supports accurate reporting.

23) How can I benchmark course strategies before risking money?

Backtest, forward test on demo, and track R-multiples. Use the frameworks in Backtesting Trading Strategies and pattern pages like Stick Sandwich Pattern to validate rules.

24) Do courses teach risk across different account sizes?

They should, position sizing is size-agnostic. Pair course content with Best Low-Spread Forex Brokers to minimize frictional costs while you learn.

25) Will I learn to adapt to high-volatility news?

Good programs include playbooks for FOMC, CPI, NFP, etc. Start with What Is FOMC? and then practice post-news execution using your platform knowledge.

26) Can I specialize in Scandinavian or European sessions?

Yes, courses that cover session microstructure help a lot. Complement with brokers/platforms that offer tight spreads in your active hours via Best Trading Platform and Best Low-Spread Brokers.

27) Do formations include community or mentorship?

The strongest ones do, peer review, live Q&A, and trade critiques. If mentorship is essential, use the Norway formations list to filter providers that offer ongoing support.

28) How do I pick a broker to practice what I learn?

Match the course platform, regulation, spreads, and instruments you plan to trade. Start your shortlists with Best Forex Brokers in Europe, Best MT5 Brokers, and Best ECN Brokers.

29) Are there mobile-first courses for learning on the go?

Many include app labs. Combine them with Best Forex Mobile Apps 2026 so practice time fits your schedule.

Try our free training to test fit. Blog tips can guide choices.